Vietnam Mining Corporation (VIMICO – Stock Code: KSV) has issued a resolution dated November 26, 2025, addressing its compliance with public company requirements. According to the resolution, VIMICO acknowledges that, as of November 2025, it does not fully meet the criteria for a public company as stipulated by the Securities Law. Specifically, the company must have at least 10% of its voting shares held by a minimum of 100 non-major investors to ensure public ownership and market liquidity. In response, VIMICO’s Board of Directors has directed the CEO to report and clarify the company’s unique shareholder structure to the State Securities Commission (SSC). However, the resolution also outlines a contingency plan: if VIMICO fails to meet the shareholder criteria or obtain SSC approval by January 1, 2026, it will file for deregistration as a public company under the Securities Law. Listed on the UPCoM market since 2016 with 200 million shares (KSV), VIMICO is a key subsidiary of the Vietnam National Coal and Mineral Industries Group (TKV), holding significant mineral assets including copper, gold, zinc, and tin. Despite nearly a decade of trading, KSV shares have consistently suffered from low liquidity, primarily due to an overly concentrated ownership structure rather than operational inefficiency. Currently, TKV holds over 98% of VIMICO’s equity, leaving less than 2% (under 4 million shares) as free-float. The minimal number of retail investors makes meeting the 10% threshold nearly impossible without state divestment. This concentration often distorts KSV’s market price dynamics, though the stock remains attractive to value investors due to its substantial asset base and consistent annual cash dividends.

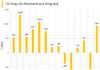

Foreign Block Buys Nearly VND 600 Billion as VN-Index Surges: Which Stocks Were Scooped Up the Most?

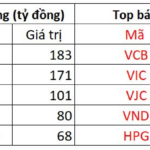

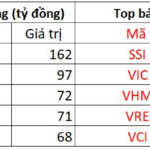

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 579 billion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.

What Does a Company Say When Its Stock Hits the Upper Limit for Five Consecutive Sessions?

Danang Oil & Gas Machinery Joint Stock Company has issued an official statement following a remarkable five consecutive sessions of its stock, DAS, hitting the ceiling price.