Stock Performance of GEE

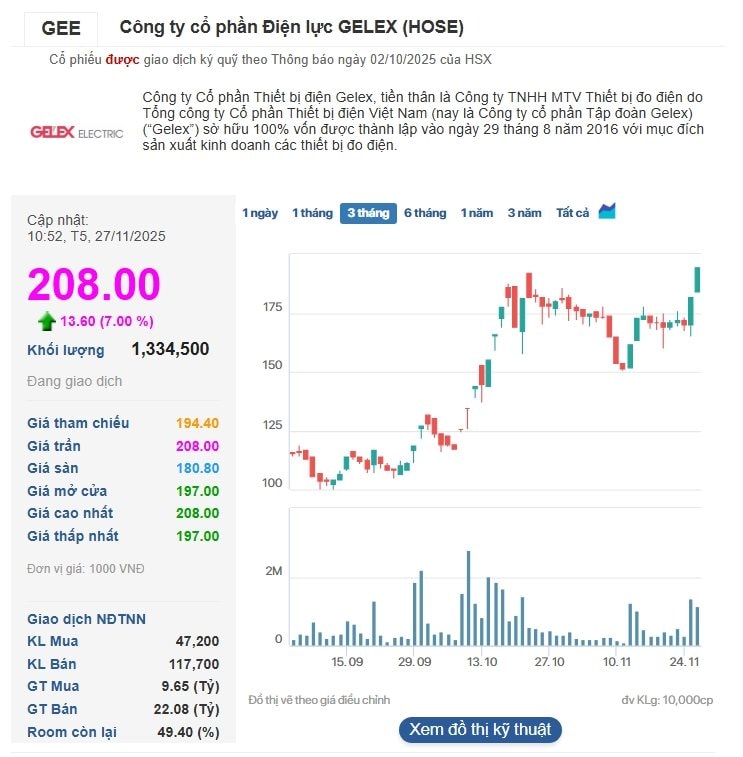

On November 27th’s trading session, investor focus remained on Gelex Electric Joint Stock Company (Stock Code: GEE). The stock sustained its upward momentum from the opening bell, closing at the ceiling price of VND 208,000 per share, marking a 7% increase from the reference price.

This marks the third consecutive ceiling session for GEE (from November 25th to 27th). Trading volume reached nearly 1.5 million shares. At the current market price, Gelex Electric’s market capitalization is approximately VND 76.1 trillion (roughly USD 2.9 billion).

Since the beginning of 2025, GEE has been one of the top performers on the HoSE. Starting the year at VND 27,250, the stock has surged 7.6 times. This return significantly outpaces the broader market, which has seen mixed index performance.

Price Performance of Select Stocks as of November 27, 2025

GEE’s price movement aligns with the company’s robust financial performance. In the first nine months of 2025, Gelex Electric reported consolidated net revenue of VND 18,235 billion and pre-tax profit of VND 3,532 billion, 2.6 times higher than the same period last year.

Notably, the company has already surpassed its 2025 pre-tax profit target of VND 3,500 billion, as approved by the Annual General Meeting, within just nine months.

1,600kVA Cast Resin Transformer by THIBIDI

This achievement is driven by the performance of its subsidiaries in the electrical equipment sector, including CADIVI (power cables), THIBIDI (transformers), and EMIC (electrical meters). These units maintained stable production to meet energy infrastructure demands while optimizing costs, significantly contributing to GEE’s profit growth.

External factors also supported Gelex stocks’ rally. The State Securities Commission recently approved the IPO registration for Gelex Infrastructure JSC, which plans to issue 100 million shares, targeting VND 2,800 billion in proceeds.

The raised capital will fund Titan Hai Phong JSC’s Tran Duong – Hoa Binh Industrial Zone project (Phase 1) and financial restructuring. This development is expected to revalue Gelex’s ecosystem assets, positively impacting GEE and parent company GEX’s stock prices.

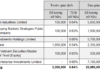

SSI to Offer Over 415 Million Shares at Half the Market Price

SSI is set to offer 415.18 million shares to its shareholders at a price of 15,000 VND per share, representing a 50% discount compared to the current market price.