At the Vietnam-Australia Financial Policy Dialogue 2025 held today (November 27), Mr. Nguyen Khac Chien, Deputy Head of Legal and External Affairs at the State Securities Commission (SSC), announced that FTSE Russell has officially upgraded Vietnam’s stock market classification from Frontier to Secondary Emerging, effective from September 2026.

Mr. Nguyen Khac Chien, Deputy Head of Legal and External Affairs, State Securities Commission.

However, Vietnam must undergo a mid-term review in March 2026. A critical aspect highlighted is the need for Vietnam to enhance market accessibility for global institutional investors through international brokers and streamline procedures to boost foreign investor confidence.

“With the upgrade to Secondary Emerging status, Vietnam’s stock market will be included in key indices, joining the ranks of major markets like China, India, and Kuwait,” Mr. Chien emphasized.

The upgrade is expected to catalyze significant reforms in market regulation, oversight, and operations, while also motivating listed companies and public firms to restructure. “A competitive race is likely to emerge among top enterprises, particularly the top 100, to secure a spot in FTSE’s selection, thereby enhancing corporate and shareholder value and elevating overall market quality,” Mr. Chien added.

Market participants, especially securities firms and custodian banks, will be compelled to enhance efficiency to better serve foreign investors.

According to Mr. Chien, the new KRX information technology system has met market expectations and effectively handled substantial trading volumes. Following its launch in May, investor sentiment improved, contributing to market surges in June, July, and August. The VN-Index reached multi-year highs, with trading sessions approaching $3 billion in value.

Vietnam-Australia Financial Policy Dialogue 2025.

During the dialogue, Vietnam expressed hopes for increased Australian investment in its stock market, bond market, and pension funds, along with enhanced cooperation and experience-sharing.

Regarding cryptocurrency asset management, Mr. Nguyen Ngoc Anh, Deputy Director of the Department of Debt Management and External Finance at the Ministry of Finance, stated that Vietnam is in the early stages of developing a legal framework for crypto assets, while Australia has already established clear definitions. As a novel legal area, Vietnam seeks further experience-sharing.

Mr. Terence (Terry) Kouts, representative of the Australian Securities and Investments Commission (ASIC), noted that Australia has published an updated approach to crypto assets, along with related recommendations. However, differing views across sectors and agencies, coupled with slower legislative progress compared to market developments, have complicated regulatory adjustments and management methods.

Vingroup’s Pham Nhat Vuong Sets Date for Largest Deal in History

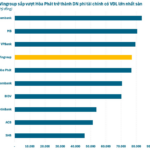

Following the issuance, Vingroup’s charter capital will double to over 77,000 billion VND, making it the non-financial enterprise with the largest charter capital on the Vietnamese stock market.

Vingroup’s Historic Deal: Official Response from the State Securities Commission of Vietnam (SSC)

Vingroup is set to issue nearly 3.9 billion bonus shares (at a 1:1 ratio), boosting its chartered capital to 77 trillion VND.