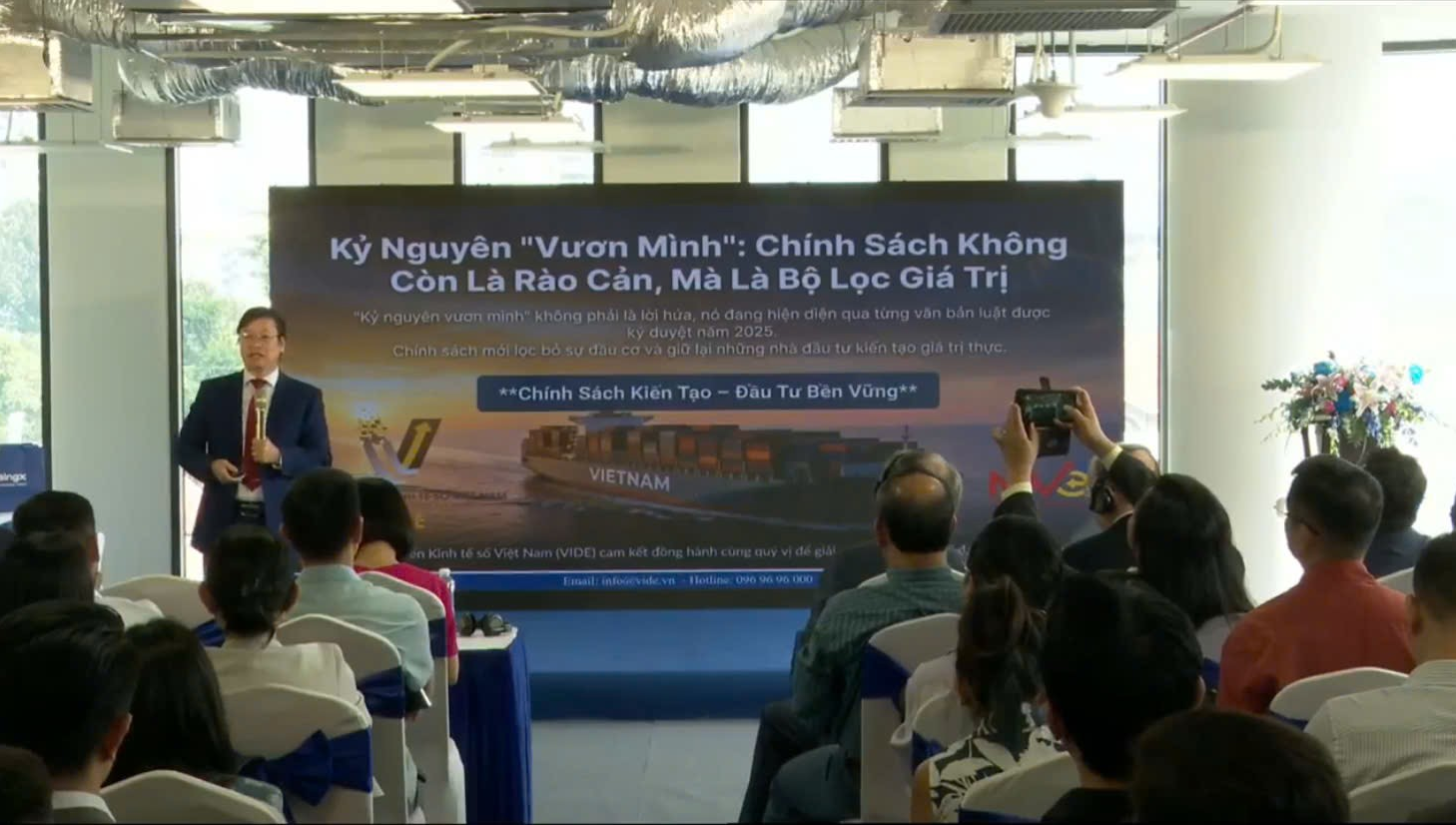

Amidst global economic fluctuations, Vietnam emerges as a beacon of stability, bolstered by strategic policies enhancing its international reputation and appeal. This was highlighted at the seminar titled “Convergence of Technology – Investment and Cooperation Opportunities in Vietnam’s Rising Era”, organized by the Ho Chi Minh City Innovation and Startup Center (SIHUB) on November 26th. Here, Dr. Tran Quy, Director of the Vietnam Institute of Digital Economy Development (VIDE), presented insights on the impact of policies on investment factors in the digital age.

