According to an announcement from the Hanoi Stock Exchange (HNX), Vietnam Posts and Telecommunications Group (VNPT) has registered to auction over 188.7 million shares in Maritime Commercial Joint Stock Bank of Vietnam (MSB).

The starting price is set at 18,239 VND per share, valuing the total lot at approximately 3,441 billion VND. This price is 1.5 times higher than MSB’s current market price of 12,200 VND per share (as of the closing session on November 26, 2025).

The auction is scheduled for the morning of December 26, 2025, at HNX, open to both institutional and individual investors, both domestic and international.

The 2024 consolidated financial report reveals that VNPT holds over 157 million MSB shares, representing 6.05% of the charter capital, with a fair value of 1,832 billion VND compared to the original cost of 580 billion VND. In 2025, MSB issued a 20% dividend in shares, increasing VNPT’s holdings while maintaining the original cost.

In addition to MSB, VNPT is also divesting from several other companies. The group plans to sell its entire stake of over 10 million shares in ICT (31.43% of the charter capital) at a starting price of 74,106 VND per share, totaling 750 billion VND. The auction is set for December 17 at HNX.

Similarly, VNPT has registered to sell its entire stake in Vietnam Technology and Communication JSC (VNTT, code: TTN). Approximately 2 million TTN shares will be sold outside the system from November 12 to December 11.

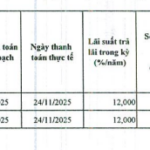

VNPT also announced the auction of over 2.1 million shares in VTC Telecom (VTC), representing 46.67% of the total issued shares based on actual contributed capital. The starting price is over 104.1 billion VND, or 49,200 VND per share.

The registration and deposit payment period is from November 18, 2025, to 3:30 PM on December 12, 2025. The payment period for the purchased shares is from December 19, 2025, to December 25, 2025.

VNPT stated that these capital transfer transactions are in compliance with Decision 620/QĐ-TTg dated July 10, 2024, by the Prime Minister regarding the restructuring plan of VNPT until the end of 2025, and Document No. 1944/UBQLV-CNHT dated August 28, 2024, from the State Capital Investment Corporation on the divestment from 24 approved enterprises.

Why Are Cement Giants Divesting from Multiple Enterprises?

Vietnam Cement Industry Corporation (Vicem) has announced plans to auction shares in batches across multiple subsidiaries and affiliates, scheduled for December 22-23. This move aligns with Vicem’s restructuring plan for the 2021-2025 period. Last year, the Ministry of Finance’s Inspectorate flagged potential capital loss risks in Vicem’s investments in several companies.

Vietravel to Fully Withdraw Capital from Vietravel Airlines

Nguyễn Quốc Kỳ, the founder of Vietravel Airlines, has stepped down from the airline’s Board of Directors as of April 2025.

Bank Auctions Multiple Foreclosed Properties

As the year draws to a close, banks are aggressively liquidating collateralized assets to recover debts ranging from tens to hundreds of billions of dong. While non-performing loan ratios have risen, they are not considered a significant cause for concern.