I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 26, 2025

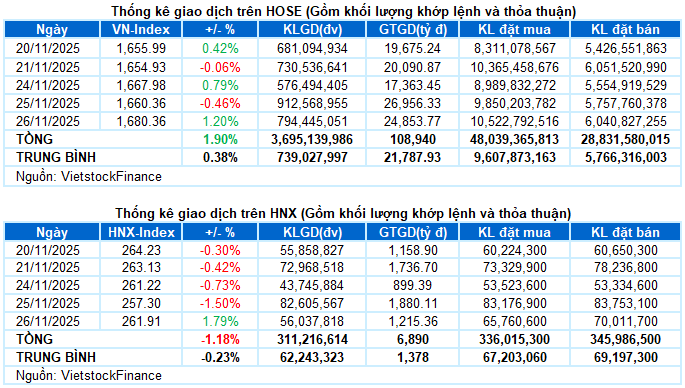

– Key indices surged during the November 26 trading session. The VN-Index rose by 1.2%, reaching 1,680.36 points, while the HNX-Index climbed 1.79% to 261.91 points.

– Trading volume on the HOSE decreased by 12.3%, totaling 682 million units. The HNX recorded nearly 55 million matched units, a 24.4% decline compared to the previous session.

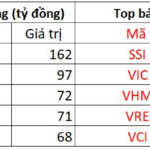

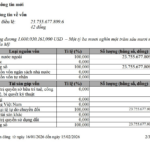

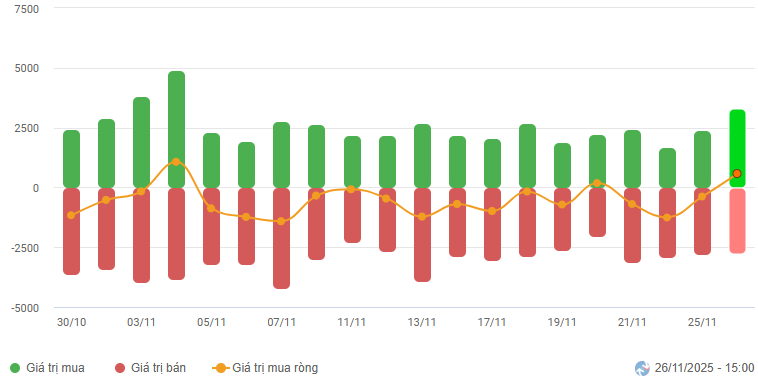

– Foreign investors resumed net buying with over 623 billion VND on the HOSE but remained net sellers with 28 billion VND on the HNX.

