Doan Nguyen Duc speaking at HAGL’s Investment Roadshow

During the Investment Roadshow event at Rex Hotel (Ho Chi Minh City), Hoang Anh Gia Lai Group (HAGL – Stock Code: HAG) announced the roadmap for the public offering of HAGL International Investment Joint Stock Company (formerly known as Hung Thang Loi Company). Mr. Doan Nguyen Duc, Chairman of HAGL’s Board of Directors, stated that this decision was made after recognizing the subsidiary’s effective performance and the completion of the group’s financial restructuring process.

HAGL’s Investment Roadshow at Rex Hotel (HCMC)

Cash Dividend Commitment

Speaking confidently before hundreds of investors, Mr. Doan Nguyen Duc asserted, “For the first time in 10 years, I can confidently present to you a dream-like asset portfolio of HAGL. We are now free from debt pressure, own a vast portfolio of clean land, and our orchards are at their prime harvesting age.”

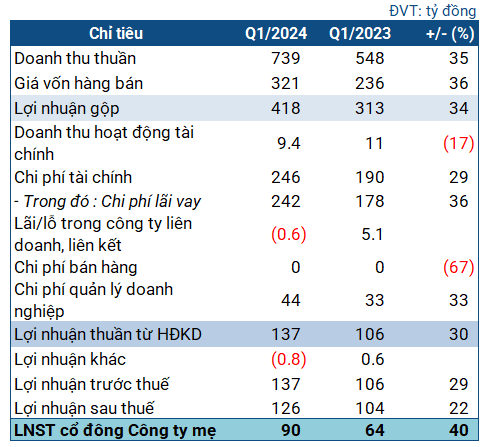

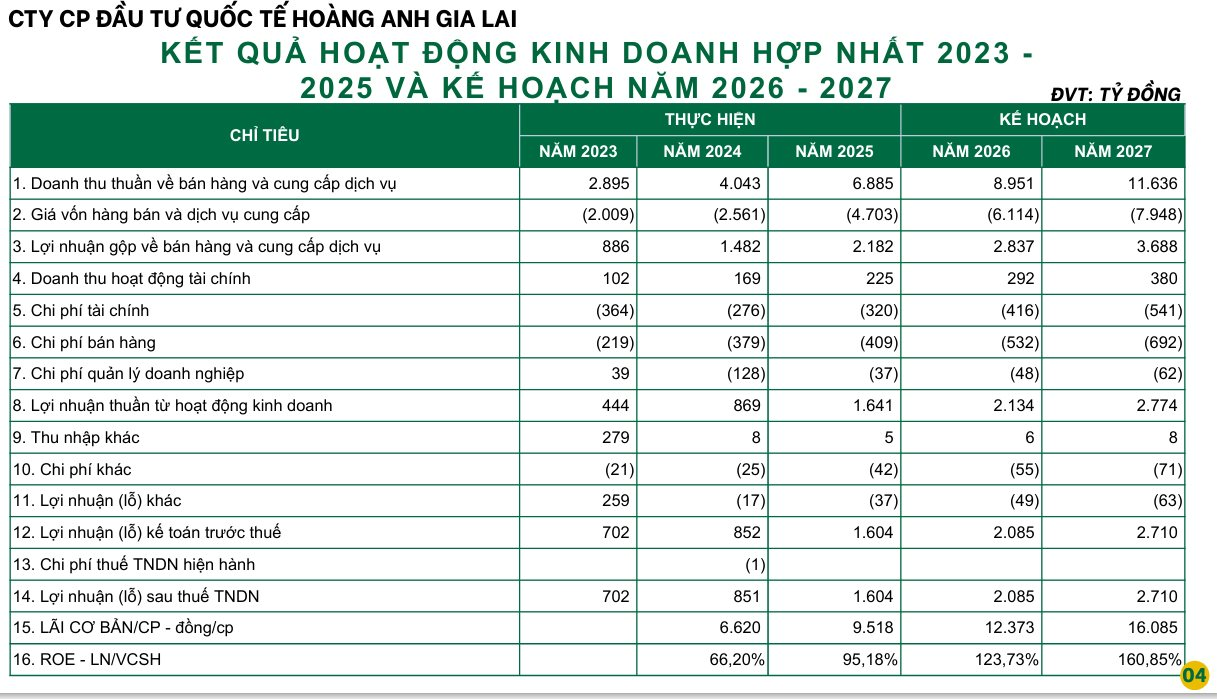

Business Results and 2026-2027 Plan of HAGL International Investment JSC

To demonstrate this confidence, Mr. Duc made a strong commitment regarding the dividend policy of HAGL International Investment Company (expected to IPO in Q2/2026). Answering a question about feasibility, he said, “We have carefully calculated internally that for three consecutive years after the IPO, the company will allocate 50% of its post-tax profit to pay cash dividends. Note that it’s cash, not stock dividends.”

