Closing the session on November 27, the VN-Index rose by 3.96 points to 1,684.32, while the HNX-Index reversed, dropping 0.48 points to 261.43. The UPCoM-Index saw a slight increase of 0.07 points, reaching 119.29. Market challenges near resistance levels were largely anticipated.

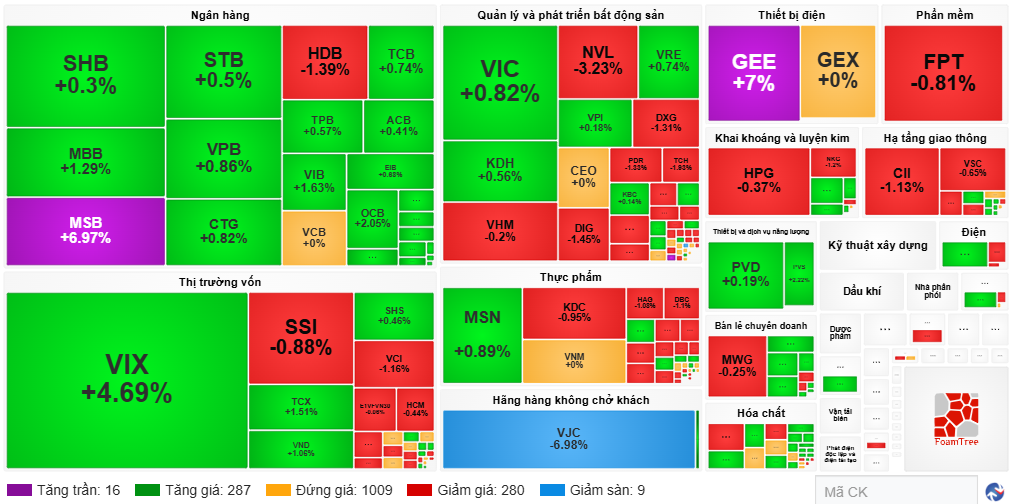

Across the market, 350 stocks gained, primarily in consumer services, hardware, equipment, and industrial goods sectors. Notably, 21 stocks hit their ceiling prices, including MSB in banking and GEE in industrials.

However, 361 stocks declined, with losses spreading across personal care, household products, telecommunications, energy, and transportation sectors.

Analyzing trading values, significant pressure was evident in large-cap sectors like banking, securities, and real estate.

In banking, aside from MSB‘s ceiling price, the sector showed mixed results. Gainers included MBB (+1.08%), VIB (+1.08%), VPB (+0.34%), and SHB (+0.3%). Decliners were STB (-1.3%), HDB (-0.93%), and TCB (-0.3%).

In securities, VIX (+2.65%) and newcomer TCX (+1.4%) were among the few positive performers, while SSI (-2.35%), VCI (-1.6%), SHS (-1.38%), and VND (-0.27%) faced declines.

Similarly, real estate saw more decliners than gainers, with NVL (-4.19%), VRE (-0.59%), DIG (-2.41%), and DXG (-2.09%) dropping. However, VIC (+1.22%) and VHM (+0.39%) helped the sector close with a 0.42% gain. Notably, VIC contributed 2.63 points to the VN-Index, the highest market impact.

Liquidity lacked highlights, but foreign investors drew attention with contrasting actions in the morning and afternoon sessions. Focused on POW, they net bought over 323 billion VND, balancing net selling of nearly 302 billion VND in VJC. Net selling narrowed from 321 billion VND in the morning to just 22 billion VND by session close.

Morning Session: Continued Divergence, VN-Index Tests 1,685

During the morning, market divergence between gains and losses intensified. The VN-Index fluctuated, closing at 1,685.82, up 5.46 points.

By the morning’s end, 303 stocks rose (16 at ceiling prices), while 289 declined (9 at floor prices). The remaining 1,009 stocks held steady at reference levels.

