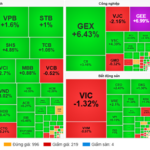

On November 26th, Vietnam’s stock market witnessed a remarkable recovery, with green dominating across most sectors. The VN-Index surged by 20.01 points, reaching 1,680.36 points, a 1.20% increase.

Liquidity remained robust, with over 782 million shares traded on HoSE, totaling 22,767 billion VND. This reflects a strong return of capital after a cautious period. Market breadth favored buyers, with 248 gainers and only 38 decliners.

The VN30 index also rallied, adding 15.93 points to close at 1,923.55. 26 out of 30 blue-chip stocks ended in positive territory, led by SSI, VPB, MWG, MSN, CTG, MBB, and SHB. Many large-cap stocks saw 2-3% gains on high volume, indicating institutional interest.

Vietnam’s stock market showed multiple positive signals on November 26th.

Banks were the session’s highlight. SHB led with over 87 million shares traded, up nearly 2%. VPB, CTG, TPB, MBB, BID, and EIB also rose 1.5-5.5%, significantly contributing to the VN-Index’s gains.

Securities firms rallied on expectations of sustained liquidity. SSI, HCM, VCI, and SHS gained 1-2% on strong volume. Real estate and construction stocks also advanced, though less impressively than financials. BCM, VHM, PDR, NVL, and DIG saw modest gains despite profit-taking pressure at higher levels. Improved sentiment is drawing capital back to this sector.

Sector-wise, financials led with 9,553 billion VND in trading value, up 1.31%. Industrials and real estate rose 1.10% and 0.86%, respectively. Energy stood out with a 1.44% gain, the day’s highest, fueled by bottom-fishing and restructuring hopes for major players.

