Nova Land Investment in Real Estate

The State Securities Commission of Vietnam (SSC) issued Decision No. 439/QĐ-XPHC regarding administrative penalties for violations in the securities and stock market against Nova Land Investment in Real Estate (Nova Land Investment, headquartered at 315 Nam Kỳ Khởi Nghĩa, Xuân Hòa Ward, Ho Chi Minh City).

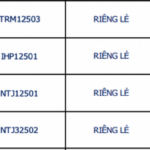

Accordingly, Nova Land Investment was fined 92.5 million VND for failing to disclose information regarding the payment of principal and interest on the NVJCH2025001 bond at maturity.

The company also failed to disclose information within the required timeframe for: the 2024 Annual Financial Report, the audited semi-annual 2024 use of proceeds from bond issuance, and the payment of principal and interest on the NVJCH2023003 bond.

Established in 2004, Nova Land Investment primarily operates in the real estate sector. It is a subsidiary of Novaland Investment Group Corporation (Novaland, Stock Code: NVL, listed on HoSE), holding 99.97% of its charter capital as of September 30, 2025.

Illustrative image

Nova Thảo Điền

According to SSC Decision No. 438/QĐ-XPHC, Nova Thảo Điền (headquartered at 27 Nguyễn Hữu Thọ, Tân Hưng Ward, Ho Chi Minh City) was fined 92.5 million VND for failing to disclose unusual information regarding the “mandatory early bond repurchase” as per Tan Viet Securities’ Notice No. 446/2023/CV-TVSI dated March 13, 2023, and their Announcement No. 802/2023/TB-TVSI dated May 11, 2023, on the results of the bondholder vote for NTDCH2227001.

Nova Thảo Điền also failed to disclose information within the required timeframe for: the audited semi-annual 2024 use of proceeds from bond issuance; the payment of principal and interest on the NTDCH2227001 bond (due for disclosure by August 31, 2024); the payment of principal and interest on the NTDCH2227001 bond using property rights; and SSC’s administrative penalty Decision No. 402/QĐ-XPHC dated October 8, 2024.

Nova Thảo Điền is a Novaland subsidiary operating in the real estate sector. As of September 30, 2025, Novaland holds 99.99% of its capital.

Lucky House

Lucky House Investment Services JSC (Lucky House) was fined 175 million VND under SSC Decision No. 459/QĐ-XPHC for administrative violations in the securities and stock market.

The penalty was due to the company’s misleading disclosures. Specifically, the reports on the use of proceeds from private bond issuances as of December 31, 2022, and June 30, 2023, audited by Nam Viet Accounting and Auditing Services LLC, contained inaccuracies regarding the company’s capital usage. The reports stated that 200 billion VND remained from bond issuance, and the company had repurchased two bond codes (LUCKYHOUSE.BOND2020.02 and LUCKYHOUSE.BOND2020.03) totaling 200 billion VND using its own capital, as per the Chairman’s Decision No. 01/2021-QĐ-LKH dated April 28, 2021.

However, bank statements provided by the Inspection Team of the Government Inspectorate revealed that on November 23, 2020, the company deposited funds at MB Bank until May 11, 2021. On May 11, 2021, the company withdrew these funds to repurchase 80 billion VND of LUCKYHOUSE.BOND2020.02 and 120 billion VND of LUCKYHOUSE.BOND2020.03.

Additionally, Lucky House was ordered to retract or correct the misleading information, as per Article 42, Clause 6 of Decree No. 156/2020/NĐ-CP, amended by Clause 33, Point d of Decree No. 128/2021/NĐ-CP.

Founded in 2018, Lucky House operates in the real estate sector with a charter capital of 300 billion VND. Novaland’s Q3 2025 Consolidated Financial Report indicates that Lucky House is a wholly-owned subsidiary of NVL.

HAGL’s Most Valuable Asset Suddenly Focused on “Purely Commercial” Unit: Bầu Đức’s Undisclosed Reasons Revealed

Bầu Đức revealed that the most valuable land assets of HAGL are currently concentrated within Hoàng Anh Gia Lai International Investment (formerly known as Hưng Thắng Lợi).

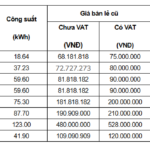

What Does the Surge in Bond Yields Reveal?

Businesses are accelerating their bond issuances, with numerous real estate companies offering double-digit interest rates, peaking at 13.5%. The Ministry of Finance continues to propose enhanced accountability for issuers, requiring clear disclosure of capital usage plans and project risks.