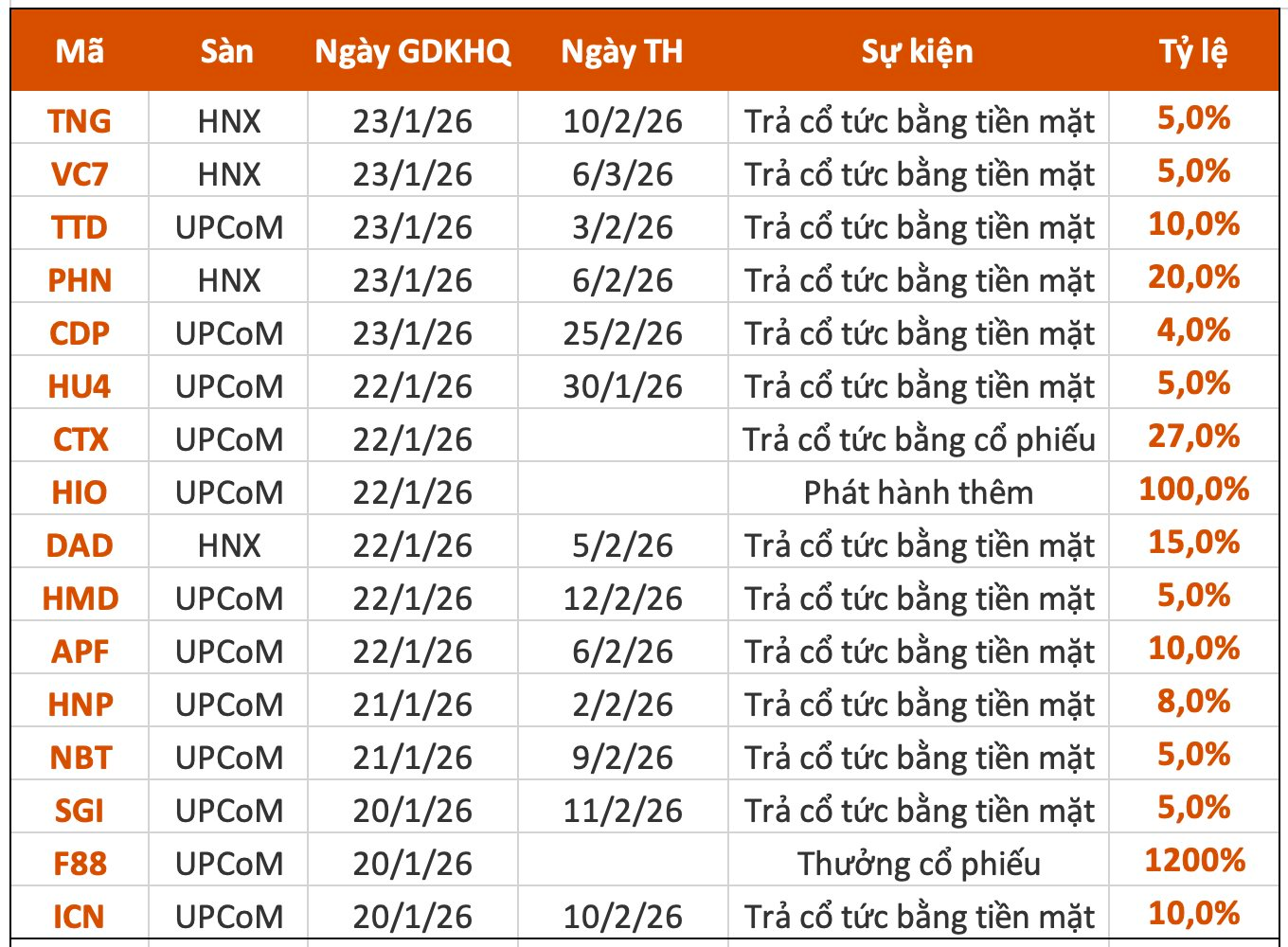

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

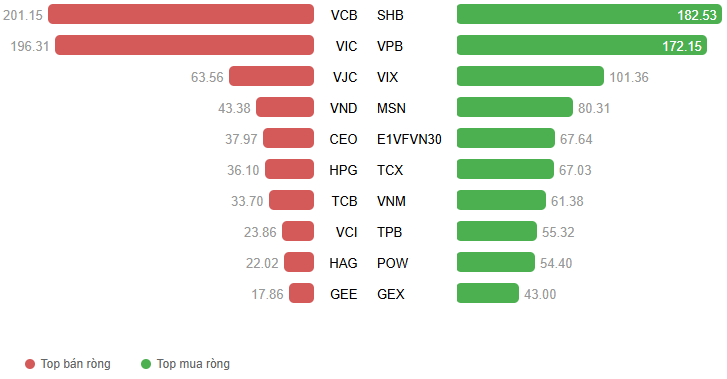

Net Trading Value by Stock Code. Unit: Billion VND

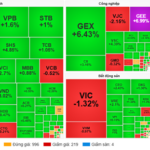

– The market witnessed a broad recovery on November 26. The VN-Index started enthusiastically as green spread across various sectors, quickly pushing the index to trade around 1,675 points. Despite some fluctuations caused by major stocks in the late morning session, buying pressure remained stable. In the afternoon session, stronger consensus among large-cap stocks reignited the upward momentum. The VN-Index accelerated decisively, closing with a 20-point gain at 1,680.36 points.

