The Ho Chi Minh City Stock Exchange (HOSE) has announced the removal of VPL – Vinpearl Joint Stock Company’s stock code from the list of securities ineligible for margin trading.

VPL shares officially listed and began trading on HOSE on May 13, 2025. To date, the stock has been listed for over six months and is not subject to any trading warnings, restrictions, or controls.

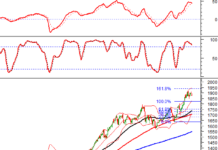

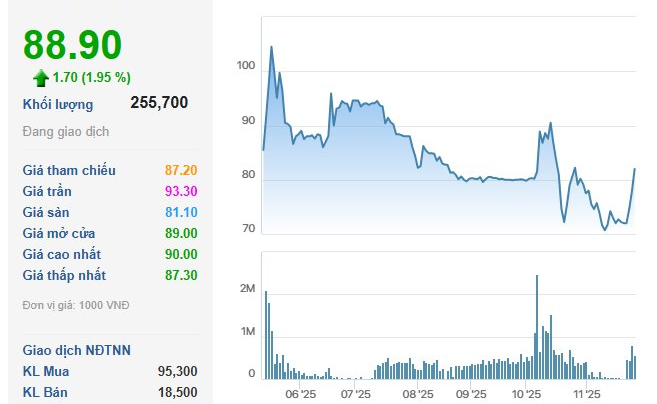

In response to the margin eligibility news, VPL shares have reacted positively, with the stock price rising for four consecutive sessions, including a ceiling-hit session on November 26. As of the morning session on November 27, VPL closed at 88,900 VND per share, with a corresponding market capitalization exceeding 158.7 trillion VND.

In terms of business performance, according to the Q3/2025 financial report, Vinpearl recorded core business revenue of 3,094 billion VND, a 28% increase compared to the same period last year. Gross profit from core operations surged by 669% year-over-year, reaching 819 billion VND. As a result, Vinpearl reported an after-tax profit of 169 billion VND in Q3/2025.

For the first nine months of 2025, Vinpearl’s total operating revenue reached 12,700 billion VND. Hotel service revenue across the entire system (including both owned and managed properties) totaled approximately 8,100 billion VND, a 27% increase year-over-year. After-tax profit exceeded 428 billion VND.

GELEX Infrastructure Approved for IPO of 100 Million Shares

On November 25th, the State Securities Commission granted CTCP Hạ tầng GELEX (GELEX Infrastructure Corporation) approval for its initial public offering (IPO). The company plans to auction 100 million shares publicly, with a starting price of 28,000 VND per share.

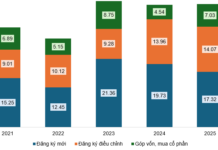

Masan Consumer Plans to Issue Nearly 238 Million Shares

Masan Consumer is seeking shareholder approval to distribute 10.88 million treasury shares while simultaneously issuing 226.8 million bonus shares to its shareholders.