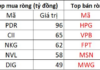

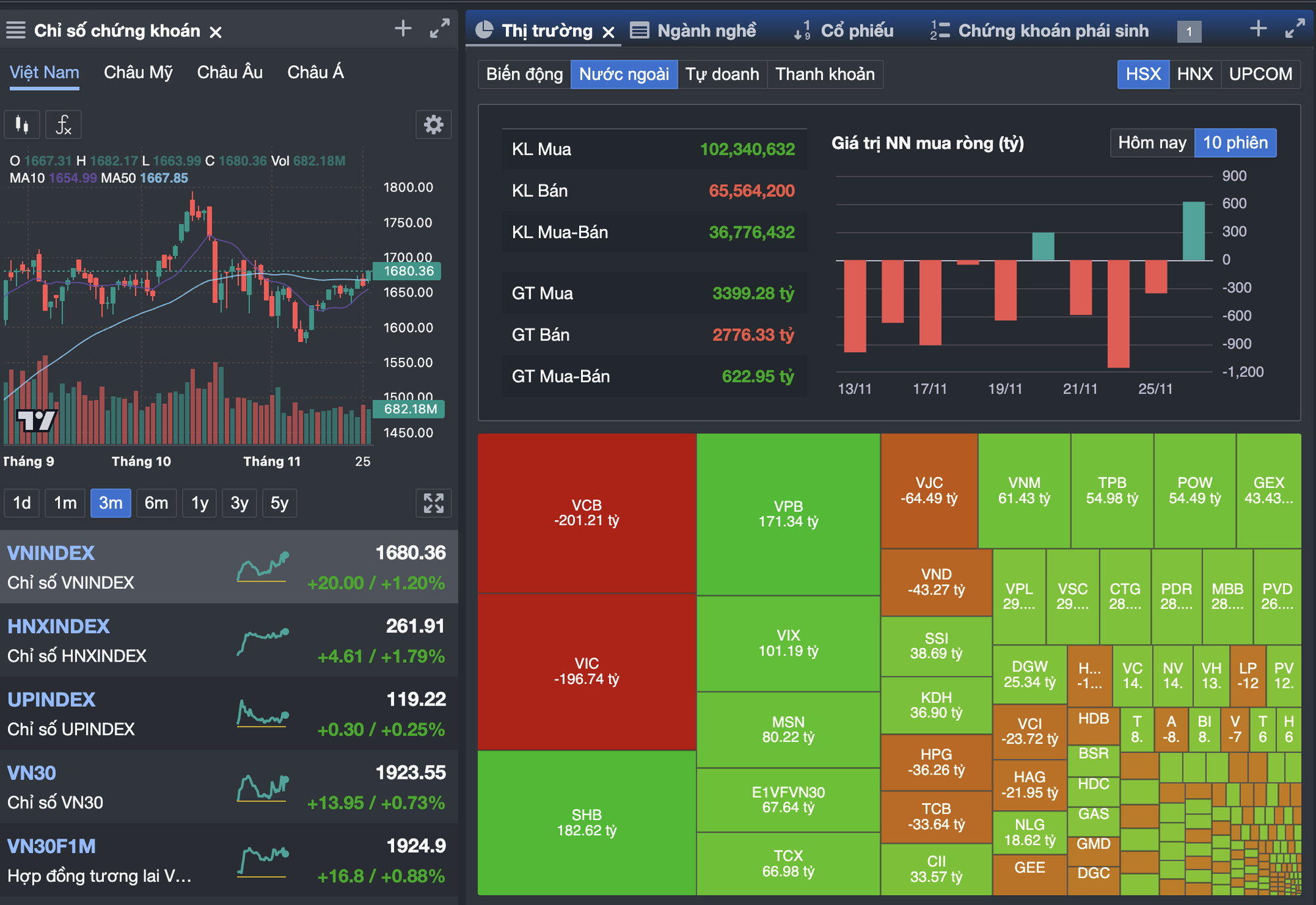

Foreign investors net bought over 622 billion VND on HoSE, focusing on VPB, SHB, VIX, FPT, and MSN. SHB and VPB alone saw 353 billion VND in net buying. VCB and VIC faced selling pressure but didn’t hinder the overall uptrend as domestic demand dominated.

The market’s overall picture is positive: strong liquidity, foreign buying, and improved investor sentiment. If this momentum continues, analysts believe the VN-Index could target the 1,700 resistance level soon.

Dual Momentum: SHB’s Capital Raise Strategy and Foreign Investment Attraction Opportunities

SHB’s upcoming capital increase strategy is poised to propel the bank into the top 4 private banks by charter capital, solidifying its competitive edge through enhanced financial strength. Additionally, SHB is anticipated to join the FTSE Russell global equity index basket once Vietnam achieves its upgrade to emerging market status. These dual catalysts collectively fuel SHB’s potential for exceptional growth in the foreseeable future.

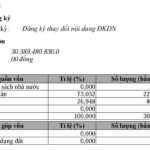

THACO Unexpectedly Reduces Charter Capital, Foreign Investors Unchanged

THACO Group, led by Tran Ba Duong, has announced a reduction in its chartered capital from VND 30,510 billion to VND 30,389.5 billion, marking a decrease of over VND 120 billion.

Market Pulse 26/11: Foreign Investors Return to Strong Net Buying in Financial Sector, VN-Index Rebounds by 20 Points

At the close of trading, the VN-Index surged 20 points (+1.2%), reaching 1,680.36, while the HNX-Index climbed 4.61 points (+1.79%) to 261.91. Market breadth favored buyers, with 484 stocks advancing and 206 declining. Similarly, the VN30 basket saw green dominate, as 24 stocks rose, 5 fell, and 1 remained unchanged.

Vietstock Daily 27/11/2025: Is Buying Momentum Making a Strong Comeback?

The VN-Index surged powerfully, decisively breaking through the 50-day SMA resistance. However, trading volume must surpass the 20-day average to solidify the short-term uptrend. The MACD indicator maintains a strong buy signal and is approaching the zero line. Should it cross above this threshold in upcoming sessions, the short-term outlook will become even more optimistic.

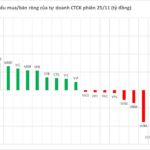

Proprietary Traders Unexpectedly Inject Capital to Scoop Up Plummeting Stock on November 25th

Proprietary trading desks at securities companies collectively net purchased VND 117 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.