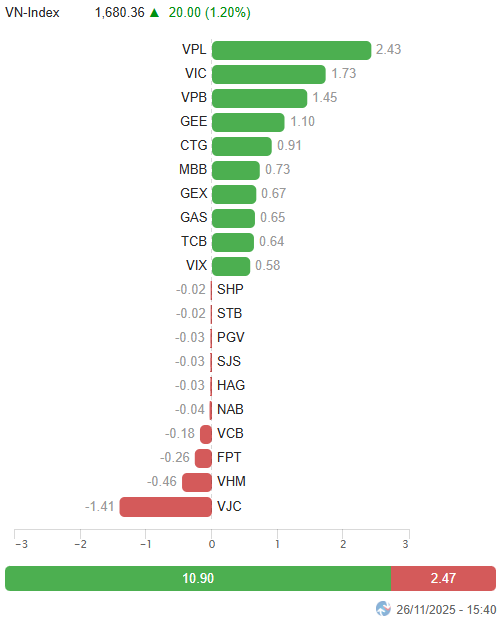

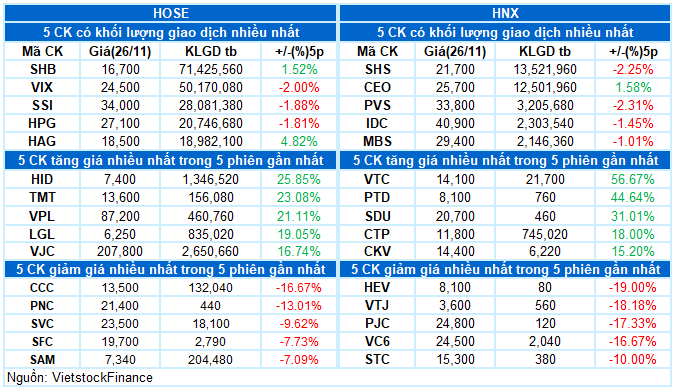

– In terms of impact, VPL, VIC, VPB, and GEE were the most positive contributors, adding a total of 6.7 points to the VN-Index. Conversely, VJC had the most significant negative impact, subtracting 1.4 points from the index.

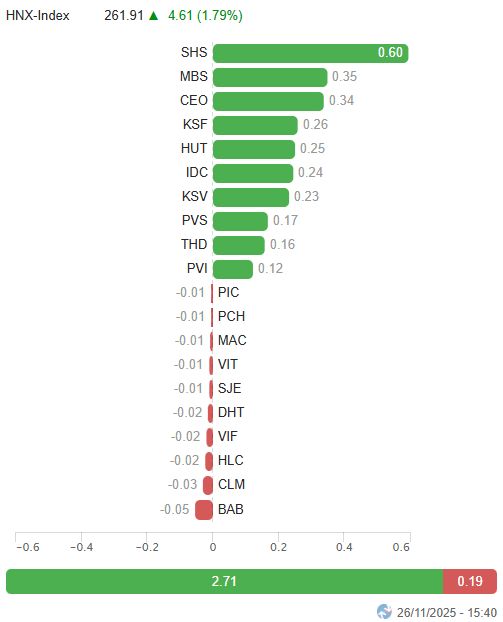

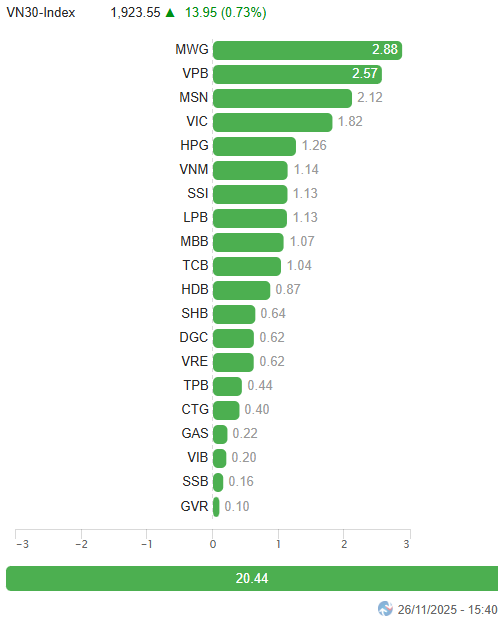

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index increased by 13.95 points (+0.73%), reaching 1,923.55 points. Buyers dominated with 24 gainers, 5 losers, and 1 unchanged stock. Notably, SSI led with a 3.5% gain, followed by VPB, TPB, MWG, and MSN, all surging over 2%. In contrast, VJC faced significant profit-taking after four consecutive strong sessions, closing at the bottom with a 5.2% decline.

Green dominated most sectors. The non-essential consumer sector led with a 3.41% gain, driven by VPL hitting the ceiling, MWG (+2.17%), FRT (+2.18%), HUT (+2.44%), HHS (+2.48%), MSH (+1.4%), and PET (+4.97%).

