I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On November 26, 2025, all VN30 futures contracts saw gains. Specifically, VN30F2512 (F2512) rose by 0.88%, closing at 1,924.9 points; 41I1G1000 (I1G1000) increased by 0.93%, reaching 1,924 points; 41I1G3000 (I1G3000) climbed 0.9%, ending at 1,921.1 points; and 41I1G6000 (I1G6000) advanced 0.67%, settling at 1,922 points. The underlying index, VN30-Index, closed at 1,923.55 points.

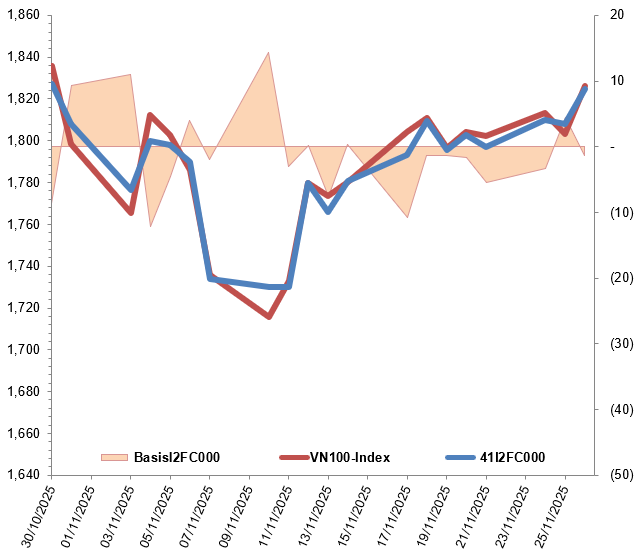

Meanwhile, most VN100 futures contracts also gained during the session. Notably, 41I2FC000 (I2FC000) rose by 0.95%, closing at 1,825 points; 41I2G1000 (I2G1000) remained unchanged at 1,800.6 points; 41I2G3000 (I2G3000) surged 1.32%, ending at 1,814.1 points; and 41I2G6000 (I2G6000) gained 1.13%, settling at 1,810.1 points. The underlying index, VN100-Index, closed at 1,826.35 points.

During the November 26, 2025 session, VN30F2512 opened with a strong upward momentum driven by dominant long positions, pushing the contract higher. However, selling pressure emerged, causing it to trade sideways for the remainder of the morning session. In the afternoon, buyers regained control, propelling VN30F2512 back to its morning high of around 1,930 points. Despite a slight narrowing of gains toward the close, the contract ended the day in positive territory at 1,924.9 points.

Intraday Chart of VN30F2512

Source: https://stockchart.vietstock.vn/

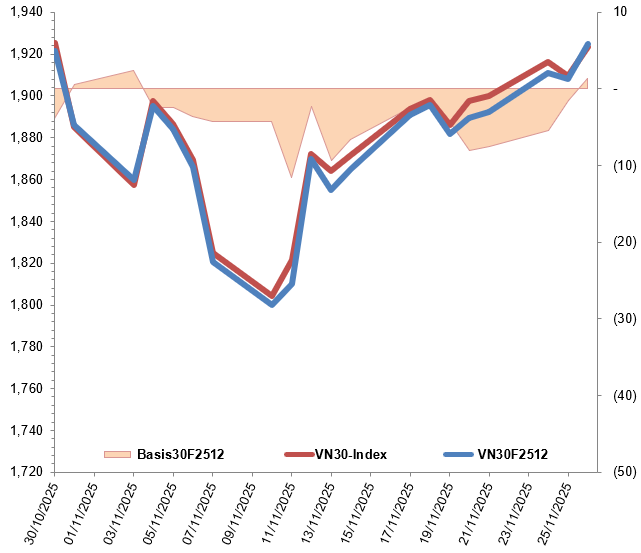

At the close, the basis of the F2512 contract reversed from the previous session, reaching 1.35 points. This indicates a return of optimism among investors.

Fluctuations of VN30F2512 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

Conversely, the basis of the I2FC000 contract reversed, reaching -1.35 points, reflecting renewed pessimism among investors.

