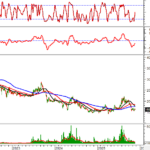

Vietjet Air (VJC), the airline owned by billionaire Nguyen Thi Phuong Thao, saw its stock surge for the fourth consecutive session, reaching a new peak of VND 219,100 per share. The company’s market capitalization also hit a record high of nearly VND 130 trillion, more than double its value at the beginning of the year.

The rally in VJC shares has significantly boosted Nguyen Thi Phuong Thao’s wealth. According to Forbes, as of November 25, Vietnam’s only female billionaire holds a fortune of $4.8 billion, ranking 832nd among the world’s wealthiest individuals. Forbes estimates her net worth is second only to Pham Nhat Vuong in Vietnam.

Notably, Vietjet Air plans to issue 118.3 million shares as a 20% dividend, meaning shareholders will receive 20 additional shares for every 100 held. The issuance is expected to take place between Q4 2025 and Q1 2026, pending approval from the State Securities Commission. Post-issuance, Vietjet’s chartered capital will rise from VND 5.916 trillion to VND 7.1 trillion.

The additional VND 1.183 trillion in capital will be allocated to support business expansion, enhance financial capacity, strengthen market presence, improve bidding capabilities, and ensure compliance with liquidity regulations.

In Q3 2025, Vietjet Air reported air transport revenue of VND 16.728 trillion and pre-tax profit of VND 393 billion. For the first nine months, cumulative revenue reached VND 52.329 trillion, with pre-tax profit at VND 1.987 trillion, a 28% increase year-over-year.

As of September 2025, Vietjet Air operates 219 routes (169 international, 50 domestic), serving 21.5 million passengers with 98 aircraft. The airline achieved an 86% seat occupancy rate and a 99.72% technical reliability rate, among the highest in the region.

In related news, Reuters reports that VietJet (VJC) is planning to resume operations of COMAC aircraft after a one-month suspension. Last month, Vietjet halted flights from Hanoi and Ho Chi Minh City to the popular tourist destination Con Dao due to the expiration of a six-month lease agreement with China’s Chengdu Airlines for two COMAC C909 aircraft, citing high costs and regulatory challenges.

According to Reuters, Vietjet’s Con Dao flights will resume on November 25, with four daily flights. While company documents reviewed by Reuters did not specify the aircraft model, sources indicate that a renewed six-month lease with Chengdu Airlines will bring the C909 back into service.

“Nguyễn Thị Phương Thảo Ranks Among Top 3 Wealthiest on Vietnam’s Stock Market, as Over Half of Billionaires See Assets Decline Since Month’s Start”

Mrs. Nguyen Thi Phuong Thao, Chairwoman of Vietjet Air, has soared to the 3rd position with a net worth of $1.8 billion, marking a $60 million (5%) increase from the beginning of the month. Previously, she consistently held the 4th spot on the list.