Financial and industrial sectors also performed strongly, with multiple stocks surging over 2%, including SSI, VPB, SHS, VCI, VND, EIB, EVF, HCM, TPB, CII, VCG, PC1, HHV, HAH, VGC, and even VIX, GEX, GEE, and VSC reaching their upper limits.

Additionally, the real estate sector spread positive sentiment, with active trading in stocks like CEO (+4.05%), DXG (+4.08%), VRE (+1.35%), KDH (+2.61%), PDR (+3.67%), NVL (+1.31%), DIG (+3.49%), TCH (+2.99%), and NLG (+3.29%).

Meanwhile, the information technology sector was the only one to decline due to FPT‘s (-0.7%) adjustment, though most others remained positive, including CMG (+0.67%), VEC (+4.45%), DLG (+2.61%), and POT (+3.02%).

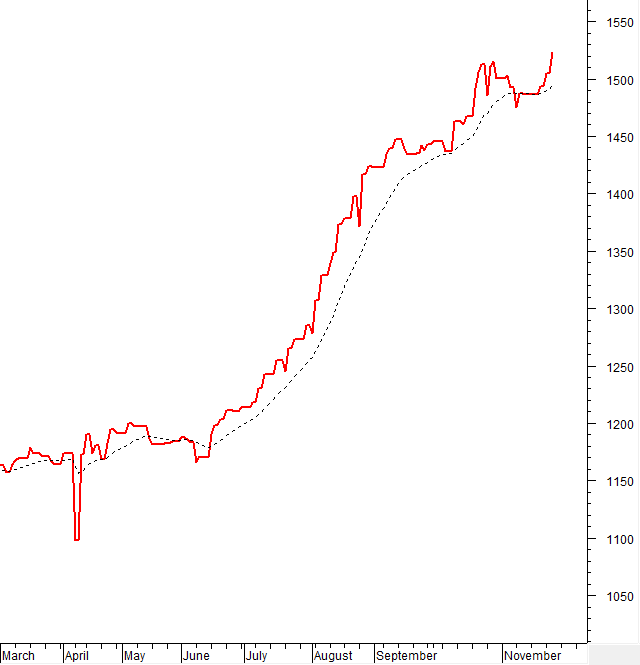

The VN-Index surged strongly, breaking through the SMA 50 resistance. However, trading volume needs to exceed the 20-day average to solidify short-term gains. The MACD indicator maintains a positive buying signal, approaching the zero line. If it crosses above this threshold in upcoming sessions, the short-term outlook will become more optimistic.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Breaking Through SMA 50 Resistance

The VN-Index surged strongly, breaking through the SMA 50 resistance. However, trading volume needs to exceed the 20-day average to solidify short-term gains.

The MACD indicator maintains a positive buying signal, approaching the zero line. If it crosses above this threshold in upcoming sessions, the short-term outlook will become more optimistic.

HNX-Index – Big White Candle Formation

The HNX-Index recovered strongly with a Big White Candle formation. However, the index remains below the Bollinger Bands’ Middle line, indicating lingering volatility risk.

Currently, the MACD indicator is narrowing its gap with the Signal line. If a buying signal reappears in upcoming sessions, the short-term outlook may improve.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the EMA 20 line. If this continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors resumed net buying on November 26, 2025. If they maintain this action in upcoming sessions, the situation will become more positive.

III. MARKET STATISTICS ON NOVEMBER 26, 2025

Economic & Market Strategy Analysis Department, Vietstock Consulting Division

– 17:02 November 26, 2025

Top Stocks to Watch at the Opening Session on November 26th

Discover the most volatile stocks in recent trading sessions with Vietstock’s comprehensive analysis. Our expertly curated list highlights the top gainers and losers, providing invaluable insights for informed investment decisions. Stay ahead of market trends and capitalize on opportunities with our up-to-date data on the most dynamic stocks.

Market Pulse 26/11: VIC Weighs Down, VN-Index Narrows Gains

The VN-Index fluctuated around the 1,665-point mark during the final hours of the morning session. After peaking with a gain of over 15 points, the VN-Index narrowed its increase to approximately 7.3 points (+0.44%), closing the mid-session at 1,667.64 points. Similarly, the HNX-Index rose by 1.41%, reaching 260.92 points. Market breadth showed 382 advancing stocks, 223 declining stocks, and 996 unchanged stocks.