Dr. Tran Quy delivering his presentation

|

“Vietnam is now a welcomed name”

Dr. Quy noted that just a few years ago, Vietnamese representatives approached international meetings with caution. Today, Vietnam’s presence is met with enthusiasm. This shift, he explained, stems from a clear national strategic vision guiding a new development cycle. The period before 2025 is labeled as “innovation and recovery,” while post-2026 marks the “breakthrough” phase, shedding outdated elements.

This strategic vision is anchored in key resolutions such as 57, 59, and 68. A significant difference, according to Dr. Quy, is that these resolutions are no longer mere guidelines but are backed by robust implementation mechanisms, signaling the government’s shift from intent to action. The primary goal is to establish a new technological framework to attract high-quality FDI, evidenced by over $25 billion USD flowing into Vietnam in 2024.

Despite its momentum, Vietnam faces a paradox: its digital asset market is thriving yet largely unregulated. Vietnam ranks among the top 5 countries in digital asset adoption, with nearly 100% of its population using digital wallets. The total value of digital asset transactions in 2024 reached $36 billion USD, equivalent to 18% of GDP.

However, the legal framework remains virtually non-existent, leading to a “law of the jungle” scenario, resulting in tax losses and prompting the Financial Action Task Force (FATF) to place Vietnam on its “grey list” for money laundering and terrorist financing concerns. This pressure has compelled the government to take decisive action.

“The Three-Pillar Policy Framework”

To address these challenges and regulate the market, Vietnam has introduced a systematic legal framework:

– The Digital Technology Industry Law acts as a “red carpet” for investors, offering substantial tax incentives, R&D cost support, and infrastructure guarantees. Notably, it introduces the concept of “digital assets” into legislation for the first time.

– Resolution 05 pilots a controlled digital asset market for five years, capping foreign ownership at 49% and mandating transaction account monitoring to enhance transparency.

– Decision 194 and Decree 94 focus on completing legal frameworks through 17 tasks to remove Vietnam from the “grey list,” while also implementing a fintech sandbox to provide a safe testing ground for innovative models.

According to Dr. Quy, these new policies have tangibly impacted three critical economic flows:

|

First, capital inflows saw a significant surge, with FDI exceeding $25 billion USD in 2024, and venture capital investments soaring by 94%. In core technology sectors like AI and blockchain, capital inflows increased eightfold, reflecting strong international investor confidence.

Second, technological advancements are driven by the expansion of data centers and the classification of blockchain as a core technology for national development.

Third, the labor force benefits from initiatives like the “talent visa” under Decree 221, personal income tax incentives, and special mechanisms such as Ho Chi Minh City’s Resolution 98, Da Nang’s Resolution 136, and the Capital Law (Hanoi), aimed at attracting global experts.

Strategic Recommendations for Investors and Startups

To navigate this new policy environment successfully, both international investors and domestic enterprises must adopt tailored strategies aligned with their contexts and strengths.

For international investors, Dr. Quy recommends aligning strategies with Vietnam’s policy directions to ensure sustainable market penetration. He emphasizes leveraging tax benefits, infrastructure support, and R&D cost advantages, while diversifying investments into prioritized technology sectors.

For Vietnamese startups, he advises actively participating in sandboxes, capitalizing on state-provided capital and infrastructure support, and exploring opportunities in emerging technology sectors.

– 17:04 26/11/2025

ADB Country Director Highlights Vietnam’s Remarkable Progress Over the Past Decade

On the morning of November 25th, in Hanoi, the Ministry of Finance and the Asian Development Bank (ADB) jointly hosted the 2025 High-Level Public-Private Partnership (PPP) Dialogue. This pivotal event brought together regulatory bodies, development partners, and domestic and international investors. It took place as Vietnam finalizes significant amendments to its PPP Law, marking a critical phase in the nation’s development trajectory.

Prime Minister Attends Key Events at the Autumn Economic Forum

On the morning of November 26th, the 2025 Autumn Economic Forum officially commenced in Ho Chi Minh City. The event was graced by the presence of Prime Minister Pham Minh Chinh, Deputy Prime Minister Bui Thanh Son, leaders from various ministries, local authorities, representatives from approximately 30 diplomatic missions in Vietnam, national leaders, experts, scientists, and over 500 domestic enterprises specializing in science, high technology, and innovation.

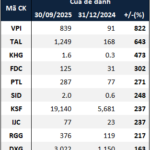

“Real Estate Firms’ Reserves Surge 59% in Nine Months”

As of the end of September 2025, the total reserves of 104 real estate companies listed on the HOSE, HNX, and UPCoM exchanges surged by 59% compared to the beginning of the year, reaching nearly VND 213.4 trillion. Short-term cash holdings also rose by 26%, climbing to approximately VND 119.7 trillion.