Based on the projected post-tax profit of VND 2,085 billion in 2026, a 50% payout would amount to over VND 1,000 billion. With the current charter capital of VND 1,685 billion, the cash dividend yield could be very high compared to the par value.

The company has outlined a 2025-2027 business plan, with projected revenue of VND 8,951 billion in 2026 and an increase to VND 11,636 billion in 2027.

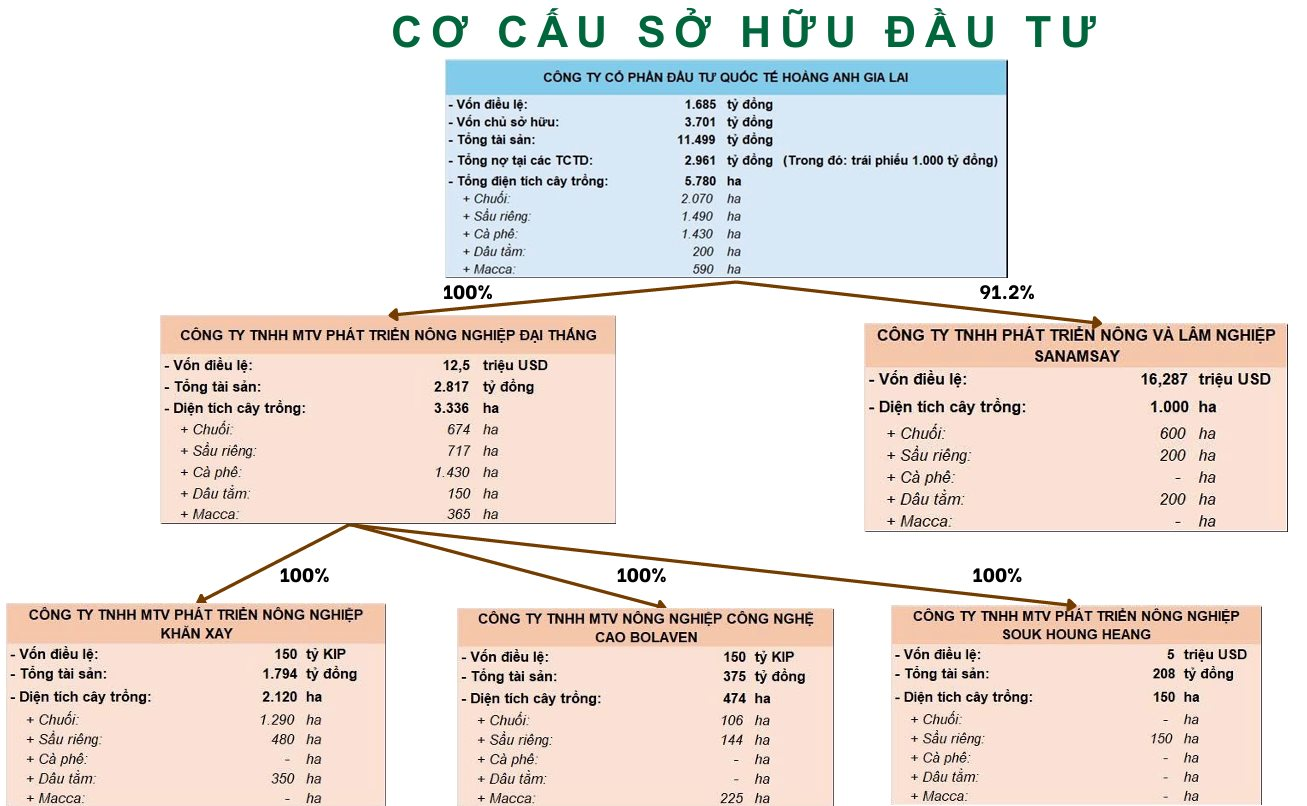

Ownership Structure of HAGL International Investment JSC

In terms of asset scale, HAGL International Investment currently manages a large agricultural land portfolio in Laos through key subsidiaries such as Dai Thang Agricultural Development Company (managing 3,336 ha) and Khan Xay Agricultural Development Company (managing 2,120 ha). As of now, the company’s total cultivated area is approximately 5,780 ha.

