At the Gaikindo Jakarta Auto Week 2025 in Indonesia, VinFast unveiled its latest lineup, including the Limo Green. The introduction of the VinFast Limo Green in Indonesia is notably early, as the model was only recently delivered in Vietnam just over two months ago.

The VinFast Limo Green marks a significant step in the company’s market expansion strategy, particularly in Indonesia—one of the largest automotive markets in the region. This move is especially strategic given Indonesia’s strong preference for 7-seater vehicles.

One of the most attention-grabbing details about the VinFast Limo Green in Indonesia is its anticipated price of approximately 319 million Rupiah, equivalent to around $21,000 USD.

VinFast Limo Green officially launched in Indonesia.

This price point is particularly noteworthy as it falls within an accessible range. In Indonesia, the top-selling 7-seater vehicle is the Toyota Kijang Innova, priced between $41,000 and $46,000 USD—significantly higher than the Limo Green.

Additionally, the Limo Green’s price in Indonesia is $10,000 USD cheaper than its retail price in Vietnam.

Toyota Kijang Innova remains Indonesia’s top-selling vehicle.

Price variations across markets are common, often tied to the manufacturer’s selection of features tailored to balance practicality, pricing, and market competitiveness.

While VinFast has not yet disclosed detailed specifications for the Indonesian Limo Green, the company has hinted at a key factor likely contributing to its lower price compared to the Vietnamese model.

VinFast Limo Green: “Made in Indonesia”

VinFast is in the final stages of completing and officially operating its assembly plant in Indonesia. At the auto show, VinFast confirmed that the Limo Green will be assembled at this facility.

Local assembly is expected to be the primary driver of cost reduction. Indonesia is increasingly recognized as the region’s automotive hub, boasting a robust supply chain, optimized logistics, favorable tax incentives, and a skilled, high-productivity workforce.

VinFast Limo Green spotted during test drives in Indonesia ahead of its official launch. Photo: AutonetMagz

As Southeast Asia’s largest automotive market in 2024, with sales nearing 800,000 units, Indonesia’s rapid urbanization and growing middle class solidify its position as a regional automotive leader. Indonesia’s Minister of Industry, Agus Gumiwang Kartasasmita, has described the country as a “vibrant hub” for the ASEAN automotive sector.

This foundation has attracted increasing investment into Indonesia’s automotive industry. As of September 2024, total investment in the sector exceeded $2.06 billion, reflecting international confidence in Indonesia’s manufacturing capabilities. Major automakers have expanded their facilities, with industrial zones in Karawang, Bekasi, and Subang emerging as key production and assembly clusters supported by a dense network of component suppliers.

Rendering of VinFast’s Indonesian plant. Photo: BMB Steel

The supporting industry is also a cornerstone of cost advantages. The Indonesian Automotive Component Manufacturers Association (GIAMM) reports that the country has developed a comprehensive supplier network, from Tier 1 to Tier 3, capable of producing everything from simple parts to complex assemblies for both domestic and export markets. This localization reduces cross-border transportation costs, shortens delivery times, and enhances production flexibility.

Indonesia’s Domestic Component Level (TKDN) policy mandates that a significant portion of a product’s value must come from local components and services. Current regulations set minimum thresholds between 25–40%, with ongoing simplifications to certification processes while encouraging higher localization rates. The government aims to increase the automotive industry’s localization ratio significantly by 2030.

VinFast’s Indonesian plant under construction. Photo: BMB Steel

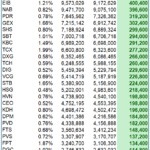

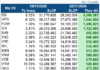

In contrast, Vietnam’s automotive market, while growing impressively in 2024, saw sales of only around 500,000 units.

Localization rates in Vietnam remain modest; even Toyota, one of the first automakers to establish a plant in Vietnam, achieves only a 40% localization rate with its Vios model. VinFast leads with over 60% localization.

Experts note that Vietnam’s automotive supporting industry contributes only about 2.7% to the sector’s total value—a figure considered “very low” by regional standards.

The disparity in market size, supporting industry development, and localization levels are key factors making production costs in Indonesia significantly lower than in Vietnam.

VinFast aims to achieve over 80% localization by 2026.

To lower vehicle prices in Vietnam, greater investment in the supporting industry is essential. However, the supporting industry and manufacturing are closely interlinked; higher localization rates are necessary to drive the supporting industry’s growth.

With most components produced domestically, large production volumes, and supportive TKDN policies, Indonesia-assembled vehicles enjoy a clear cost advantage. Conversely, Vietnam’s reliance on imported components, higher logistics costs, and smaller production volumes result in higher prices, despite comparable labor costs.

VinFast Limo Green Debuts in Indonesia: Priced Over $22,000, Deliveries Expected Next Year

VinFast Limo Green’s debut at the Gaikindo Jakarta Auto Week 2025 underscores the Vietnamese automaker’s ambitious expansion into Indonesia. This all-electric MPV is strategically designed to prioritize practicality, affordability, and versatility, catering to both family and commercial service markets.

Revolutionizing Dental Implants: FastMap® with X-Guide NXT Navigation Technology

Following the milestone of 2020, when Nhan Tam Dental System pioneered the introduction of the X-Guide navigation system to Vietnam and Southeast Asia, on September 14, 2025, Nhan Tam Dental once again solidified its leadership position by receiving the transfer of the advanced FastMap® optical scanning technology, seamlessly integrated with the next-generation X-Guide NXT system.

Localizing the Automotive Industry: A Test of Vietnam’s Industrial Mettle

In the pursuit of industrialization and modernization, few industries rival the automotive sector in terms of its far-reaching impact and inherent challenges. Each vehicle, a marvel of engineering, comprises tens of thousands of components, serving as a testament to a nation’s manufacturing prowess, technological sophistication, and intrinsic strength. Over the past few years, Vietnam’s automotive industry has made significant strides, solidifying its position as a key player in this dynamic landscape.