TOD Model: The “Brain” of Ho Chi Minh City’s New Urban Development

In a comprehensive report titled “TOD Model in Ho Chi Minh City: Future Development Trends,” CBRE Vietnam highlights the advantages of real estate projects located within the influence of TOD. Notably, properties with metro lines passing nearby have seen the most significant price fluctuations over the past decade.

According to CBRE, TOD is a compact, high-density, mixed-use urban development model (living, working, shopping) within a walkable radius (400-800m) around transit stations. The core principle of this model is to optimize land value around stations, encourage public transport use over private vehicles, foster vibrant, sustainable communities, and reduce emissions.

CBRE outlines factors influencing TOD real estate value.

CBRE considers the TOD model as the “brain” of Ho Chi Minh City’s new urban development. The firm explains that TOD addresses traffic congestion, reduces pollution, prevents urban sprawl, and promotes multi-centered development. It significantly impacts urban planning and project models.

In urban planning, TOD transforms the structure from “sprawling urban” (motorcycle-dependent) to “compact urban” (metro-dependent). It fosters multi-centered development, with each TOD zone becoming a sub-center, reducing pressure on the historical city center. TOD areas often receive higher land-use coefficients and population densities, allowing high-rise construction and concentrated populations.

For project planning, TODs benefit from higher planning indicators and mandatory direct connections (underground/elevated) to transit stations. Consequently, the real estate market shifts toward TOD-influenced areas, where properties typically command higher values than other regions.

How Have Property Prices Risen Around Metro Lines?

CBRE provides examples of property price increases around metro lines globally and in Vietnam.

In countries like Singapore, Hong Kong, South Korea, and Thailand, property prices have doubled with the introduction of metro lines. Notably, in Bangkok and Manila, apartment prices along metro lines increased by 50-100% within the first five years of investment. Large-scale urban developments along these lines saw exponential price growth due to metro accessibility.

(Source: CBRE report)

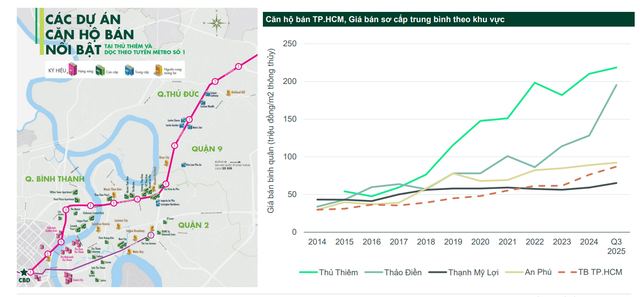

In Vietnam, the market has witnessed significant property price increases related to metro lines. A prime example is the Hanoi Highway, where Metro Line 1 (Ben Thanh – Suoi Tien) passes through. Apartment prices along this route (in Thao Dien, An Phu, and former Thu Duc) have increased 3-4 times since their launch.

Specifically, Keppel Land’s Estella Heights rose from VND 40 million/m² (2015) to over VND 120 million/m² (currently), a 200% increase. Gateway Thao Dien, launched in 2015 at around VND 40 million/m², now stands at nearly VND 140 million/m², a 230% increase. Q2 Thao Dien, launched in 2018 at around VND 38 million/m², has reached nearly VND 150 million/m², a 250% increase. Similarly, The Nassim has seen over a 200% price increase in the past decade.

At the recent seminar “Realizing Vietnam’s TOD Urban Vision: Opportunities and Challenges” organized by the Vietnam Real Estate Association (VNREA), Mr. Vo Huynh Tuan Kiet, Director of Residential Project Marketing at CBRE Vietnam, noted that property prices around Metro Line 1 have increased by 50-200% before and after its operation—a trend consistent with global patterns.

This reflects the rule: wherever infrastructure improves, property prices rise. Thanks to urban rail, high-tech zones, and residential planning, properties around metro lines experience faster price growth than other areas.

