Source: State Bank of Vietnam (SBV)

|

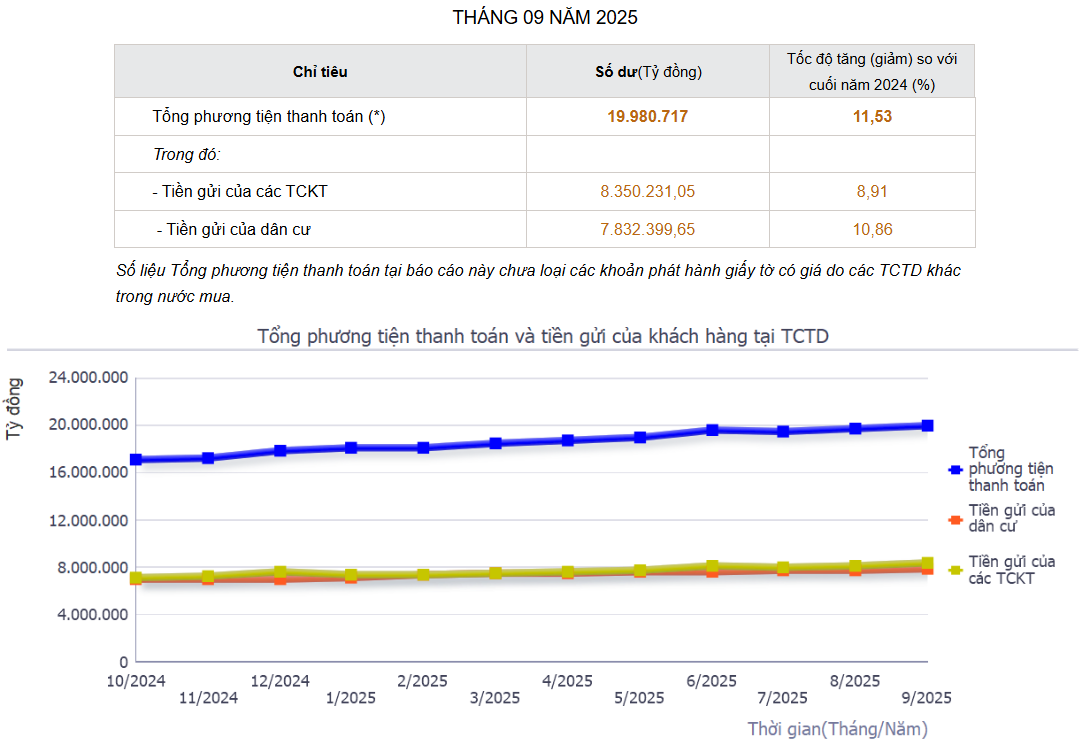

According to the State Bank of Vietnam (SBV), as of the end of September, the total means of payment reached VND 19,980 trillion, a year-to-date increase of 11.53%.

Of this, deposits from economic organizations totaled over VND 8,350 trillion, up 8.91%; while household deposits reached VND 7,830 trillion, growing by 10.86%.

Consequently, the total deposits flowing into the banking system amounted to nearly VND 16,200 trillion.

The SBV reported that the average deposit interest rates offered by commercial banks in September were as follows: 0.1 – 0.2% per annum for demand deposits and deposits with terms under 1 month; 3.4 – 4.1% per annum for deposits with terms from 1 month to under 6 months; 4.6 – 5.5% per annum for deposits with terms from 6 to 12 months; 4.9 – 6.1% per annum for deposits with terms from 12 to 24 months; and 6.7 – 7.5% per annum for deposits with terms over 24 months.

In reality, since October, deposit interest rates at banks have begun to rise again. According to VCBS, deposit rates are likely to edge up by year-end, driven primarily by two factors.

First, liquidity pressure within the banking system is increasing as credit growth is expected to accelerate strongly in the final months of the year, with full-year growth projected at 18-20%. As of the end of October, credit had grown by 13.37% compared to the end of 2025, reflecting robust capital demand in the economy.

Second, the risk of USD/VND exchange rate fluctuations remains present, amid heightened foreign currency demand during the peak import season at year-end.

As a result, VCBS anticipates that deposit interest rates may be adjusted upward at some joint-stock commercial banks to meet capital needs and manage systemic risks, while still being maintained at a low level in line with growth support policies.

– 10:21 28/11/2025

After the Prolonged Boom, Real Estate Prices Face Sharp Correction Due to This Key Factor

The real estate market is teetering on the brink of a significant cooldown, and the culprit can be summed up in two words: interest rates.