The market landscape mirrored mid-morning trends, with banking showing strength, while most sectors exhibited clear divergence.

|

Morning Market Map, November 27

Source: VietstockFinance

|

Among the top 10 positive contributors to the VN-Index, VIC led with 1.76 points, followed by GEE (1.19 points), VPL (0.7 points), and banking stocks like MSB, MBB, CTG, VPB, and LPB. Conversely, VIC also exerted the most pressure, subtracting 1.79 points.

By market cap, Large Cap (+0.35%), Small Cap (+0.18%), and Micro Cap (+0.64%) rose, while Mid Cap fell by 0.02%.

Morning liquidity was unremarkable, with trading values exceeding 10,600 billion VND, including over 9,970 billion VND on HOSE, down from the previous session.

Foreign investors traded moderately but net sold nearly 321 billion VND. VJC faced the heaviest net selling, nearing 185 billion VND in the morning.

10:40 AM: Pressure at 1,695 Threshold

After reaching 1,695 points early, the VN-Index faced immediate adjustment pressure. By 10:40 AM, it gained 8.12 points to 1,688.48.

Gainers held steady at 300, while decliners rose to 266.

|

Market Struggles at 1,695 Threshold

Source: VietstockFinance

|

Large-cap banking stocks showed positive impacts, with MSB at the ceiling, MBB (+1.08%), VPB (+1.03%), CTG (+1.02%), VIB (+1.36%), and OCB (+2.05%).

Securities and real estate sectors diverged. In securities, VIX (+4.49%) and TCX (+1.72%) rose, while SSI (-0.88%), VCI (-0.44%), and HCM (-0.22%) fell. In real estate, VIC, VHM, and VRE gained, but most others struggled.

Notably, aviation giant VJC fell 6.16%, facing the heaviest net selling (over 170 billion VND) and subtracting 1.7 points from the VN-Index.

Opening: Recovery Continues

Extending recent gains, the VN-Index opened on November 27 at 1,688.52, up 8.16 points by 9:30 AM.

The HNX-Index rose 0.57 points to 262.48, and the UPCoM-Index gained 0.22 points to 119.44. The market saw 287 gainers versus 142 decliners.

Of 23 sectors, 18 rose, led by hardware/equipment (+2.05%), consumer services (+1.92%), and energy (+0.95%). Notable performers included VEC (+3.77%), SMT (+5.74%), VPL (+2.06%), PVS (+2.53%), PVD (+1.72%), and OIL (+1.9%).

Large-cap sectors like securities, banking, and real estate also showed positive signals.

As predicted by securities firms, approaching the 1,700-point threshold may trigger volatility. Investors can remain optimistic but should exercise caution.

Asian markets opened positively, with Nikkei 225 (+1.28%), Hang Seng (+0.36%), and Shanghai Composite (+0.64%) all advancing.

On Wall Street, markets were upbeat ahead of Thanksgiving. The Dow Jones rose 314.67 points (0.67%) to 47,427.12. The S&P 500 gained 0.69% to 6,812.61, and the Nasdaq Composite added 0.82% to 23,214.69.

Market gains were supported by AI firm Oracle (+4%) and Nvidia (+1%), rebounding from recent declines. Microsoft, part of the “Magnificent Seven,” rose nearly 2%.

– 15:55 27/11/2025

Vietstock Daily 28/11/2025: Is Market Polarization Returning?

The VN-Index trimmed its gains, forming a Long Upper Shadow candlestick pattern, signaling heightened profit-taking pressure as the index tests its September 2025 peak (around 1,695-1,711 points). Nevertheless, the short-term outlook remains positive, supported by the MACD indicator’s continued upward trajectory and its recent crossover above the zero line.

Vietnamese Billionaire Bags Billions Amid Fiery Stock Market Rally

Amidst a sea of red in the market and a VN-Index that plummeted by over 20 points, the fortunes of Vietnam’s top billionaires surged impressively. On November 25th, Phạm Nhật Vượng’s net worth soared by approximately $1.1 billion, while Nguyễn Phương Thảo’s wealth climbed by nearly half a billion dollars.

Vietnamese Billionaire Pham Nhat Vuong Sets Unprecedented Record on Historic “Red Day”

Billionaire Pham Nhat Vuong has become the first Vietnamese individual to achieve this remarkable milestone.