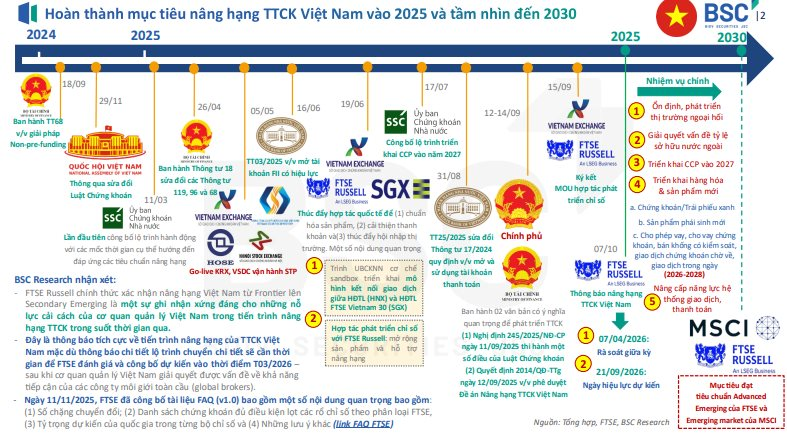

On October 8, 2025, FTSE Russell officially announced the approval of Vietnam’s stock market upgrade. By November 11, 2025, FTSE released an FAQ (version 1.0) to clarify key points in Vietnam’s upgrade process for 2026.

BSC Research has compiled critical updates from FTSE’s announcements and notable reforms by regulatory bodies for Vietnam’s stock market.

According to the FAQ, the FTSE Frontier Index will be removed in a single phase, scheduled for the September 2026 review. BSC anticipates this will directly impact the Fubon ETF, a $500 million fund tracking the FTSE Vietnam 30 Index under the Frontier category.

If the index removal proceeds, the fund must liquidate its portfolio during the September 2026 review, potentially triggering sell pressure on all 30 stocks in its holdings.

Additionally, Vietnam’s transition to the Secondary Emerging Market category will occur in multiple phases, with details expected in the March 2026 review.

A key focus of the March 2026 mid-year review is meeting global broker requirements, essential for aligning Vietnam’s market with international standards. FTSE has also outlined key 2026 dates, including mid-year results on April 7, 2026, and FTSE GEIS September 2026 review results on August 21, 2026.

BSC Research notes that domestic regulators and market participants are addressing these issues. The State Securities Commission is expected to submit amendments to Circulars 96, 120, and 121 to the Ministry of Finance to meet global broker requirements before the March 2026 review.

FTSE’s documents reiterate that five Vietnam-related indices—FTSE Frontier ex Vietnam, FTSE Global All Cap incl Vietnam, FTSE Emerging All Cap incl Vietnam, FTSE All-World incl Vietnam, and FTSE Emerging incl Vietnam—have been on the Watch List since July 2020. These indices are likely to transition to the Transitional Indices category by the March 2026 review.

Based on October 31, 2025 data, FTSE estimates Vietnam’s weighting in four potential indices at 0.04% for FTSE Global All Cap, 0.34% for FTSE Emerging All Cap, 0.02% for FTSE All-World, and 0.22% for FTSE Emerging.

FTSE also released a list of 28 Vietnamese stocks eligible for inclusion in these indices. This includes four large-cap stocks (HPG, VCB, VIC, VHM), three mid-cap stocks (MSN, SAB, VNM), and 21 small-cap stocks as classified by FTSE.

FTSE Russell emphasizes that Vietnamese stocks will undergo the same review process as new listings, requiring compliance with liquidity and size criteria for each index.

BSC Research notes that the current stock list is based on December 31, 2024 data, and significant changes are expected after VN-Index’s strong 2025 performance. BSC plans to update the potential stock list based on December 31, 2025 data.

Under the Government-approved Market Upgrade Plan, the Ministry of Finance and SSC have outlined a 2030 roadmap focusing on legal reforms, infrastructure upgrades, and product expansion. The SSC will collaborate with exchanges, VSDC, and the State Bank to finalize the legal framework for clearing and settlement, enabling CCP implementation by 2027.

Regulators are also developing the forex market, introducing risk management tools for foreign indirect investment, and enhancing capital flow monitoring.

To attract foreign investment, the Foreign Investment Agency will review conditional business sectors and relax or remove foreign ownership limits in non-national security areas, enhancing Vietnam’s appeal to international investors.

The 2030 reform roadmap includes non-pre-funding mechanisms, transparent foreign ownership reporting, and STP system upgrades. It also involves omnibus accounts, enhanced trading and settlement capacity, addressing foreign ownership caps, and CCP launch by 2027.

Elevating Health Awareness: Long Châu and STADA Pymepharco Unite to Combat Health Risks

Obesity has become a pressing global health concern, and Vietnam is no exception. In a collective effort to promote a healthier Vietnam, Long Châu has partnered with STADA Pymepharco to launch a series of impactful community initiatives. These activities aim to raise awareness about safe, scientifically-backed, and reliable weight loss methods, empowering individuals to take control of their well-being.

Prime Minister Pham Minh Chinh: Accelerating Cooperation to Transform Ho Chi Minh City into a “Global Digital Metropolis”

On the afternoon of November 25th, Prime Minister Pham Minh Chinh chaired the “CEO 500 – TEA CONNECT” dialogue program, themed “Ho Chi Minh City: Towards a Global Digital Metropolis.” This special event was held as part of the 2025 Autumn Economic Forum in Ho Chi Minh City.