According to a recent report by Vietcap Securities, Kinh Bac City Development Shareholding Corporation (KBC) is poised for a positive outlook in 2025. The handover of industrial land at Nam Son Hap Linh Industrial Park (NSHL) is expected to be the primary driver of Q4 profits.

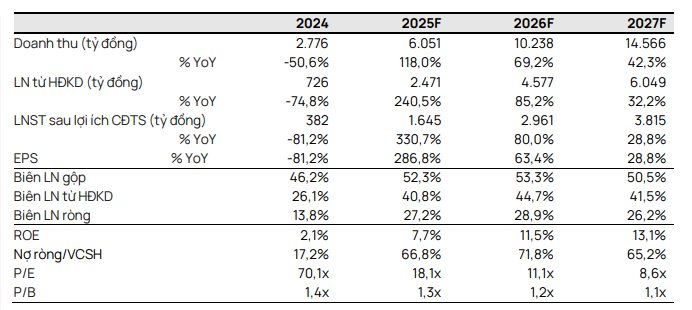

Vietcap forecasts KBC’s post-tax profit, excluding minority interests, to surge by 331% year-on-year, reaching VND 1.6 trillion in 2025. In Q4 alone, approximately 17 hectares are slated for handover at NSHL, following 88 hectares delivered in the first half of the year (primarily from industrial clusters in Hung Yen) and 17 hectares in Q3 to Goertek.

Moving into 2026, KBC’s profit growth is projected to sustain momentum, with post-tax profit excluding minority interests estimated to rise by approximately 80% compared to 2025.

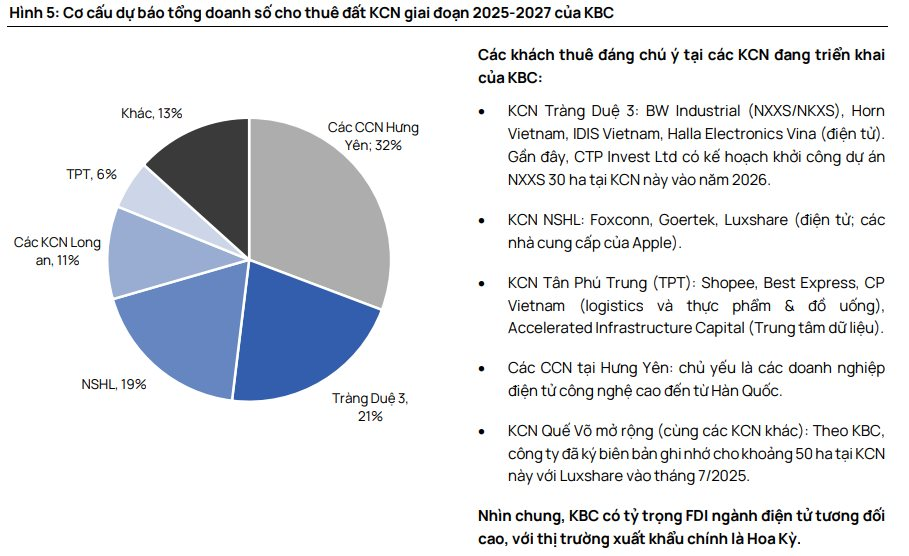

Starting in 2026, KBC is expected to commence handovers at several major projects, including Trang Due 3 Industrial Park, Que Vo 2 Expanded Industrial Park, and industrial parks in Long An (Tan Tap, Loc Giang). The unrecorded backlog by the end of 2025 is estimated at around 98 hectares, laying the groundwork for accelerated handovers in the subsequent two years. Additionally, Vietcap anticipates KBC will launch and deliver approximately 12 hectares of wholesale land at Trang Cat Urban Area in 2026, benefiting from completed legal procedures, along with 5 hectares from social housing projects in Nen Town and Trang Due.

Furthermore, the average selling price of industrial land is expected to increase in 2026, driven by contributions from new projects such as Trang Due 3, Que Vo 2 Expanded, and Long An industrial parks, replacing lower-priced projects like Hung Yen Industrial Clusters and NSHL in 2025.

Vietcap believes KBC is well-positioned to capitalize on the wave of manufacturing shifts to Vietnam, boasting a portfolio of high-quality tenants such as LG, Foxconn, and Goertek. The company’s strategic industrial and urban land bank, concentrated primarily in the North, remains a competitive advantage. By the end of Q3 2025, leasable industrial land is estimated at approximately 2,600 hectares, with 450 hectares fully cleared and ready for development.

In the industrial park segment, the substantial backlog is expected to fuel robust growth from 2026 onward. Vietcap projects handover areas to increase by 14% and 16% in 2026 and 2027, respectively, reaching 140 hectares and 163 hectares, compared to the anticipated 122 hectares in 2025. Key drivers include Trang Due 3 Industrial Park (approximately 30 hectares under MOU, with potential for an additional 30 hectares with CTP Invest Ltd in 2026), Que Vo 2 Expanded (around 50 hectares under MOU), and Long An industrial parks.

The urban area segment is also expected to become a medium- to long-term growth driver. Handover areas are projected to rise from 5 hectares in 2025 to 17.3 hectares in 2026 and 34 hectares in 2027, driven by the planned launch of Trang Cat Urban Area (585 hectares) in 2026 and the relaunch of Phuc Ninh Urban Area in 2027. For Trang Cat, Vietcap forecasts KBC to wholesale approximately 12 hectares in 2026, leveraging completed legal procedures and low capital costs due to investments made since 2006.

Vietcap notes that the Trump International Hung Yen project was first recognized in KBC’s book value in Q3 2025, after no contributions in the previous quarter. However, Vietcap indicates that this project has not been included in profit forecasts, despite KBC’s plans to begin sales in 2026, with approximately 136 hectares of marketable area expected to hit the market.

Regarding valuation, Vietcap has raised the target price based on three key factors: updating the valuation model to the end of 2026; incorporating the Q3 2025 book value of the Trump International Hung Yen project, which was previously unreflected despite KBC’s plans to launch 136 hectares in 2026; and adjusting the valuation of Trang Cat Urban Area after KBC settled all outstanding deposits, eliminating a VND 5.65 trillion cash outflow in the previous model.

The company also highlights potential risks that could impact KBC’s outlook, including possible delays in launching new projects, tenant disbursement progress, and adverse changes in U.S. tariff policies affecting Vietnam.

Why Do Businesses Concede Defeat on Crypto Asset Platforms Before the Race Even Begins?

Several banks and securities firms have expressed interest in establishing cryptocurrency trading platforms. However, Vietcap Securities JSC has abandoned its plans due to the excessively high capital requirement mandated by regulations.