At the recent IR Talk event, reflecting on the journey since Masan’s takeover, Mr. Phan Nguyễn Trọng Huy – Chief Financial Officer of WinCommerce emphasized: “The company has gone through three phases: formation, restructuring, and entering a new growth cycle”.

In 2019, WinCommerce recorded an operational loss of over 3.7 trillion VND. By 2025, the company is projected to achieve nearly 1 trillion VND in operating profit; operating margin improved from -13.8% in 2019 to -1.1% in 2023 and is expected to reach over 2% in 2025. Over six years, WinCommerce achieved a turnaround of nearly 4 trillion VND, a significant leap in the retail industry where profit margins are low and financial erosion occurs rapidly if the operating model is not efficient enough.

The period from 2019 to 2023 was a fundamental restructuring phase when WinCommerce opened only about 600 new stores, a modest number compared to the current expansion rate. During this time, the company closed underperforming stores, standardized the mini-supermarket model, restructured the product portfolio, and optimized investment and operating costs.

“Retail relies heavily on people; without a pioneering team, we couldn’t have achieved this”, shared the CFO of WinCommerce.

The company swiftly focused on strengthening its workforce. The executive team comprises top retail experts from both domestic and international markets. Notably, the current Chief Information Officer is an international expert who previously held senior positions and directly operated the largest retail chain in Russia, with a system scale far exceeding Vietnam’s market.

The technology system was also invested in and became the foundation for standardizing processes, controlling inventory, and centralized operations across the entire chain.

From 2024 to 2025, the results of the restructuring became evident. Mr. Huy noted: “During the 2019-2023 restructuring phase, we opened only about 600 stores, but in just one year from 2024 to 2025, we opened 750 stores, surpassing the total opened during the four-year restructuring period”. This directly demonstrates that the model has reached its optimal point: newly opened stores can quickly break even, investment costs have been minimized, and the supply chain foundation is capable of supporting high-speed nationwide expansion.

Regional Flexibility, Demand Optimization

WinCommerce’s store model has been redefined based on regional and customer group needs. Mr. Huy described: “Four business models (including Rural and Urban models for mini-supermarkets and large supermarkets) are customized to meet regional demands, helping WinMart compete strongly and sustainably”.

The mini-supermarket model focuses on areas of 100-150 m², with a streamlined assortment of 1,500-2,000 SKUs, emphasizing essential goods, fresh produce, household items, and Masan-branded products.

Large supermarkets are designed with standard layouts, optimized customer flow, and attract shoppers through promotions, ready-to-eat meals, and unique concepts with vibrant colors. Additionally, WinCommerce implements a flat-rate policy for basic fashion items, creating a seamless shopping experience and increasing revenue per visit.

Customizing models helps WinCommerce maintain a stable profitability rate for stores while increasing scalability without altering core operational structures.

The product strategy is built on four pillars: prioritizing product quality; ensuring essential items are always available for homemakers; offering daily savings through competitive pricing programs; and creating excitement with unique, differentiated product categories.

Source: WCM

|

Cost Optimization, Cash Flow Management, and LFL Growth

To turn around business results, WinCommerce focused on three pillars: cost optimization, unit efficiency improvement, and cash flow management. Investment costs per store were reduced to 800-900 million VND thanks to compact store sizes and streamlined assortments. Operating costs decreased by 30% after restructuring operational processes for each store. Gross margin increased by 7 percentage points through assortment optimization, gross profit management, and improved fresh produce quality. Key products like MEATDeli, WinEco, and in-house FMCG brands created trade advantages, enabling stores to break even within three years.

Mr. Huy noted that warehouse throughput increased to 60%, shelf availability reached 90%, and logistics costs decreased by 11%. Cash conversion cycles improved significantly from +16 days (2019) to 0 days (2024) and are expected to reach -7 days in 2025 due to enhanced inventory turnover.

WinCommerce’s revenue grew from 27 trillion VND in 2019 to 30.055 trillion VND in 2023 and is projected to reach approximately 39 trillion VND in 2025. EBIT margin peaked at 2.7%, reflecting that optimized existing stores have achieved stable profitability, laying the foundation for growth.

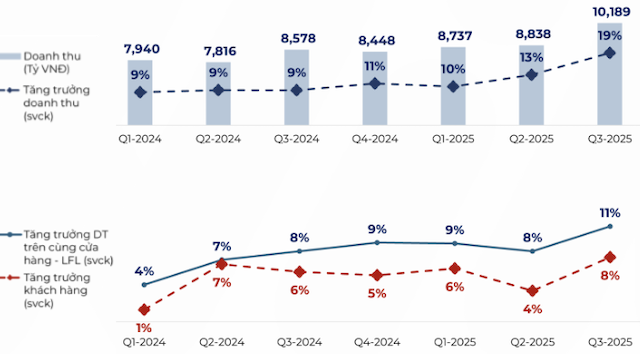

A more critical metric is like-for-like (LFL) revenue growth, indicating whether a retail business operates efficiently and healthily. Previously, same-store revenue growth was around 4%. Currently, this growth has approached double digits at 9% and remained stable over the past four quarters. In Q3/2025, it reached 11%.

