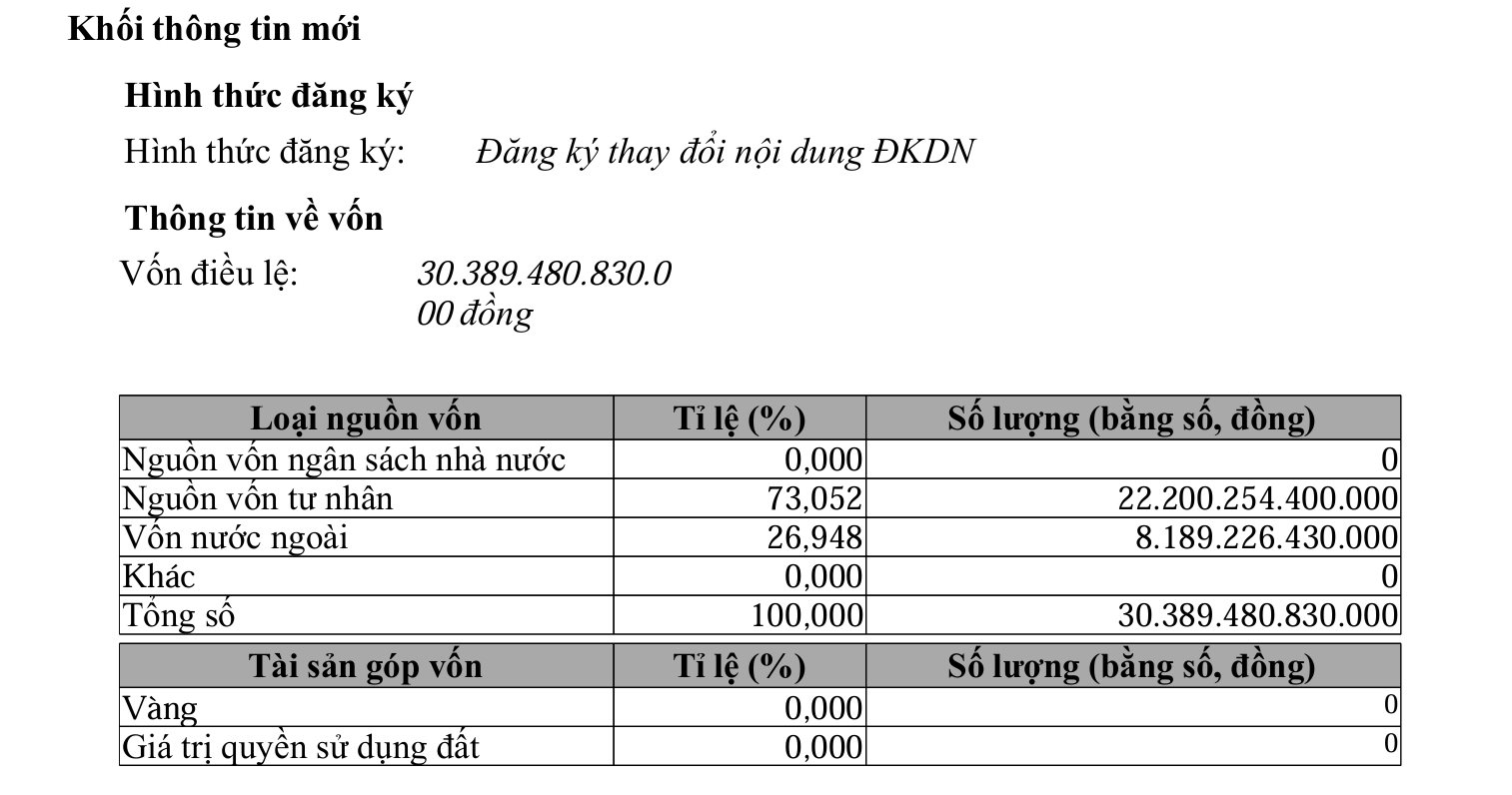

In the new charter capital, the foreign share remains unchanged at VND 8,189.2 billion. Meanwhile, the domestic private capital decreases from VND 22,320.8 billion to VND 22,200.3 billion.

With this adjustment, the foreign ownership ratio slightly increases to 26.95%, while the domestic private sector’s share drops to 73.05%.

Established in 1997 in Dong Nai by Mr. Tran Ba Duong, who also serves as the Chairman of the Board, THACO began as a company specializing in importing used cars and providing auto repair parts. Over the years, it has diversified into a multi-industry conglomerate comprising six member groups: Thaco Auto (automotive), Thaco Industries (mechanical and supporting industries), Thaco Agri (agriculture), Thadico (investment and construction), Thiso (trade and services), and Thilogi (logistics).

In 2024, THACO reported a consolidated after-tax profit of VND 3,228 billion. The majority of this profit came from Thaco Auto, with a consolidated pre-adjustment after-tax profit of VND 4,410 billion. Following closely were Thaco Industries, Thilogi, and Thadico – ĐQM, with profits of VND 312 billion, VND 251 billion, and VND 242 billion, respectively. Thiso earned VND 76 billion, while Thaco Agri reported a modest profit of VND 3 billion.

Compared to 2023’s after-tax profit of VND 2,734 billion, THACO’s 2024 profit increased by 18%. Previously, THACO’s 2023 profit had plummeted by 63%, reaching its lowest point in nine years.

Also in November, THACO announced details about its 108 foreign investors. Jardine Cycle & Carriage Limited (JC&C) of Singapore holds the largest share at VND 8,127 billion, equivalent to 26.6%. Mr. Cheah Kim Teck is the authorized representative for JC&C’s entire contribution.

Among the 108 foreign investors, 107 are primarily linked to South Korea, as evidenced by their registered addresses in the country.

VPI No Longer the Parent Company of Van Phu – B&C

Following Văn Phú – B&C’s capital increase to 1.866 trillion VND, VPI’s ownership stake has been reduced to a mere 0.225%, effectively ending its status as the parent company.