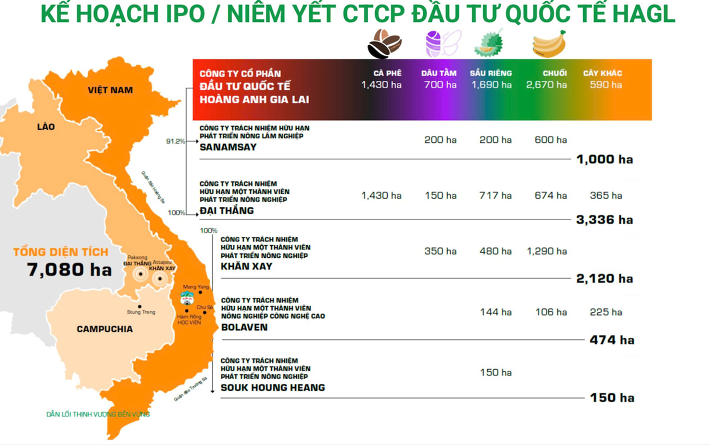

At the Investment Roadshow on the afternoon of November 25th, Hoang Anh Gia Lai Group (HAGL, HoSSE: HAG) announced that Hoang Anh Gia Lai International Investment Company (formerly Hung Thang Loi) currently holds a land fund of 7,080 hectares in Laos, dedicated to cultivating bananas, durians, coffee, mulberry, and other crops.

According to Chairman Doan Nguyen Duc (also known as Bau Duc), the company was originally established for trading purposes. However, “for a reason yet to be disclosed,” the most valuable land assets of HAGL are now concentrated within this subsidiary.

He emphasized that the company is currently the largest revenue and profit generator in HAGL’s agricultural sector. The cultivated areas include both active plantations and those entering the harvesting phase, ensuring sustained growth for years to come.

Building on this foundation, HAGL declared that Hoang Anh Gia Lai International Investment will be the first entity within its ecosystem to undergo an IPO. The plan is scheduled for the second quarter of 2026, with a listing on the stock exchange expected in the same year, ahead of Gia Suc Lo Pang Company, which is slated for a 2027 listing.

Explaining this decision, Bau Duc stated that the move to list the subsidiary was considered after the unit achieved high operational efficiency and HAGL’s financial restructuring was largely completed.

Overview of Hoang Anh Gia Lai International Investment. (Source: HAGL)

Speaking confidently before hundreds of investors, Doan Nguyen Duc asserted, “For the first time in 10 years, I can proudly present to you a dream-like asset portfolio of HAGL. We are now free from debt pressure, own a vast clean land fund, and have orchards at their prime harvesting age.”

To bolster investor confidence, Bau Duc also announced a robust dividend policy for Hoang Anh Gia Lai International Investment post-IPO. Addressing feasibility concerns, he stated, “We have meticulously calculated internally that for three consecutive years after the IPO, the company will allocate 50% of its post-tax profits for cash dividends. Note that it’s cash, not stock dividends.”

Hoang Anh Gia Lai International Investment was established in 2016, with Ms. Vo Thi My Hanh, a member of HAGL’s Board of Directors, as its legal representative. According to publicly available data, the company has a chartered capital of 1,685 billion VND, owner’s equity of 3,701 billion VND, and total assets of 14,499 billion VND.

Regarding HAGL’s land fund, the People’s Committee of Gia Lai Province recently adjusted and supplemented the list of housing development projects for the 2021-2025 period, including 12 projects across 7 communes and wards in the western region of Gia Lai. Among the additions is the Phu Dong High-Rise Residential and Commercial Complex, with a total area of nearly 0.7 hectares, including approximately 0.42 hectares of residential land.

This project was announced by Bau Duc in August when the Gia Lai Provincial People’s Committee issued a memorandum of investment. In a mid-October 2025 interview with Thanh Nien newspaper, he revealed that the land had been owned by HAGL for over 15 years, dating back to the group’s prosperous period. “Back then, we were like the rich kid on the block, so we didn’t pay much attention. If we had, we might have sold it to pay off debts,” he said.

He admitted that re-entering the real estate sector felt like “breaking a promise to shareholders.” However, this was a serendipitous discovery of long-forgotten land. Bau Duc stressed that the project is compact and manageable, primarily aimed at contributing to the newly merged province. “That’s all it is; I have no plans to expand further. HAGL will remain focused on agriculture,” he affirmed.

Hoang Anh Gia Lai Group once enjoyed a golden era in real estate. From 2006 to 2012, real estate was the flagship sector, generating record revenues for the group. In 2009, with four major projects in Ho Chi Minh City—New Saigon, Hoang Anh River View, Phu Hoang Anh, and Hoang Anh Golden House—the group earned over 3,300 billion VND, accounting for 77% of its total revenue that year. HAGL’s footprint also extended to Gia Lai, Quy Nhon, Dak Lak, Da Nang, and Can Tho.

However, after this peak period, HAGL gradually withdrew from real estate to focus on agriculture. To date, the group has successfully restructured its debt, attracted new shareholders, and emerged from cumulative losses, marking a significant turning point in its restructuring journey.

Unusual Price Surges in Ho Chi Minh City Real Estate Projects Under Scrutiny

Ho Chi Minh City is placing a strong emphasis on scrutinizing the legal compliance, market entry conditions, and transparency of real estate projects exhibiting abnormal price increases.

Unlocking Housing Affordability: Addressing Root Causes is the Key to Sustainable Price Reductions

To reduce housing costs, transparency in expenses—especially land and administrative procedures—is essential. This clarity empowers regulatory bodies to adjust land price coefficients based on real data, rather than relying on rigid administrative measures.

Bầu Đức Lists Lao Subsidiary, Pledges 50% Cash Dividends for 3 Years, No Stock Dividends

At the investor meeting held on the afternoon of November 25th, HAGL Chairman Doan Nguyen Duc announced plans to list HAGL International Investment Joint Stock Company on the stock exchange in Q2 2026. He also committed to distributing cash dividends at a rate of 50% of profits for the first three years.