Theoretically, same-store revenue growth can come from three factors: more customers visiting stores, customers purchasing more items, and price increases. Among these, price increases are the easiest way to boost profits immediately. However, 3-6-9 months later, consequences will arise as customers are sensitive to price hikes and may leave. The most challenging factor is attracting more customers, as it reflects consumer trust in the store chain. In retail, customer growth contributes 70-80% to revenue growth.

WinCommerce’s customer chart shows a steady 5-7% increase over seven consecutive quarters, contributing 70% to revenue growth.

Note: Revenue here includes only WCM stores, excluding other revenue sources.

|

Mr. Huy estimated that with current revenue of approximately 39 trillion VND, a 1-1.5 percentage point increase in operating margin annually can be used to estimate operating profit.

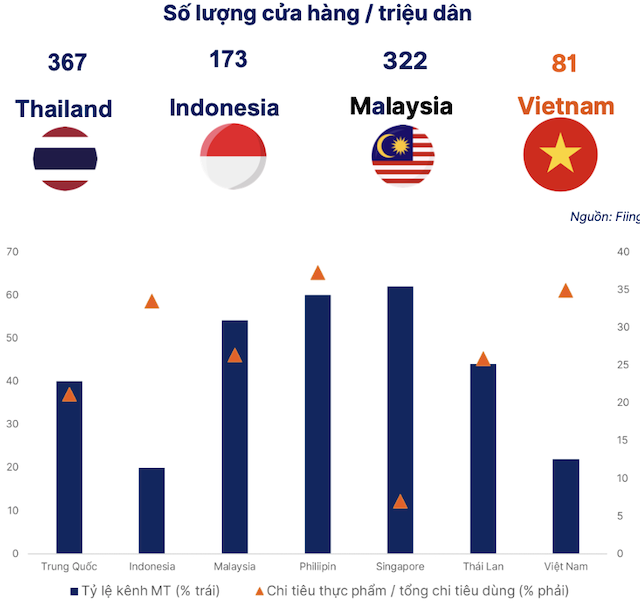

The target of 4,500 stores by year-end will position WinCommerce among the region’s largest retail chains, although Vietnam’s modern store density per million people remains lower than regional peers.

For expansion, WinCommerce focuses on areas with significant growth potential, particularly suburban and rural areas where traditional channels still dominate and modernization is accelerating. The company is also preparing to integrate additional services like consumer finance, payments, utilities, and expand non-food categories to increase basket value and customer revisit frequency.

Discussing Vietnam’s modern retail landscape, expert Nguyễn Minh Hạnh – Director of Analysis at SHS Securities, noted that it is following the trajectory of regional predecessors. In Thailand, Indonesia, and the Philippines, development cycles are repetitive: a prolonged fragmentation phase, a model standardization phase, and a breakthrough phase when 2-3 leading companies capture 30-40% market share.

According to SHS statistics, Indonesia’s Alfamart has over 20,120 stores, and Thailand’s 7-Eleven will have 17,000 stores by 2025 with nearly 19% market share. Vietnam’s retail market still lacks a “final winner” and is entering the third phase—rapid expansion based on proven models. With a modern store density of only 81 stores per million people, far below Indonesia or Thailand, growth potential remains vast.

Source: SHS

|

– 20:38 25/11/2025

Circle K Deploys 35-Year Veteran Executive to Vietnam, Aiming for 1,000-Store Milestone

Circle K Vietnam has announced the appointment of Mr. TC Cheng as its new Chief Executive Officer, effective October 30, 2025. This strategic move is poised to herald a new era of robust growth for the international convenience retail brand in Vietnam.

WinCommerce Surges with Nearly 25% Growth in October, New Stores Profitable Year-to-Date

WinCommerce, the powerhouse behind the WinMart and WinMart+ supermarket and convenience store chains, is experiencing a remarkable growth trajectory this year. Month after month, the company has consistently achieved double-digit revenue growth, signaling a robust recovery in consumer demand and the proven effectiveness of its operational model.

Strategic Shift in Leasing Trends: Oriental Square by OSI Emerges as the New Prime Choice

The growing supply of Grade A office space is prompting tenants to reevaluate their workspace strategies. In this context, Oriental Square by OSI, strategically located in the heart of Starlake, emerges as a prime choice, aligning with trends of cost optimization, design flexibility, and enhanced employee experience.