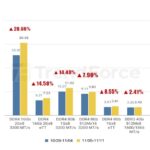

If you’re considering upgrading your smartphone, purchasing a new laptop, or building a PC, now might be the last chance to secure a reasonable price. According to the latest data from TrendForce, a wave of price increases is set to hit the consumer tech market in 2026, driven by a tiny yet critical component: memory.

Memory prices have surged nearly 200% since the start of this summer, with certain types of RAM now costing nearly three times their previous price. However, these increases have yet to be fully reflected in the prices of end-consumer electronic products. Manufacturers have been absorbing some of these additional costs, but TrendForce predicts a complete shift next year as they can no longer sustain this practice.

Soaring DRAM prices are poised to ripple across other devices

For the smartphone market, the forecasts are grim. Smartphone production is expected to decline by 2% in 2026, a significant shift from the previously projected 0.1% growth. With global smartphone production in 2024 at around 1.2 billion units, this translates to tens of millions of devices being cut from production lines. More critically, smartphone prices could rise by up to 10% in certain segments.

Budget smartphones will bear the brunt of this impact. The reason is straightforward: their profit margins are already slim, leaving manufacturers with less room to absorb higher material costs. TechPowerUp predicts this could lead to industry consolidation next year, as smaller suppliers struggle to secure the necessary components to produce devices at an affordable scale.

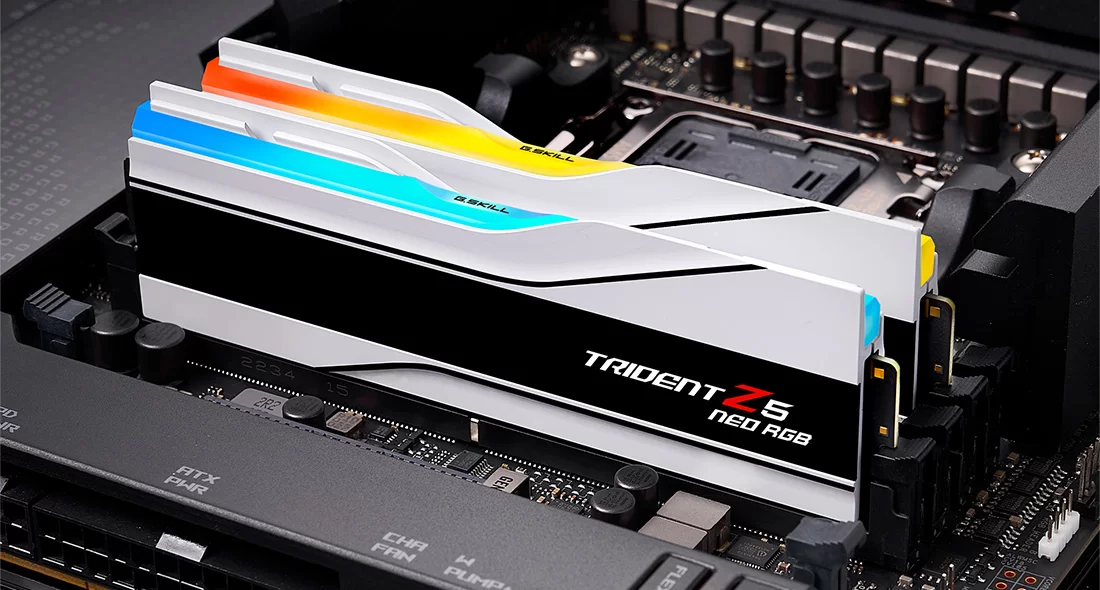

The laptop market may face even greater challenges. Memory and storage costs typically account for 10 to 18% of laptop production expenses, but this figure could soar to 20% or higher if DRAM chip prices continue to rise. This could push laptop prices up by as much as 15% year-over-year, making it harder to sell new models. Budget-conscious buyers may shift to the second-hand market, driving prices up there as well.

Smartphone brands gear up for price hikes

Evidence of this trend is already emerging in China, the world’s largest smartphone market. When the Redmi K90 launched on October 23, its price increased by 300-600 yuan compared to its predecessor, with a 600 yuan gap between models with the same RAM but different storage capacities, sparking heated debates among users.

The standard 12GB+256GB version is priced at 2,599 yuan, while the 12GB+512GB version costs 3,199 yuan, a 600 yuan difference for an additional 256GB of storage.

Lei Jun, Xiaomi’s founder, admitted on Weibo that the recent memory price surge has been “overwhelming.” The company quickly adjusted, reducing the price of the standard 12GB+512GB version by 300 yuan during the first-month discount to 2,899 yuan.

Xiaomi Redmi K90

Lu Weibing, Xiaomi’s Chairman, explained that upstream cost pressures have been factored into new product prices, and the global supply chain trends are beyond the company’s control, with memory costs soaring far beyond expectations and continuing to rise.

Xiaomi isn’t alone. The vivo X300 series increased by 100-300 yuan, the OPPO Find X9 by 200-300 yuan, the Realme GT8 by 300-500 yuan, and the iQOO 15 series starting price rose from 3,999 to 4,199 yuan, a roughly 5% increase. Xu Qi, Realme China’s Chairman, noted that for iQOO, the largest costs come from displays and memory, and the price increases affect not only launch prices but the entire product lifecycle, including major promotional periods.

The root cause of this crisis lies in a severe memory shortage. According to Commercial Times, lead times for DRAM and NAND have significantly extended, with LPDDR5X now taking 26-39 weeks, meaning orders placed today may not arrive until mid-2026. The price hike trend shows no signs of slowing, and cost pressures on processor manufacturers and smartphone brands are mounting. Major memory producers, including Samsung, SK hynix, and Micron, are planning further price increases of up to 30% in Q4.

What does this mean for consumers? If you’re planning to buy a new phone, laptop, or upgrade your PC in the next year or two, now might be the best time to act. Current prices, though higher than earlier this year, are still significantly lower than what’s expected in 2026. With memory lead times extending and further price increases on the horizon, budget-conscious consumers should consider shopping early before the full wave of price hikes hits the market.

Global Chip Shortage Forces Smartphone and PC Makers to Consider Price Hikes

Leading memory manufacturers, including Samsung and SK Hynix, are ramping up production of high-value products to meet the surging demand driven by the AI wave. This strategic shift has significantly tightened the supply of standard DRAM, causing a notable decline in its availability.