Following its upgrade to Secondary Emerging Market status by FTSE Russell on October 8, 2025, Vietnam’s stock market will undergo an additional review in March 2026, leading to a final decision in September 2026.

At the seminar titled “Stock Market Upgrade: Opportunities and Challenges” on November 26, Ms. Tran Thi Thanh An, Acting Deputy Head of the Securities Research and Training Center (SRTC) in Ho Chi Minh City, emphasized that as the market approaches this critical milestone, a new question arises: How can Vietnam maintain and strengthen its Secondary Emerging Market position? According to SRTC, the focus should be on the market’s most vital players—listed companies and public enterprises—as they are the creators of market value.

“What retains investors is the quality of the offerings—specifically, the quality of companies, their management capabilities, and their transparency,” Ms. An remarked.

Ms. Tran Thi Thanh An, Acting Deputy Head of SRTC in Ho Chi Minh City, speaks at the seminar.

|

While Vietnam’s corporate governance legal framework is relatively comprehensive compared to the region, its practical implementation among public companies remains limited.

In the 2024 ASEAN Corporate Governance Scorecard (ACGS), Vietnam ranked last among ASEAN-6, trailing Singapore, Indonesia, Malaysia, the Philippines, and Thailand. Despite a robust legal framework, Vietnam has consistently ranked last for years. Additionally, only 69 Vietnamese companies were evaluated in the 2024 ACGS, down from approximately 100 in previous assessments.

Corporate governance among Vietnamese listed companies faces several challenges, including uneven governance quality, a lack of shareholder meeting documents in English, and insufficient independent board members as required by regulations.

ESG (Environmental, Social, and Governance) practices remain in their infancy, with primarily large enterprises participating. Few companies disclose environmental and social impacts through policies or stakeholder engagement, adopt ethical codes, or report on gender balance policies.

Companies must shift their mindset and enhance governance practices to align with international standards. Amid market upgrades and ESG demands to attract foreign investment, SRTC experts believe companies have much to accomplish.

To improve transparency and sustainable governance, the first step is enhancing English reporting capabilities in line with global standards. Large listed companies are encouraged to adopt IFRS for financial reporting—a long-term goal in the market upgrade plan.

Next, companies must strengthen governance in accordance with OECD standards. This involves integrating risk management into governance ecosystems by establishing processes from the board level to individual departments.

Beyond legal compliance, companies should proactively enhance transparency, bolster board independence, manage environmental and climate risks, and rigorously monitor related-party transactions to mitigate conflicts of interest.

Another critical recommendation is embedding governance and ESG into long-term business strategies. Currently, only a few companies, such as Vinamilk, FPT, and Vietcombank, actively implement ESG. Companies must integrate ESG into their long-term strategies, establish risk management committees, measure ESG metrics, and prioritize gender balance policies.

Finally, companies should strengthen stakeholder engagement and improve ESG disclosures.

Ms. Tran Thi Thanh An participates in a panel discussion.

|

A recent survey by the Vietnam Institute of Directors (VIOD) found that major investment funds prioritize transparency, fair shareholder treatment, and genuine ESG implementation. To capitalize on the market upgrade and retain foreign capital, listed companies must adopt practical solutions.

According to SRTC, sustaining the market upgrade requires multiple factors, with company quality and capabilities at the core. Training is essential to meet international standards.

“When companies are transparent, the market becomes transparent; when the market is transparent, investor confidence grows, and capital remains,” Ms. An concluded.

– 11:06 28/11/2025

Vietnam Officially Upgraded: Inflow of Foreign Capital and the Pressure to “Breakthrough” in Corporate Governance

October 8, 2025, marked a historic milestone as FTSE Russell officially upgraded Vietnam’s stock market to Secondary Emerging Market status. This upgrade unlocks access to a vast pool of international capital, but it also demands an urgent elevation in corporate governance standards to meet the expectations of institutional investors.

SHB: Dual Momentum Fueled by Capital Expansion Strategy and Foreign Investment Opportunities

Our upcoming capital increase strategy is poised to propel SHB into the top 4 private banks by charter capital, solidifying our competitive edge through enhanced financial strength.

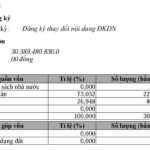

THACO Unexpectedly Reduces Charter Capital, Foreign Investors Unchanged

THACO Group, led by Tran Ba Duong, has announced a reduction in its chartered capital from VND 30,510 billion to VND 30,389.5 billion, marking a decrease of over VND 120 billion.