Hoang Quan Real Estate Consulting Services Trading Corporation (stock code: HQC, HoSE market) has announced a Board of Directors Resolution to temporarily halt the submission of its private share issuance dossier for debt conversion.

According to Hoang Quan Real Estate, the suspension is due to the need for further adjustments and updates to the issuance dossier following a thorough review.

The company will proceed with the necessary amendments and additions to the dossier, aiming to resume the issuance process at an opportune time.

Illustrative image

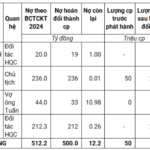

Previously, Hoang Quan Real Estate approved a plan to issue 50 million shares at 10,000 VND per share to convert 500 billion VND in debt. The shares will be restricted from transfer for one year from the end of the issuance period.

The debt conversion ratio is 10,000 VND: 1 share, meaning 10,000 VND of debt will be converted into one newly issued common share.

This share issuance aims to improve the company’s financial and operational performance by reducing costs and increasing its charter capital.

According to the previously disclosed list, four creditors will participate in the debt-to-equity conversion: VDC Construction Design Consulting Co., Ltd. (19 billion VND), Mr. Truong Anh Tuan – Chairman of the Board (236 billion VND), Ms. Nguyen Thi Dieu Phuong – spouse of Mr. Truong Anh Tuan (33 billion VND), and Hai Phat Investment Joint Stock Company (Hai Phat Invest, stock code: HPX) with a debt value of 212 billion VND.

If the issuance is successful, Hoang Quan Real Estate’s charter capital will increase from 5,766 billion VND to 6,266 billion VND.

In terms of business performance, in the first nine months of 2025, Hoang Quan Real Estate generated nearly 51 billion VND in net revenue, a 12.8% increase compared to the same period in 2024. After-tax profit reached over 18.1 billion VND, a 32% decrease.

As of September 30, 2025, the company’s total assets slightly decreased by 2.3% from the beginning of the year to approximately 9,872 billion VND. This includes short-term receivables of over 4,843.9 billion VND (49.1% of total assets), inventory of over 1,410.6 billion VND (14.3%), and long-term financial investments of over 2,350 billion VND (23.8%).

On the liabilities side, total debt stands at over 4,460.1 billion VND, a 5.3% decrease from the beginning of the year. Loans and financial leases account for nearly 1,697 billion VND, or 38% of total liabilities.

IDICO Announces 15% Cash Dividend Advance Payment

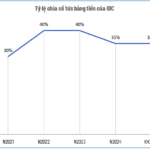

IDICO Group (HNX: IDC) has announced the dividend payment for its shareholders, offering a 15% cash dividend for the first phase of 2025, equivalent to 1,500 VND per share. The ex-dividend date is set for December 3rd, and shareholders can expect to receive their payments starting from December 23rd.

Breaking News: CEO and Entire Leadership Team Liquidate All Company Shares

Every transaction is meticulously executed with the primary goal of achieving personal financial balance, utilizing either negotiated agreements or order matching on the trading platform.