Fluctuations of 41I2FC000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

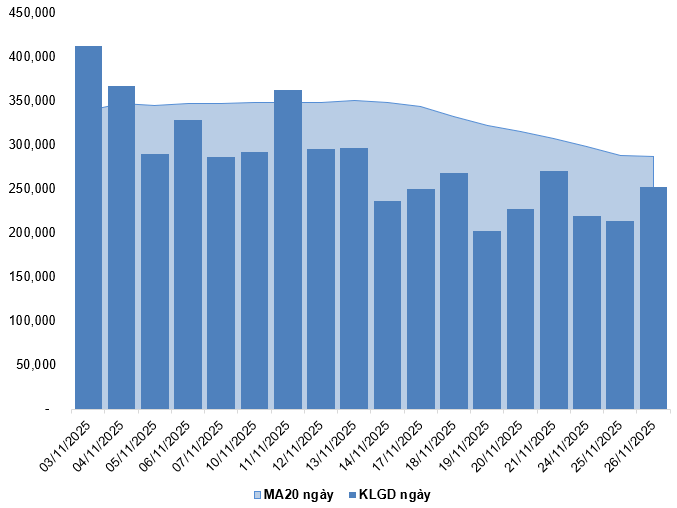

Trading volume and value in the derivatives market increased by 18.04% and 18.51%, respectively, compared to the previous session on November 25, 2025. Specifically, F2512 trading volume rose by 18.05%, with 252,411 contracts traded. I2FC000 trading volume reached 73 contracts, up 30.36%.

Foreign investors continued to sell, with a net selling volume of 2,074 contracts on November 26, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

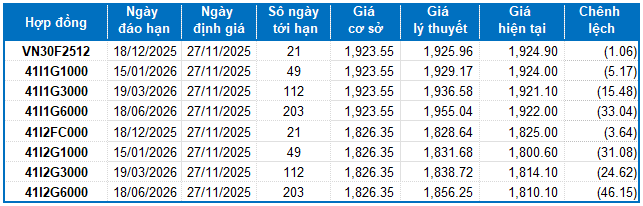

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of November 27, 2025, the fair value ranges of actively traded futures contracts are as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with tenure adjustments suitable for each futures contract.

I.3. Technical Analysis of VN30-Index

On November 26, 2025, the VN30-Index saw a slight gain, accompanied by a small-bodied candlestick pattern and reduced trading volume compared to the previous session, indicating investor hesitation.

Currently, the Bollinger Bands continue to narrow, while the ADX indicator remains in the gray zone (20 < adx < 25).

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of November 27, 2025, the fair value ranges of actively traded bond futures contracts are as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with tenure adjustments suitable for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, and 41BAG6000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they present favorable opportunities in the market.

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 18:28 26/11/2025

Derivatives Market Update 26/11/2025: Bulls Losing Steam

On November 25, 2025, most VN30 and VN100 futures contracts declined during the trading session. The VN30-Index reversed its trend after three consecutive up sessions, forming a small-bodied candlestick pattern accompanied by increased trading volume that surpassed the 20-session average. This suggests a less optimistic sentiment among investors.

Derivatives Market Week 24-28/11/2025: Persistent Decline in Overall Market Liquidity

On November 21, 2025, the VN30 and VN100 futures contracts exhibited a mixed performance during the trading session. The VN30-Index edged higher, retesting its 50-day SMA, while trading volume remained below the 20-session average, indicating investor hesitation.

Derivatives Market on November 21, 2025: Persistent Tug-of-War in Trading Sessions

On November 20, 2025, both the VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index continued its sideways movement, forming small-bodied candlestick patterns in recent sessions, while trading volume remained below the 20-session average, reflecting investor hesitation.

Derivatives Market on November 20, 2025: Market Liquidity Declines Ahead of Expiry Session

On November 19, 2025, futures contracts for the VN30 and VN100 indices predominantly closed in negative territory. The VN30-Index reversed its trend, forming a small-bodied candlestick pattern after retesting the 50-day SMA, accompanied by increased trading volume compared to the previous session. This suggests a cautious sentiment among investors.