Vietjet Aviation Joint Stock Company (Vietjet, Stock Code: VJC) has submitted a document to the Hanoi Stock Exchange (HNX) announcing the issuance of domestic private bonds.

The company issued 10,000 bonds under the code VJC12504, with a face value of VND 100 million per bond, totaling VND 1,000 billion in face value.

The bonds were issued on November 24, 2025, for the domestic market, with a 60-month term, maturing on November 24, 2030. Vietjet completed the distribution and collection of bond proceeds from investors on the same day.

This marks the fourth bond issuance by Vietjet since the beginning of 2025, as per HNX disclosures.

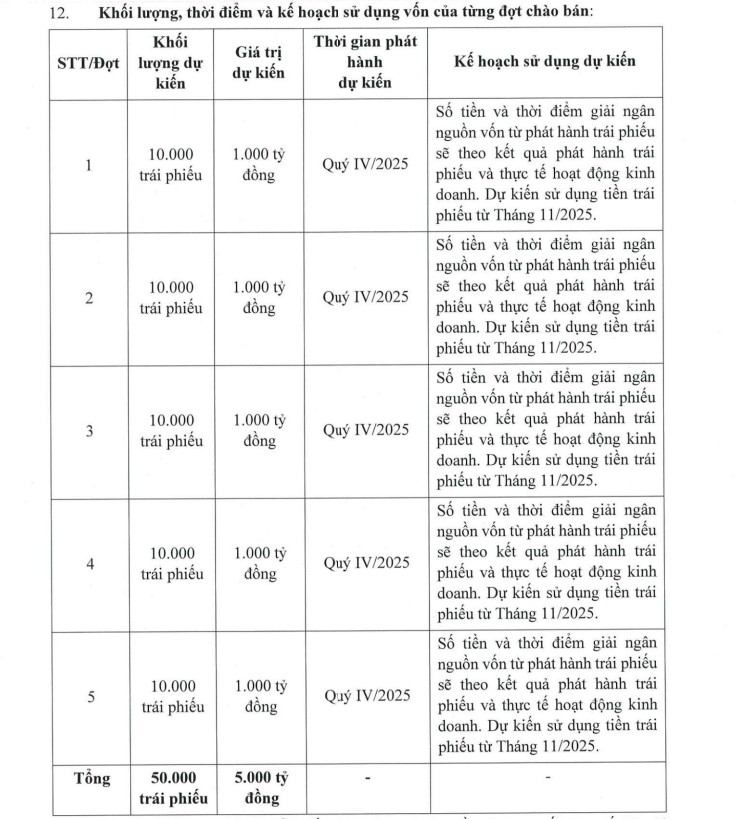

Previously, on November 11, 2025, Vietjet’s Board of Directors issued Resolution No. 70 – 25/VJC-HĐQT-NQ, approving the plan to issue VND 5,000 billion in private bonds (Second Issuance of 2025).

The issuance includes 50,000 non-convertible, warrant-free, and unsecured bonds with a face value of VND 100 million each. The issuance is scheduled for Q4 2025.

Source: VJC

The proceeds from this bond issuance will be used to cover operational expenses, including fuel, port fees, flight operations, maintenance, insurance, aircraft deposits (PDP), asset rentals, aircraft leasing, engine leasing, and other costs.

Conversely, from October 8 to 23, 2025, Vietjet repurchased the entire series of VJCH2429002 bonds. These bonds, with a face value of VND 100 million each and a total issuance value of VND 1,000 billion, were issued on September 30, 2024, with a 60-month term, originally maturing on September 30, 2029.

Vietjet fully settled the VJCH2429002 bond series just over a year after issuance.

In another development, Vietjet’s Board of Directors issued Resolution No. 64 – 25/VJCHĐQT-NQ on October 22, 2025, approving a plan to issue shares for dividend payments and capital increase.

Vietjet plans to issue over 118.3 million shares as dividends, with a rights ratio of 100:20 (shareholders holding 100 shares will receive 20 new shares). These dividend shares are unrestricted for transfer.

The issuance will be funded by undistributed after-tax profits from the audited 2024 consolidated financial report. The process is expected to take place in Q4 2025 – Q1 2026, with the exact timing determined by the Board of Directors following approval from the State Securities Commission.

The additional capital from this issuance, totaling over VND 1,183 billion, will be used to meet requirements for business expansion, enhance financial capacity, improve market competitiveness, strengthen bidding capabilities, and ensure compliance with solvency regulations.

Why Are Con Dao Flights Always Sold Out and Overbooked?

Return flights from Hanoi to Con Dao are priced between 7 to 9 million VND per ticket, while flights from Ho Chi Minh City to Con Dao cost over 3 million VND per ticket. Currently, the number of flights to Con Dao is insufficient to meet travel demands, prompting the Con Dao Special Zone People’s Committee to request airlines increase flights during peak periods.

The Joy of Billionaire Nguyen Thi Phuong Thao on Vietnam Teachers’ Day

VJC shares surged to their upper limit on November 20th, significantly boosting the net worth of billionaire Nguyen Thi Phuong Thao on Vietnamese Teachers’ Day.