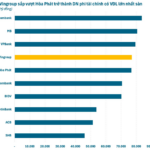

On the morning of November 26th, VIX shares of VIX Securities Corporation surged by 7%, hitting the upper limit. The stock closed at VND 24,500 per share with a trading volume exceeding 61 million units. Buy orders at the ceiling price reached nearly 4 million units.

Prior to this rally, VIX had experienced a sharp decline, plummeting from its peak of nearly VND 40,000 per share (on October 16th) to below VND 23,000 per share (on November 25th), representing a loss of nearly 74% in just over a month.

The rebound occurred just before VIX’s Extraordinary General Meeting of Shareholders in 2025, scheduled for November 28th in Hanoi. The list of eligible shareholders was finalized on October 9th.

The meeting will focus on two key agendas: adjusting the 2025 business plan and approving a rights issue to existing shareholders.

According to the proposal, VIX plans to issue over 919 million shares to existing shareholders at VND 12,000 per share, with a ratio of 10:6 (for every 10 shares held, shareholders can purchase 6 additional shares). Post-issuance, VIX’s chartered capital will increase from VND 15,314 billion to VND 24,502 billion, positioning the company among the largest securities firms in the market.

The total proceeds of over VND 11,000 billion will be allocated to increase capital in VIX Crypto Asset Exchange JSC, bolster proprietary trading, and expand margin lending operations.

VIX’s leadership highlighted that Vietnam’s stock market continues to demonstrate positive growth in indices, market capitalization, and liquidity. Notably, FTSE Russell’s upgrade of Vietnam to Secondary Emerging Market status on October 8th marks a significant milestone, attracting foreign capital and fostering deeper integration into the global financial system.

Another supportive factor is Government Resolution 5/2025/NQ-CP, issued on September 9th, which pilots the crypto asset market in Vietnam. As a founding shareholder of VIX Crypto Asset Exchange JSC, VIX is well-positioned to capitalize on the high-growth potential of the digital asset sector.

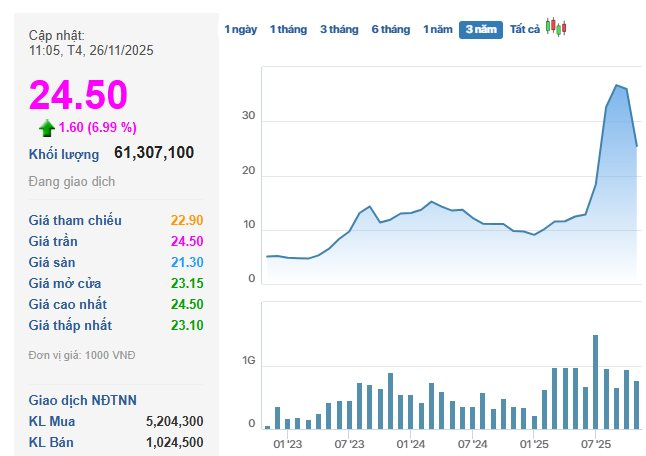

Quadrupling 2025 Profit Target

Alongside the capital increase, VIX has significantly revised its 2025 business targets. Pre-tax profit is now projected at VND 6,500 billion, VND 1,500 billion higher than the September proposal and a 433% increase from the initial 2025 plan. Post-tax profit is expected to reach VND 5,200 billion.

In terms of performance, VIX led the securities industry in profitability during Q3 and the first nine months of 2025. In Q3 alone, the company reported pre-tax profit of VND 3,048 billion, an 839% year-on-year increase.

For the nine-month period, VIX’s operating revenue reached VND 6,178 billion, up 378% year-on-year. Pre-tax and post-tax profits stood at VND 5,116 billion and VND 4,123 billion, respectively, more than seven times higher than the same period in 2024.

As of September 30, 2025, VIX’s total assets amounted to nearly VND 31,535 billion, a 61% increase year-to-date. The company invested over VND 16,100 billion in lending activities, primarily margin loans, nearly tripling the year-start figure. Its FVTPL financial assets totaled VND 9,254 billion in book value, with EIB, GEE, and GEX accounting for over VND 1,000 billion.

Vingroup’s Pham Nhat Vuong Sets Date for Largest Deal in History

Following the issuance, Vingroup’s charter capital will double to over 77,000 billion VND, making it the non-financial enterprise with the largest charter capital on the Vietnamese stock market.