Following a session marked by intense selling pressure, the market rebounded strongly at the start of the November 26 session. Supply was well-absorbed across numerous stocks, with the VN-Index showing improved liquidity in the afternoon session. At close, the VN-Index gained 20 points (+1.20%), reaching 1,680.36 points, reclaiming the losses from the previous session. Foreign trading was a highlight, with net buying of approximately VND 579 billion.

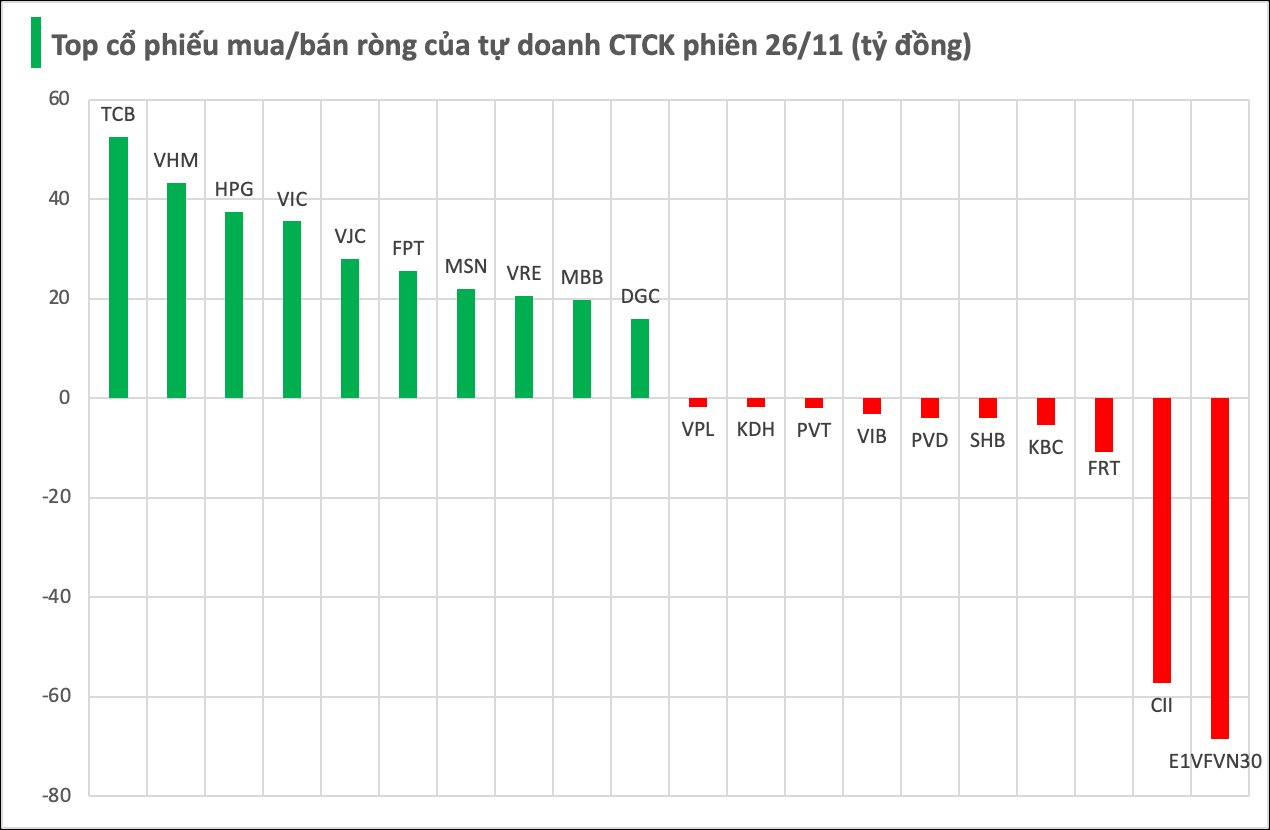

Securities firms’ proprietary trading desks net bought VND 322 billion on HOSE.

Specifically, TCB saw the strongest net buying at VND 53 billion, followed by VHM (VND 43 billion), HPG (VND 37 billion), VIC (VND 36 billion), VJC (VND 28 billion), FPT (VND 26 billion), MSN (VND 22 billion), VRE (VND 21 billion), MBB (VND 20 billion), and DGC (VND 16 billion).

Conversely, securities firms were the strongest net sellers in E1VFVN30, with a value of -VND 68 billion, followed by CII (-VND 57 billion), FRT (-VND 11 billion), KBC (-VND 5 billion), and SHB (-VND 4 billion). Other stocks also recorded notable net selling, including PVD (-VND 4 billion), VIB (-VND 3 billion), PVT (-VND 2 billion), KDH (-VND 2 billion), and VPL (-VND 2 billion).

PYN Elite Fund Propels VN-Index to 3,200 Points

According to Pyn Elite, the 6-month and 12-month profit outlook remains highly promising. The market could resume its upward trend at any moment.

Market Pulse 28/11: Continued Divergence as Vingroup Stocks Bolster VN-Index by Over 14 Points

At the close of trading, the VN-Index climbed 6.67 points (+0.4%) to reach 1,690.99, while the HNX-Index dipped 1.52 points (-0.58%) to 259.91. Market breadth tilted toward the downside, with 417 decliners outpacing 289 advancers. The VN30 basket reflected this trend, as 17 constituents closed lower, 10 advanced, and 3 remained unchanged.

Technical Analysis Afternoon Session 27/11: MACD Crosses Above Zero Threshold

The VN-Index continues its upward trajectory, firmly positioned above the 50-day SMA, while the MACD has decisively crossed above the zero line. Meanwhile, the HNX-Index is experiencing a tug-of-war as it retests the Middle Band of the Bollinger Bands.