Last night (Vietnam time), silver prices surged past $53 per ounce, nearing the historic peak set in mid-October 2025. Since the beginning of 2025, silver prices have soared by 80%, making it one of the top-performing assets during this period.

The rally in silver prices is partly driven by its extensive industrial applications, with 70% of demand stemming from this sector. In 2025, the United States officially designated silver as a “Strategic Mineral” in the U.S. Geological Survey’s (USGS) list on November 7, recognizing its critical role in the economy and national security, particularly in high-tech industries.

The boom in electric vehicles (EVs), solar panels, and AI has pushed demand to record levels. Since 2020, global demand has outpaced supply by approximately 800 million ounces cumulatively. In 2025, mine production reached only 835 million ounces, largely dependent on byproduct mining, leading to a “supply squeeze.” This tightness has made prices highly volatile, with physical silver nearly running out in London exchanges in October.

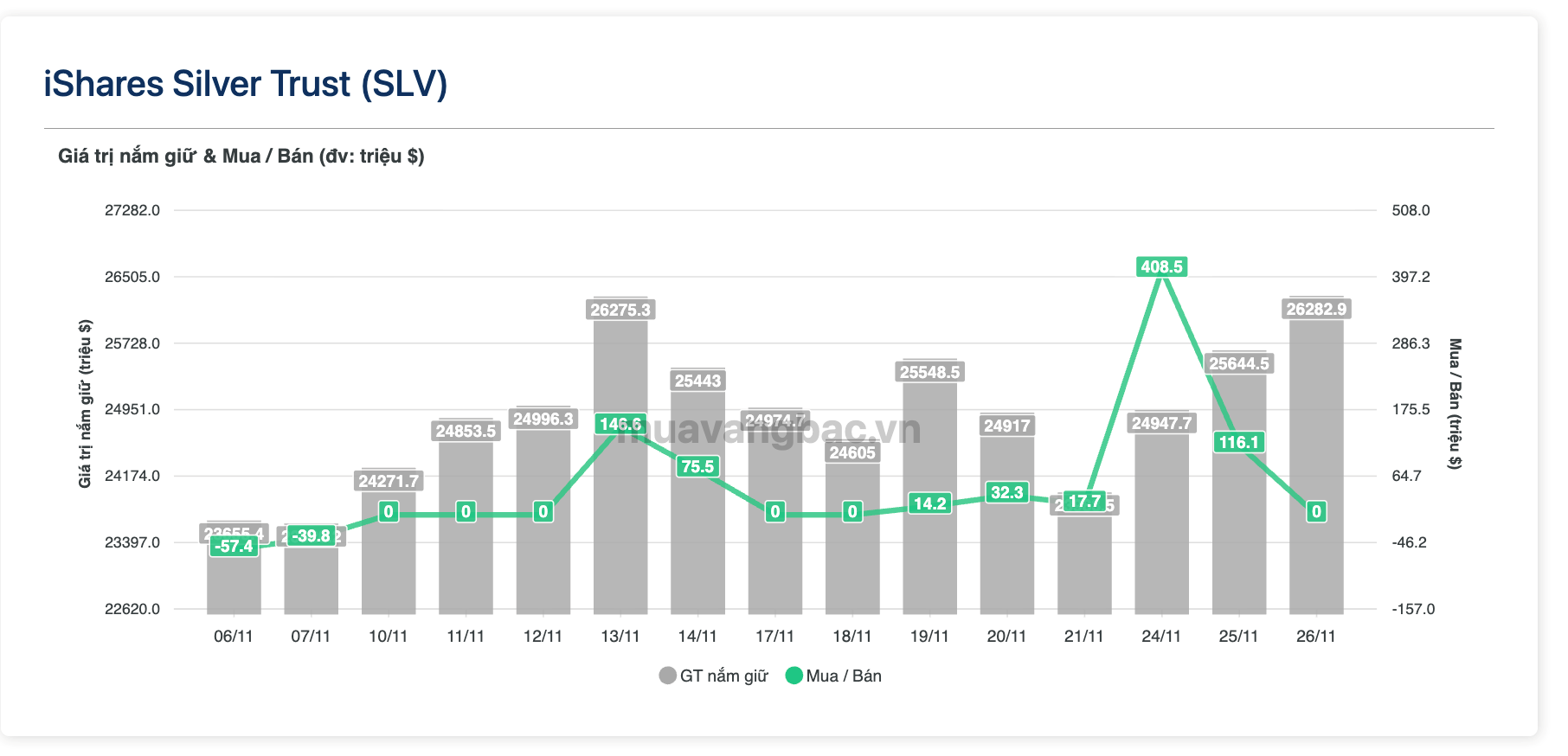

Additionally, aggressive buying by institutional investors has significantly impacted silver prices. BlackRock, the world’s largest asset manager, resumed heavy purchases in November after taking profits the previous month. Since the start of November 2025, the iShare Silver Trust managed by BlackRock has attracted a net inflow of $650 million for silver acquisitions.

Year-to-date, the world’s largest silver fund has spent $1.7 billion to purchase approximately 32 million ounces of silver (1,000 tons). As of now, the iShare Silver Trust holds over 500 million ounces of silver (around 15,600 tons) in total.

Since the start of November, the iShare Silver Trust managed by BlackRock has attracted a net inflow of $650 million for silver acquisitions. Source: muavangbac.vn

This buying pressure from institutional giants has supported silver prices against anticipated short-selling near historic highs. According to some expert forecasts, if silver successfully surpasses its peak, short positions will need to be covered, potentially accelerating price gains.

Bank of America (BofA), one of the largest banks in the U.S. and globally, recently released an optimistic report on precious metals, predicting silver could reach $65 per ounce in 2026. This level is nearly 20% higher than silver’s historic peak.