Within the crop structure, 2,070 ha of bananas are currently being harvested, playing a crucial role in generating stable short-term cash flow. Additionally, the company owns 1,490 ha of durian and 1,430 ha of coffee, either in the development phase or beginning to yield harvests, expected to be the main growth drivers for profits in 2026-2027.

Strategy and Risks

The Q&A session at the event was lively, with many questions focusing on HAGL’s core issues.

Investors questioning Mr. Doan Nguyen Duc and HAGL Group

On IPO Valuation: An investor asked about the expected valuation when the projected profit for 2027 reaches VND 2,700 billion. Mr. Duc stated that the company currently owns a large portfolio of clean land with completed infrastructure and crops. He expressed confidence that with strong financial indicators and growth potential, the valuation of HAGL International Investment will be very attractive, though the specific valuation will be determined by the market at the time of listing. “I’m not a fortune teller to predict the stock price, but I believe in the real value of assets and cash flow,” he said.

On Natural Disaster and Climate Risks: Addressing concerns about storms and floods, Mr. Duc explained, “HAGL’s farms are located in the Western Truong Son region (Gia Lai, Laos, Cambodia). This geographical feature helps us avoid most storms from the East Sea that typically hit the central coastal areas. For centuries, this area has experienced very few storms. As for droughts, we have invested in an Israeli drip irrigation system, ensuring a steady water supply for our crops.”

On Market Strategy: When asked why HAGL doesn’t develop retail brands in the U.S. or other distant markets, and about deep processing, Mr. Duc emphasized the importance of “knowing oneself and the enemy.” He believes HAGL’s strength lies in large-scale agricultural cultivation. Therefore, the wise strategy is to sell wholesale to major distributors in China, Japan, and South Korea.

He directly countered the notion that deep processing is necessary for higher efficiency: “Many say fruits must be deeply processed to increase efficiency, which is fundamentally wrong. Processed fruits are typically inferior-grade. Fresh fruits always command higher prices. Why pursue lower-value activities when you can focus on high-value ones?”. He stressed that HAGL will not engage in retail distribution or deep processing but will concentrate on cultivating and exporting fresh agricultural products to maximize profit margins.

On Crop Structure: Mr. Duc revealed a strategic shift: “Soon, coffee will become the primary crop, followed by durian. Bananas will move to the third or fourth position, despite currently being the main revenue source.” He explained that HAGL owns 10,000 ha of land at elevations above 1,000 meters in Laos, ideal for high-value Arabica coffee.

Financial Overview and Strategic Partnerships

Regarding the group’s overall financial health, HAGL has reduced its total debt from VND 36,000 billion in 2016 to VND 6,441 billion currently. The company’s leadership believes the balance sheet has become healthier following debt and asset restructuring.

Mr. Doan Nguyen Duc emphasized that the partnership with these financial institutions is a crucial lever for HAGL to strengthen its financial foundation and move toward a large-scale circular agriculture model in the Indochina region.

Dương Ngọc Minh’s Candid Reflection on the Brink of Bankruptcy

“A staggering debt of $1.5 billion loomed as a terrifying figure. To say liquidity was lost is an understatement—it was, in essence, a declaration of bankruptcy. The question remained: how to proceed? Clearly, HAG had lost credibility among friends, partners, and financial institutions alike,” recalled Bầu Đức.

Strategic Partnership Signed Between OCB, OCBS, and Hoang Anh Gia Lai

On November 25th, Orient Commercial Bank (OCB), OCBS Securities Company (OCBS), and Hoang Anh Gia Lai Corporation (HAGL) officially signed a Strategic Cooperation Agreement. This partnership aims to promote green finance and drive sustainable development.

Strategic Partnership Signed Between OCB, OCBS, and Hoàng Anh Gia Lai

On November 25, 2025, Orient Commercial Joint Stock Bank (HOSE: OCB), OCBS Securities Corporation (OCBS), and Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) officially signed a Strategic Cooperation Agreement. This partnership aims to promote green finance and drive sustainable development.

Bầu Đức’s IPO Pledge for Subsidiary: 30% Annual Growth, 50% Profit as Dividends

At the investor meeting held on the afternoon of November 25th, Mr. Doan Nguyen Duc (Bầu Đức), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG), unveiled preliminary details about the IPO plans for its subsidiary, HAGL International Investment Joint Stock Company, accompanied by impressive commitments.