Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 682 million shares, equivalent to a value of more than 19.9 trillion VND; the HNX-Index reached over 54.7 million shares, equivalent to a value of more than 1.1 trillion VND.

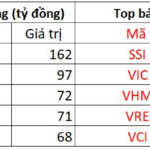

The VN-Index opened the afternoon session quite favorably, with buyers continuing to dominate, pushing the index up sharply despite selling pressure re-emerging, and closing in a positive green zone. In terms of influence, VPL, VIC, VPB, and GEE were the most positively impactful stocks on the VN-Index, contributing over 6.7 points. Conversely, VJC, VHM, FPT, and VCB faced selling pressure, reducing the index by 2.3 points.

| Top 10 Stocks Most Impacting the VN-Index on November 26, 2025 (Calculated by Points) |

Similarly, the HNX-Index showed a positive trend, influenced by stocks such as SHS (+5.34%), MBS (+3.52%), CEO (+4.05%), KSF (+0.67%), and others.

| Top 10 Stocks Most Impacting the HNX-Index on November 26, 2025 (Calculated by Points) |

The non-essential consumer sector led the market with a 3.41% increase, primarily driven by stocks like VPL (+6.99%), MWG (+2.17%), FRT (+2.18%), and HUT (+2.44%). Additionally, the financial sector saw a notable 1.33% rise, with stocks such as VIX (+6.99%), SSI (+3.5%), SHB (+1.83%), and MBB (+1.75%). The real estate and industrial sectors also rebounded, with increases of 0.83% and 0.66%, respectively, led by stocks like CEO (+4.05%), DXG (+4.08%), VRE (+1.35%), KDH (+2.61%), GEX (+6.98%), VSC (+6.93%), GEE (+6.99%), and CII (+5.14%). Conversely, the information technology sector experienced a 0.53% decline, mainly due to FPT (-0.7%).

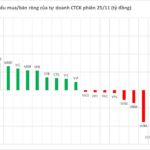

In terms of foreign trading, foreign investors turned net buyers with over 623 billion VND on the HOSE, focusing on stocks like SHB (182.53 billion), VPB (172.15 billion), VIX (101.36 billion), and MSN (80.31 billion). On the HNX, foreign investors were net sellers with over 28 billion VND, concentrated in stocks like CEO (37.97 billion), SHS (5.66 billion), C69 (3.19 billion), and MBS (2.38 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: VIC Exerts Pressure, VN-Index Narrows Gains

The VN-Index fluctuated around the 1,665-point mark during the late morning session. From a peak increase of over 15 points, the VN-Index narrowed its gain to approximately 7.3 points (+0.44%), closing the mid-session at 1,667.64 points. The HNX-Index also rose by 1.41%, reaching 260.92 points. Market breadth showed 382 gainers, 223 losers, and 996 unchanged stocks.

In terms of influence, VPL was the most positively impactful stock, contributing 1.46 points to the VN-Index. GEE and VPB also added a combined 1.9 points to the index. Conversely, VIC was the most negatively impactful stock, reducing the index by 2.75 points.

| Top 10 Stocks Most Impacting the VN-Index in the Morning Session of November 26, 2025 (Calculated by Points) |

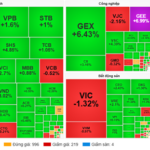

Among sectors, green dominated most stock groups. The non-essential consumer sector led with a 1.83% increase, driven by stocks like VPL (+4.29%), FRT (+1.55%), HUT (+1.83%), MSH (+1.02%), PET (+2.08%), and HTM (+13.19%).

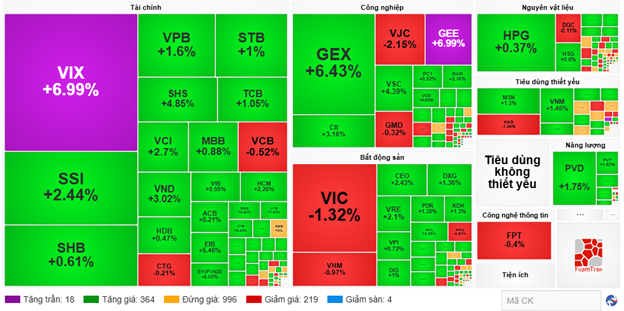

The financial and industrial sectors also showed many highlights with notable liquidity, such as VIX hitting its ceiling, SSI (+2.44%), VPB (+1.6%), SHS (+4.85%), VCI (+2.7%), VND (+3.02%), GEX (+6.43%), CII (+3.16%), VSC (+4.39%), HAH (+2.16%), and GEE reaching its upper limit.