Meanwhile, CNBC’s analysis in late October projected that silver could double to $100 per ounce after breaking the $50 threshold, a significant resistance level since the 2011 peak. This target aligns with historical patterns, where silver experiences explosive rallies when major resistance levels are breached.

“The volatility of this white metal often mirrors that of gold but with amplified fluctuations. With gold trading above $4,000 earlier this year, the spillover effect on silver could be substantial,” CNBC’s analysis noted.

Paul Williams, CEO of Solomon Global, a gold and silver supplier, believes the fundamental drivers of the silver market show no signs of weakening, suggesting the rally could continue into 2026. Despite reaching record highs, silver remains undervalued compared to gold. “In the current context, $100 silver by the end of 2026 is entirely feasible,” he stated.

Philippe Gijsels, Chief Strategist at BNP Paribas Fortis, who predicted silver would reach $50 over a year ago, shares this view. He believes silver’s value could double from its new highs, arguing that round numbers often attract investors like magnets. As silver approaches these milestones, buying momentum typically accelerates, leading to peaks.

He suggests this could be the early stages of the largest silver bull market in history. “I wouldn’t be surprised to see silver far exceed $100 in the near future,” Philippe Gijsels remarked.

Vietnam Officially Upgraded: Inflow of Foreign Capital and the Pressure to “Breakthrough” in Corporate Governance

October 8, 2025, marked a historic milestone as FTSE Russell officially upgraded Vietnam’s stock market to Secondary Emerging Market status. This upgrade unlocks access to a vast pool of international capital, but it also demands an urgent elevation in corporate governance standards to meet the expectations of institutional investors.

BlackRock’s Aggressive Silver Acquisition Sparks Expert Predictions of Prices Doubling

Since the beginning of 2025, the world’s largest silver fund, managed by BlackRock, has invested $1.7 billion to acquire approximately 32 million ounces of silver (1,000 metric tons), bringing its total holdings to over 500 million ounces (roughly 15,600 metric tons).