Series of Companies Engaging in Share Buybacks

In recent months, the market has witnessed numerous companies announcing share buyback programs, including several major players.

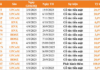

Most recently, The Gioi Di Dong (HOSE: MWG) announced plans to repurchase 10 million treasury shares, as approved by the Board of Directors and shareholders. The transaction is expected to be executed via order matching from November 19 to December 18, 2025, with the aim of reducing the charter capital. The funding will come from the company’s existing capital and undistributed after-tax profits (based on the audited 2024 financial statements, totaling nearly VND 12.6 trillion). MWG is projected to spend approximately VND 800 billion to complete this repurchase.

The Gioi Di Dong Announces Repurchase of 10 Million Treasury Shares

TVC (T-Corp Asset Management Group) also initiated a buyback of 15 million treasury shares between October 6 and November 4. Although the full target was not met due to unfavorable market conditions, TVC successfully repurchased 14.46 million shares, totaling around VND 170 billion. This transaction reduced TVC’s charter capital below the VND 1 trillion mark, with the outstanding shares now totaling over 96.1 million.

TVC Falls Short of Repurchasing 15 Million Treasury Shares

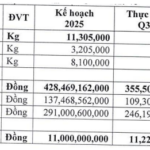

Nhua Tan Dai Hung (HOSE: TPC) recently announced plans to reduce its charter capital by over 25%, as outlined in documents to be presented at the upcoming 2025 Extraordinary Shareholders’ Meeting on December 1. TPC intends to repurchase 5.7 million shares using surplus capital from the most recent audited financial statements, totaling VND 77.2 billion, at a maximum price of VND 13,500 per share. Upon completion, TPC’s charter capital will decrease from over VND 225 billion to more than VND 168 billion.

Nhua Tan Dai Hung Aims to Reduce Charter Capital by Over 25% Through Share Repurchase

Why Repurchase Shares?

Before the 2019 Securities Law took effect, treasury shares served as a lifeline for many companies during market downturns. The previous legal framework allowed companies to repurchase shares to reduce supply and resell them when capital was needed, essentially enabling them to “trade” their own shares—buying low to stabilize prices and selling high when conditions were favorable.

However, since January 1, 2021, with the enforcement of the 2019 Securities Law, the purpose of treasury shares has shifted. Companies are now required to cancel repurchased shares and reduce their charter capital accordingly. Additionally, share buybacks must be approved by the shareholders’ meeting, rather than being decided by the Board of Directors, who previously had the authority to repurchase up to 10% of shares. Consequently, while share repurchases can still support prices, they cannot immediately counteract undervalued shares.

As a result, treasury shares have become more of a financial tool. Repurchasing shares reduces charter capital, directly improving earnings per share (EPS) and return on equity (ROE). Book value may decrease or remain unchanged (depending on the funding source), but book value per share (BVPS) can increase due to the reduced share count. Conversely, the debt-to-equity ratio (D/E) may rise, potentially making the stock less attractive.

For MWG, whose stock price is at a record high (compared to its peak in April 2022), the share repurchase primarily focuses on improving financial metrics. In its announcement, MWG stated the purpose as “reducing charter capital,” a natural outcome of repurchasing treasury shares. However, Chairman Nguyen Duc Tai emphasized that this move is not aimed at price support but is part of a long-term strategy to increase shareholder ownership, thereby enhancing real value for investors.

| MWG Share Price Movement |

Mr. Tai affirmed that MWG consistently allocates a portion of its annual profits for this activity, independent of short-term price adjustments. The use of undistributed after-tax profits highlights the company’s strong operational performance and ample liquidity, reinforcing its commitment to long-term shareholder value.

TVC also funded its share repurchase using undistributed after-tax profits. At the 2025 Annual Shareholders’ Meeting, company leadership stated that this strategy aims to enhance value and credibility among shareholders, particularly as TVC’s stock price remains below its book value.

Chairwoman Nguyen Thi Hang commented on the plan: “The company’s accumulated profits exceed VND 300 billion. Repurchasing up to 15 million shares at VND 13,500 per share (as of June 14) will utilize approximately VND 200 billion. The remaining funds are earmarked for a 10% dividend in 2021. If 2025 results are positive, the company plans to distribute an interim dividend of around 6% by year-end.”

TPC’s situation is somewhat different. At the 2025 Shareholders’ Meeting, Chairman Pham Trung Cang noted increasing competition in the plastic packaging sector, particularly from Chinese rivals, as a key factor in the company’s 2023 losses. TPC has implemented restructuring measures, including selling non-core assets, scaling down production, and streamlining operations to reduce fixed costs. The share repurchase will help alleviate pressure on return on equity, paving the way for dividend resumption this year.

Mr. Cang stated that if the share repurchase and charter capital reduction are successful, the number of outstanding shares will decrease from over 22 million to 15–17 million, boosting earnings per share and dividend payment capacity.

Of course, some companies repurchase shares solely to support prices. Gemadept (HOSE: GMD) announced plans to repurchase 21 million treasury shares at its 2025 Shareholders’ Meeting in June. However, the company specified that this would only occur if GMD’s market price fell below 1.5 times its BVPS, approximately VND 45,000 per share.

GMD’s 2025 Annual Shareholders’ Meeting

|

This plan was developed during a sudden market downturn in early April due to tariff issues, when GMD’s share price dropped to VND 42,000—its lowest since September 2023. GMD’s management believed the stock was undervalued. However, by the time of the meeting, the price had recovered to VND 60,000–63,000, rendering the repurchase plan unnecessary for now.

– 08:04 27/11/2025

Plastic Company’s 25% Capital Reduction Plan Sparks 50% Stock Surge in 4 Months

The company’s primary objective is to reduce the number of outstanding shares, thereby enhancing dividend distribution to shareholders in the coming years.