Market sentiment improved on November 26th, driving a positive session for the stock market. The VN-Index closed up 20 points (1.2%) at 1,680. Trading volume increased, with HOSE transactions reaching nearly 25 trillion VND.

Foreign investors were net buyers, purchasing approximately 579 billion VND worth of stocks.

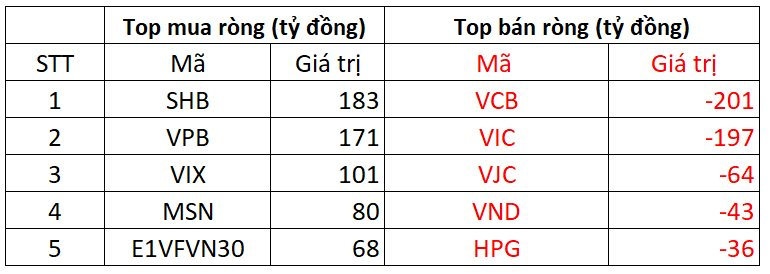

On HOSE, foreign investors were net buyers of 623 billion VND.

SHB led foreign purchases on HOSE with over 183 billion VND, followed by VPB at 171 billion VND. VIX and MSN also saw significant buying interest, with 101 billion VND and 80 billion VND respectively.

Conversely, VCB saw the heaviest selling pressure from foreign investors, with 201 billion VND sold. VIC and VJC followed with 197 billion VND and 64 billion VND sold respectively.

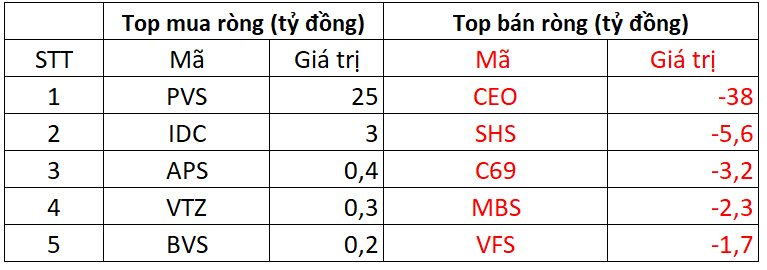

On HNX, foreign investors were net sellers of 28 billion VND.

PVS was the most heavily bought stock on HNX by foreign investors, with 25 billion VND purchased. IDC followed with 3 billion VND. APS, VTZ, and BVS also saw net buying activity.

CEO faced the strongest selling pressure from foreign investors on HNX, with nearly 38 billion VND sold. SHS followed with 5.6 billion VND sold, while C69, MBS, and VFS saw smaller selling activity.

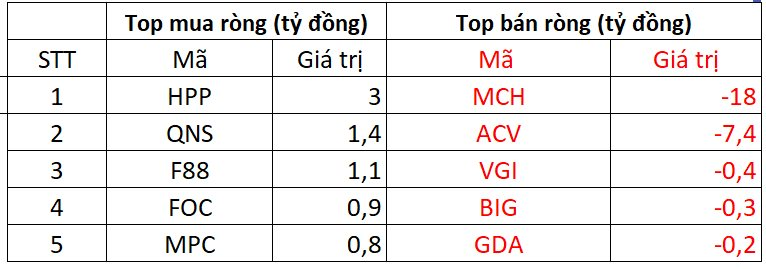

On UPCOM, foreign investors were net sellers of 16 billion VND.

HPP saw the most foreign buying on UPCOM, with 3 billion VND purchased. QNS and F88 also saw net buying activity, with a few billion VND each.

MCH faced the strongest selling pressure from foreign investors on UPCOM, with 18 billion VND sold. ACV and VGI also saw net selling activity.

VN-Index Surges Over 20 Points on November 26th

The market is converging with multiple favorable factors: robust capital inflows, foreign investors returning to net buying, and a more positive investor sentiment.

Market Pulse 26/11: Foreign Investors Return to Strong Net Buying in Financial Sector, VN-Index Rebounds by 20 Points

At the close of trading, the VN-Index surged 20 points (+1.2%), reaching 1,680.36, while the HNX-Index climbed 4.61 points (+1.79%) to 261.91. Market breadth favored buyers, with 484 stocks advancing and 206 declining. Similarly, the VN30 basket saw green dominate, as 24 stocks rose, 5 fell, and 1 remained unchanged.

Vietstock Daily 27/11/2025: Is Buying Momentum Making a Strong Comeback?

The VN-Index surged powerfully, decisively breaking through the 50-day SMA resistance. However, trading volume must surpass the 20-day average to solidify the short-term uptrend. The MACD indicator maintains a strong buy signal and is approaching the zero line. Should it cross above this threshold in upcoming sessions, the short-term outlook will become even more optimistic.

SSI to Offer Over 415 Million Shares at Half the Market Price

SSI is set to offer 415.18 million shares to its shareholders at a price of 15,000 VND per share, representing a 50% discount compared to the current market price.