The Vietnamese stock market closed in the red on November 25th, with the VN-Index dropping 7.62 points (0.46%) to 1,660.36. The HNX-Index fell 3.92 points (1.5%) to 257.3, while the UPCoM Index dipped slightly by 0.01 points to 118.92. Trading volume surged, with HoSE transactions exceeding VND 25.475 trillion, nearly 50% higher than the previous day. Foreign investors net-sold over VND 400 billion.

Selling pressure was widespread across sectors, weakening indices from the opening bell and persisting throughout the session.

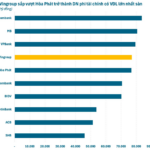

Notably, the top underperforming stocks on November 25th were all from the financial sector, including VPB, VCB, BID, TCB, CTG, and SSI. Bank stocks also universally declined, with most losses around 1%. While not drastic individually, the cumulative effect and spillover from large-cap stocks weighed on the market.

The VN30 Index fell 6.76 points to 1,909.6, reflecting significant pressure on large-cap stocks. Many banking, securities, steel, and real estate stocks also declined. Foreign investors continued their strong net-selling trend.

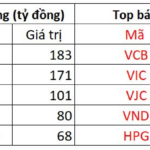

Amid the market’s gloom, Vingroup’s VIC stock remained resilient, rising VND 3,500 (+1.46%) to close at VND 243,000 per share—an all-time high.

Similarly, VJC stock surged, hitting its ceiling price by session’s end. Specifically, VJC gained 3.2% in the afternoon session, reaching its ceiling price of VND 219,100 per share—a new peak that pushed Vietjet Air’s market capitalization above VND 591 trillion.

VJC’s positive performance boosted the wealth of billionaire Nguyen Thi Phuong Thao, Chairwoman of Vietjet Air, to USD 4.9 billion (up USD 412 million). According to Forbes, she ranks 818th globally and is Vietnam’s second-richest individual, trailing only Pham Nhat Vuong.

Pham Nhat Vuong Sets Unprecedented Record in Vietnam

Pham Nhat Vuong’s wealth continued to grow during the November 25th trading session. Photo: VIC

At VND 243,000 per share, Vingroup’s market capitalization reached nearly VND 950 trillion, leading Vietnam’s stock market and nearly doubling Vietcombank’s valuation.

With VIC’s rally, Forbes estimates Pham Nhat Vuong’s wealth at USD 22.2 billion, up over USD 1 billion from the last update and triple his 2025 year-start figure. This places him 102nd globally, with a brief entry into the Top 100—an unprecedented feat for a Vietnamese national.

In the Forbes Top 100, Vuong ranks above Giancarlo Devasini, co-founder of Tether (issuer of the USDT stablecoin).

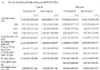

Vuong directly owns 389.9 million VIC shares (10.1%). Combined with family and private company holdings, his group controls approximately 65% of Vingroup. Vietnam’s richest individual also holds nearly half of VinFast’s capital through two private companies.

Experts attribute VIC’s recent surge to positive Vingroup developments.

In October 2025, Vuong and his family established VinMetal (steel), Vin New Horizon (eldercare), and V-Film (entertainment). In early November, he founded VinSpace, holding a 71% stake. VinSpace focuses on manufacturing aircraft, spacecraft, communication satellites, and air cargo transport.

Vingroup’s Historic Deal: Official Response from the State Securities Commission of Vietnam (SSC)

Vingroup is set to issue nearly 3.9 billion bonus shares (at a 1:1 ratio), boosting its chartered capital to 77 trillion VND.

Billionaire Pham Nhat Vuong’s Latest Move at VinSpeed High-Speed Rail Company

VinSpeed, founded by Phạm Nhật Vượng in May 2025, specializes in railway infrastructure development, locomotive manufacturing, and passenger car production.