Meanwhile, the real estate sector temporarily lagged, with selling pressure concentrated in two leading stocks: VIC (-1.32%) and VHM (-0.97%). The rest maintained positive gains, such as VRE (+2.1%), KSF (+2.15%), KDH (+1.3%), PDR (+1.38%), DXG (+1.36%), and CEO (+2.43%).

Source: VietstockFinance

|

Foreign investors continued to sell heavily, with a value of over 229.59 billion VND across all three exchanges. Selling pressure was concentrated in VIC with a value of 191.27 billion VND, followed by VCB with 109.38 billion VND. Conversely, VIX led the net buying with a value of 101.57 billion VND.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of November 26, 2025 |

10:30 AM: Buyers Dominate Significantly

As of 10:30 AM, the VN-Index increased by over 10.8 points, trading around 1,671 points. The HNX-Index rose by over 4.3 points, trading around 261 points.

The VN30 group showed green dominance. Specifically, VIC contributed 1.81 points, LPB 1.6 points, MWG 1.33 points, and HPG 1.26 points. Conversely, only VJC and VHM faced selling pressure, reducing the index by over 1.2 points.

Source: VietstockFinance

|

The securities and banking sectors saw green across most stocks, rebounding after the previous session’s decline. Specifically, VIX increased by 6.77%, SSI by 2.89%, TCB by 1.2%, and VCI by 3%…

The real estate sector also turned green across most stocks, with notable performers like CEO (+3.24%), DXG (+1.36%), DIG (+2%), and KDH (+1.16%)…

The industrial sector maintained its positive recovery from the start of the session, with stocks like GEX (+5.1%), CII (+3.75%), GEE (+6.99%), and VSC (+4.39%)…

Compared to the opening, buyers significantly dominated. The number of gainers was 388, while the number of losers was 166.

Source: VietstockFinance

|

Opening: Financial Stocks Recover Early in the Session

At the start of the session on November 26, as of 9:30 AM, the VN-Index surged and then fluctuated around 1,666 points. Similarly, the HNX-Index increased slightly by over 1 point, trading around 258 points.

Green dominated all sectors, reflecting a recovery after the previous session’s adjustment. The financial sector led the early recovery, with VIX (+1.97%), SHS (+1.46%), VCI (+0.9%), and others…

The real estate sector also contributed to the green trend, with most stocks rising. Specifically, VIC (+0.62%), NVL (+0.33%), VRE (+0.75%), and DIG (+0.25%)…

In addition to these sectors, many Large Caps showed positive movements, including VNM, HPG, and MSN, supporting the index.

– 15:25 26/11/2025

Vietstock Daily 27/11/2025: Is Buying Momentum Making a Strong Comeback?

The VN-Index surged powerfully, decisively breaking through the 50-day SMA resistance. However, trading volume must surpass the 20-day average to solidify the short-term uptrend. The MACD indicator maintains a strong buy signal and is approaching the zero line. Should it cross above this threshold in upcoming sessions, the short-term outlook will become even more optimistic.

Foreign Investors Reduce Net Selling, Counter-Trend with Hundreds of Billions Invested in a Banking Stock

Foreign investors’ trading activity remains a drag on the market, with a net sell-off of approximately VND 400 billion. However, this figure marks a significant decrease compared to the net selling of thousands of billions of dong witnessed in the early sessions of the week.

Market Pulse 26/11: VIC Weighs Down, VN-Index Narrows Gains

The VN-Index fluctuated around the 1,665-point mark during the final hours of the morning session. After peaking with a gain of over 15 points, the VN-Index narrowed its increase to approximately 7.3 points (+0.44%), closing the mid-session at 1,667.64 points. Similarly, the HNX-Index rose by 1.41%, reaching 260.92 points. Market breadth showed 382 advancing stocks, 223 declining stocks, and 996 unchanged stocks.