Salary Increase Effective from the Start of the Year Instead of Mid-Year

Decree No. 293/2025/NĐ-CP stipulates the minimum wage for employees working under labor contracts, effective from January 1, 2026.

The minimum wage increases by 250,000-350,000 VND compared to the current rate.

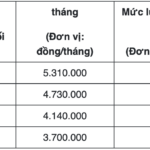

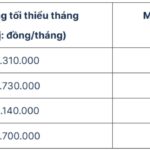

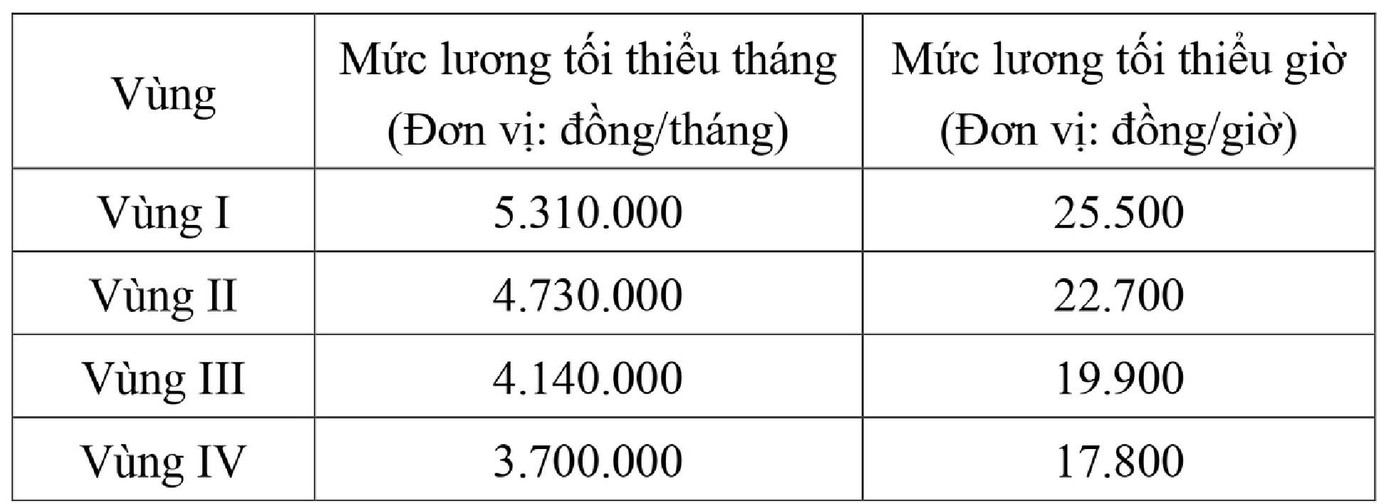

The decree outlines the monthly and hourly minimum wages for employees by region as follows: Region I (5,310,000 VND/month, 25,500 VND/hour); Region II (4,730,000 VND/month, 22,700 VND/hour); Region III (4,140,000 VND/month, 20,000 VND/hour); Region IV (3,700,000 VND/month, 17,800 VND/hour).

Thus, the minimum wage increases by 250,000-350,000 VND, depending on the location.

This wage increase is implemented six months earlier than usual. The new wage rates will take effect from January 1, 2016, instead of mid-year.

The early adjustment is expected to help businesses proactively plan their production and operations while improving income for employees.

Two Groups Eligible for the Minimum Wage Increase

The wage increase applies to two groups. The first group includes employees working under labor contracts as defined by the Labor Code.

The second group comprises employers as defined by the Labor Code, including: Enterprises as per the Enterprise Law; agencies, organizations, cooperatives, households, and individuals hiring or employing workers under agreements. Other agencies, organizations, and individuals related to the implementation of the minimum wage as stipulated in this Decree.

Two groups eligible for the minimum wage increase.

Employers operating in a specific region will apply the minimum wage stipulated for that region.

Businesses with units or branches operating in regions with different minimum wages will apply the wage rate corresponding to the region where the unit or branch is located.

Employers operating in industrial zones or export processing zones spanning multiple regions will apply the highest minimum wage rate among those regions.

Additionally, employers operating in areas with name changes or divisions will temporarily apply the minimum wage rate of the area before the change or division until the Government issues new regulations.

Furthermore, employers operating in newly established areas formed from one or more regions with different minimum wages will apply the highest minimum wage rate among those regions.

No Cuts, No Compromises: Preserving Wages and Benefits in Minimum Wage Adjustments

The grassroots trade union meticulously reviews collective labor agreements, regulations, and policies to strategize and propose adjustments to the minimum wage within the organization.