Exemplary property prices around Metro Line 1. (Source: CBRE)

Similar to Hanoi Highway, National Highway 13 in northeastern Ho Chi Minh City—where the Thu Dau Mot – Ho Chi Minh City metro line is prioritized—is expected to directly impact local property prices.

The Thu Dau Mot – Ho Chi Minh City metro line, spanning 21.87km, runs parallel to National Highway 13 and the Ho Chi Minh City – Chon Thanh – Hoa Lu Expressway (CT30), creating a seamless regional transport link. Projects like La Pura by Phat Dat, Landmark Binh Duong by Phu Cuong, Ho Guom Xanh – TBS Group, and Ava Center will directly benefit from future price increases.

National Highway 13, a key connector between Ho Chi Minh City and southern economic hubs, is planned for expansion to 60m by early 2026, from Binh Trieu Bridge (Thu Duc, former Ho Chi Minh City) to Vinh Binh Bridge, Thuan An, Binh Duong. Upon completion, travel time from Binh Hoa and Lai Thieu wards to Hang Xanh, central Ho Chi Minh City, will reduce to just 15 minutes.

Surveys show that frontage land prices on National Highway 13 (Hiep Binh – Binh Trieu section) have risen from VND 45-55 million/m² (2020) to VND 100-180 million/m² currently. Nearby internal roads have nearly doubled, reaching VND 60-80 million/m². Currently, only a few projects like La Pura and Habitat remain priced around VND 50 million/m². Prices are expected to rise further with regional infrastructure improvements. Experts predict that high-end apartments along National Highway 13 could reach VND 90-100 million/m² by 2027-2030, following highway expansion, Metro Line 2 investment, and post-merger stabilization.

At the seminar “Realizing Vietnam’s TOD Urban Vision: Opportunities and Challenges,” experts emphasized the urgent need to implement the Transit-Oriented Development (TOD) model.

Dr. Nguyen Van Dinh, Vice Chairman of VNREA, stated that Ho Chi Minh City is entering a phase of robust restructuring, particularly in planning and development space management. TOD is seen as the “backbone” of the new urban strategy, addressing congestion, expanding urban space, and enhancing long-term quality of life.

According to Dr. Dinh, as the city expands, demand for living near public transport hubs will create new development poles, laying the foundation for Ho Chi Minh City to become a true megacity.

Echoing this view, Mr. Vo Huynh Tuan Kiet, Director of Residential at CBRE Vietnam, believes that post-merger, Ho Chi Minh City will develop satellite cities and embark on a “TOD revolution.” With a complete metro network, residents will accept living farther from the center, prioritizing projects with clear legal status, full amenities, and rental potential.

However, Mr. Kiet noted that for TOD to be effective, public transport must seamlessly connect residential areas to stations, reducing reliance on private vehicles.

T&T Group Unveils $1.2 Billion Urban Development Project in Emerging Centrally-Governed City

Introducing the groundbreaking Ngòi Con Tên New Urban Area and Regional Healthcare-Sports Complex project, located in the communes of Chi Lăng and Tân Chi. Spanning approximately 355 hectares, this ambitious development includes the Zone 1 sub-district and is projected to require a total investment of nearly 32 trillion VND.

The Real Estate Race: Hanoi and Ho Chi-Minh City in a Constant Chase

Mr. Vu Cuong Quyet, CEO of Dat Xanh Northern Region, observes that the Hanoi and Ho Chi Minh City markets have long been engaged in a dynamic race. Historically, Ho Chi Minh City has consistently taken the lead, only for Hanoi to later surge ahead, followed by Ho Chi Minh City’s recovery and renewed pursuit. This pattern of close competition has persisted since 1991–1992, driven by the cyclical nature of the market and investor capital flow trends.

Gold Shops in Ho Chi Minh City Under Scrutiny

The Market Management Force of Ho Chi Minh City recently conducted inspections at multiple gold shops in Phu Thanh Ward, uncovering and confiscating a significant amount of jewelry valued at hundreds of millions of Vietnamese dong.