On November 24th, Novaland Investment Group Corporation (Novaland – stock code: NVL) issued a Board of Directors (BOD) resolution approving the contribution of 47.06% of the shares in No Va Real Estate Investment JSC and 99.99% of the shares in An Phát Commercial Investment and Real Estate Development JSC to Mega House LLC.

NVL stated that an independent valuation firm will assess the assets before the capital contribution. This move aims to restructure the investment portfolio and optimize the capital structure.

According to the Q3/2025 financial report, Novaland currently holds 99.97% of No Va Real Estate Investment JSC and 100% of An Phát Commercial Investment and Real Estate Development JSC (renamed from An Phát Investment and Real Estate Development LLC on November 18th).

Upon completion of the capital contribution, NVL is expected to no longer hold any equity in An Phát. Its total investment in Mega House LLC will increase from approximately VND 212 billion to VND 5,413 billion, representing 99.9% of Mega House LLC’s charter capital.

Following the capital increase, NVL plans to divest its entire 99.9% stake in Mega House LLC to restructure its investment portfolio when suitable investors and market conditions are identified. An independent valuation firm will be engaged to determine the transfer price.

After the divestment, NVL will no longer hold any equity in Mega House LLC.

Established in September 2013, Mega House LLC is headquartered at Sunrise City North, 27 Nguyen Huu Tho Street, Tan Hung Ward, Ho Chi Minh City. The company recently converted from a joint-stock company to a limited liability company on November 14th. Its current charter capital is VND 215 billion, with NVL holding 98.6%, Nguyen Huu Duy holding nearly 1.4%, and Nguyen Ngoc Tuan holding 0.001%.

No Va Real Estate Investment JSC is the developer of Sunrise City and Golf Park Residence projects and a joint venture partner in the Aqua City Phoenix Island project in Dong Nai Province. An Phát was established in August 2020 with a charter capital of nearly VND 1,633 billion.

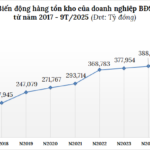

Record-High Inventory Squeeze Hits Real Estate Firms

The inventory landscape for real estate businesses reached unprecedented heights by the end of Q3 2025. Several firms saw their stockpiles surge by tens of trillions of Vietnamese dong.