The plastics industry experienced a vibrant quarter, with growth across construction plastics, packaging, and household goods. According to VietstockFinance, out of 23 listed companies, only 4 reported a decline in Q3/2025 profits compared to the same period last year.

Total industry revenue exceeded VND 12.7 trillion, up 3.9%, while net profit surged 66% to VND 934 billion, driven by lower raw material costs improving business efficiency.

Construction Plastics Extend Record Streak

Construction plastics companies continued to lead the industry, with BMP and NTP both posting double-digit growth.

Bình Minh Plastics (HOSE: BMP) reported revenue of nearly VND 1.5 trillion, nearing a three-year high, thanks to a record-high gross margin of 47.9%. Net profit hit a record VND 351 billion, up 21% year-on-year.

Thiếu niên Tiền Phong Plastics (HNX: NTP) saw a 34% revenue increase to over VND 1.6 trillion. Margins rose from 28.5% to 31%, pushing net profit to VND 258 billion, 1.5 times higher and just below the previous quarter’s peak.

| BMP and NTP Profits Remain Strong in Q3/2025 |

An Phát Holdings Group Profits Surge

Other finished product manufacturers also stood out, particularly those under An Phát Holdings.

An Phát Xanh Plastics (HOSE: AAA) reported a profit of VND 118 billion, over five times higher year-on-year, despite revenue dropping to VND 2.4 trillion after deconsolidating some units. Focusing on high-margin finished products and reducing low-margin trading contributed to the positive results.

Hà Nội Plastics (HOSE: NHH) saw profits rise 5.2 times to VND 29 billion, as losses from associates were eliminated.

Similarly, An Tiến Industries (HOSE: HII) turned a profit of VND 37 billion, despite stable revenue. Expanding high-margin finished product lines significantly boosted the bottom line.

| AAA Net Profit Improves Through Low-Margin Trading Restructuring |

Packaging and Household Plastics Show Promise

The packaging segment also performed well. Việt Nam Ecological Plastics (UPCoM: ECO) saw profits rise nearly 56% to VND 5.1 billion by expanding finished products and reducing low-margin plastic resin trading.

Tân Đại Hưng Plastics (HOSE: TPC) turned a profit of VND 5.2 billion, driven by higher revenue and improved margins.

Thuận Đức (HOSE: TDP) achieved record revenue and profit of VND 1.27 trillion and VND 35 billion, respectively, despite narrower margins due to higher raw material costs.

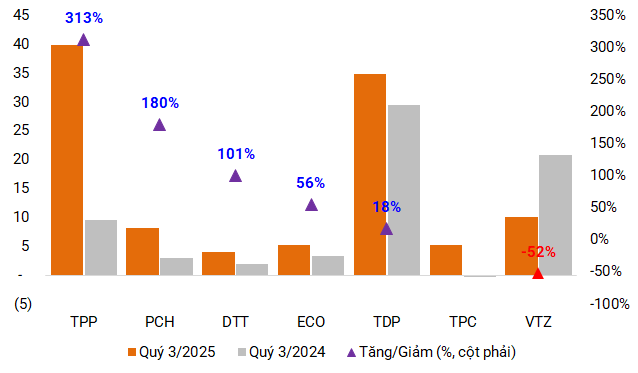

In household plastics, Tân Phú Việt Nam (HNX: TPP) shone with a 313% profit increase to nearly VND 40 billion, the highest ever, thanks to significantly lower production costs.

Conversely, despite record revenue of nearly VND 1.2 trillion, Việt Thành Plastics (HNX: VTZ) saw profits halve to VND 10 billion due to higher production costs and interest expenses.

|

Several Companies Report Triple-Digit Q3/2025 Profit Growth (Unit: Billion VND)

Source: Author’s Compilation

|

Cement Packaging Also Positive

The cement packaging segment also had a strong quarter, benefiting from recovering demand and low PP resin prices.

VICEM Bao bì Hải Phòng (HNX: BXH) reported revenue of over VND 68 billion, up 40%, and profit of VND 245 million, up 136%, as packaging margins rose from 5.9% to 7.2%.

VICEM Bao bì Bút Sơn (HNX: BBS) saw revenue surge 71% and packaging volume jump 78%, turning a profit of nearly VND 1.9 billion, reversing last year’s loss.

|

Cement Packaging Companies Post Strong Growth in Q3

Source: Author’s Compilation

|

Plastic Resin Trading Struggles

HCD Trading and Production (HOSE: HCD) faced significant pressure as falling resin prices pushed revenue below VND 200 billion. Margins narrowed to 3.78%, causing net profit to drop nearly 60% to VND 3.5 billion. This marks the third consecutive quarterly decline, one of the toughest periods in years.

According to HCD’s CEO, the main causes were U.S. tax policies lowering raw material prices and reduced consumption, directly impacting business results.

| HCD Profits Decline with Falling Resin Prices |

Positive Outlook for Final Quarter?

Low PVC prices remain a key driver for BMP and NTP, enabling record profits for nearly two years. Prices peaked at around 5,300 CNY/T in Q3, the lowest in five years, and have since fallen below 4,600 CNY/T, the lowest since 2016.

Prolonged Low PVC Prices. Source: tradingeconomics.com

|

According to FPT Securities (FPTS), domestic construction plastics output rose 21% in the first nine months, driven by recovering construction demand and expanded infrastructure.

Going forward, increased housing supply in Hanoi and Ho Chi Minh City, especially in expanded HCMC areas, is expected to boost demand for pipes and plastic fittings.

FPTS forecasts 15% growth in construction plastics output for 2025, supported by recovering housing demand and peak public investment disbursement. BMP and NTP are expected to ramp up promotions in Q4 to sustain sales momentum.

Prices for packaging and household plastics resins like PE and PP have also declined since late 2024. Despite a slight Q3/2025 recovery, prices remain over 10% lower year-on-year, keeping input costs favorable.

The securities firm believes PVC and PE prices will stay low, while PP may ease slightly due to oversupply, offering a positive outlook for companies in Q4.

PE Resin Prices Decline Throughout 2025. Source: tradingeconomics.com

|

– 12:00 26/11/2025