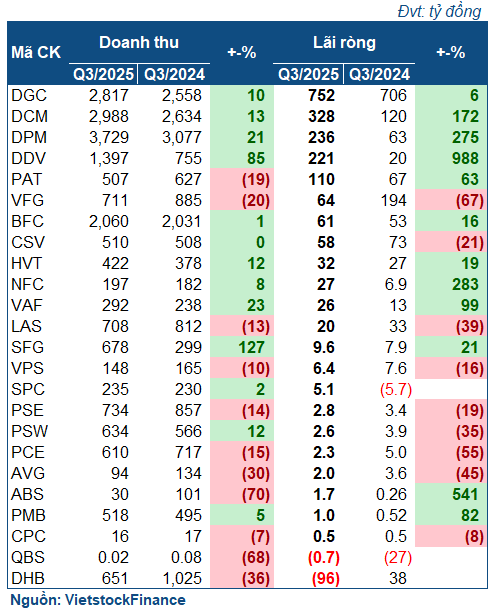

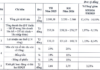

According to VietstockFinance, out of 24 fertilizer and chemical companies that released their Q3/2025 financial reports, 13 showed profit growth (with one turning losses into profits). Nine companies experienced declines, and two reported losses.

|

Q3/2025 Business Performance of Fertilizer and Chemical Companies

|

Strong Performance by Industry Leaders

In Q3, domestic urea prices surged by 30% year-on-year, outpacing global trends. Coupled with the implementation of a 5% VAT on fertilizers, these companies experienced a robust quarter.

Among the top players, Đạm Phú Mỹ (HOSE: DPM) and Phân bón Cà Mau (Đạm Cà Mau, HOSE: DCM) saw significant growth compared to the low base of the previous year. DPM reported a 21% revenue increase to over 3.7 trillion VND, with net profit reaching 236 billion VND, 3.8 times higher than the same period last year. The company attributed this growth to increased sales, while a near-doubling of gross margin from 11.7% to 19.3% highlighted effective cost control and optimized pricing strategies.

| Đạm Phú Mỹ’s Strong Growth on a Low Base |

DCM posted an even larger profit of 328 billion VND, 2.7 times higher year-on-year, primarily due to a 13% revenue increase and a significant improvement in gross margin (from 14% to nearly 22%). Additionally, DCM completed its 2025 comprehensive maintenance five days ahead of schedule, further enhancing operational results.

| Cost Control and Operational Efficiency Boosted Phân bón Cà Mau’s Performance |

Vinachem member BFC (Phân bón Bình Điền) saw a 16% profit increase to 61 billion VND, alongside modest revenue growth. BFC noted that despite a 14% decline in sales volume, revenue growth indicates the company benefited from higher selling prices. The actual driver of profit growth, however, was cost reduction, as rising input costs pressured gross margins.

In the chemical sector, caustic soda prices rose in the first two months of the quarter before declining in September, while hydrochloric acid prices fell sharply before gradually recovering. Amid these fluctuations, industry leader Hóa chất Đức Giang (HOSE: DGC) reported a modest 6% growth, with net profit reaching 752 billion VND. Although gross profit dipped slightly, cost-cutting measures helped the company achieve a positive quarter.

| Hóa chất Đức Giang Maintained Stability |

Mixed Performance Among Other Companies

The remaining companies showed mixed results, with some Vinachem members posting strong gains while others faced significant declines.

Most notably, DDV, another Vinachem member, saw an 85% revenue increase to nearly 1.4 trillion VND and a record profit of 221 billion VND, nearly 11 times higher year-on-year. Gross profit quadrupled to 305 billion VND, driven by surging input costs and strong sales volume growth.

| DDV Reported Record Profits in Q3/2025 |

Similarly, NFC (Phân lân Ninh Bình) reported a profit of 27 billion VND, nearly four times higher year-on-year, with an 8% increase in net revenue. The company attributed this growth to a 3.5% rise in phosphate powder sales volume and a 25% increase in selling prices, as well as a 14% increase in NPK prices.

Driven by similar factors, VAF (Phân lân Văn Điển) saw profits nearly double to 26 billion VND, while SFG (Phân bón miền Nam) reported a 21% profit increase to 9.6 billion VND, thanks to higher sales volumes. Other fertilizer companies, including PMB and ABS, also posted profit growth.

The chemical sector saw positive growth from several companies. Vinachem member HVT (Hóa chất Việt Trì) reported a 19% increase in net profit to 32 billion VND, while PAT, a subsidiary of DGC, saw a 63% profit increase to 110 billion VND.

However, not all companies thrived in Q3, even among Vinachem members. CSV (Hóa chất Cơ bản miền Nam) saw a 21% profit decline to 58 billion VND, primarily due to reduced yellow phosphorus sales at its subsidiary. LAS reported a 39% profit decline to 20 billion VND, citing volatile fertilizer input prices, apatite ore supply shortages, and natural disasters impacting distribution and revenue.

| CSV Experienced a Profit Decline |

DHB (Đạm Hà Bắc) reported a significant loss of 96 billion VND, compared to a 38 billion VND profit in the same period last year. The company cited production challenges due to equipment issues requiring extended shutdowns for major repairs, reducing production time and sales volume.

Other companies experiencing profit declines include VFG (-67%), PCE (-55%), AVG (-45%), and PSW (-35%).

Positive Outlook for Q4

According to VCBS, the outlook for the fertilizer and chemical sectors in Q4 remains positive. Urea prices are expected to ease slightly from Q3 levels, following global trends, but will remain high compared to the same period last year. Domestic demand is likely to rebound from late October as floodwaters recede and winter-spring rice cultivation expands, supporting stable domestic consumption.

Caustic soda prices are also projected to recover. Despite surplus aluminum supply, the automotive industry’s entry into a peak production and sales phase in Q4 will support consumption. Improved aluminum production demand is expected to boost caustic soda demand. While new caustic soda supply is anticipated from expansion projects and new plants, growth will be limited by capacity control and environmental policies.

Similarly, yellow phosphorus prices are expected to recover slightly due to supply shortages in late October, though significant increases are unlikely due to limited orders. Global semiconductor market demand continues to recover, with major market semiconductor revenues growing.

For the fertilizer industry, post-harvest domestic demand in China is expected to decline. However, Brazil and India are entering their year-end planting seasons, which should drive demand growth.

– 10:00 27/11/2025

Q3 2025 Aviation Outlook: Airline Growth Stalls, Services Diverge Sharply

The Vietnamese aviation market in Q3/2025 concluded with contrasting business results among different enterprise groups. ACV reported a significant profit surge, driven by a wave of international passengers, while airlines faced declining profits. The inauguration of Terminal 3 at Tan Son Nhat Airport has reshaped the aviation service landscape.