Kido Group Joint Stock Company (KIDO, Stock Code: KDC) has recently released a written shareholder consultation document, outlining several significant proposals.

Ending the Ice Cream Venture: Selling Remaining 49% Stake to Nutifood

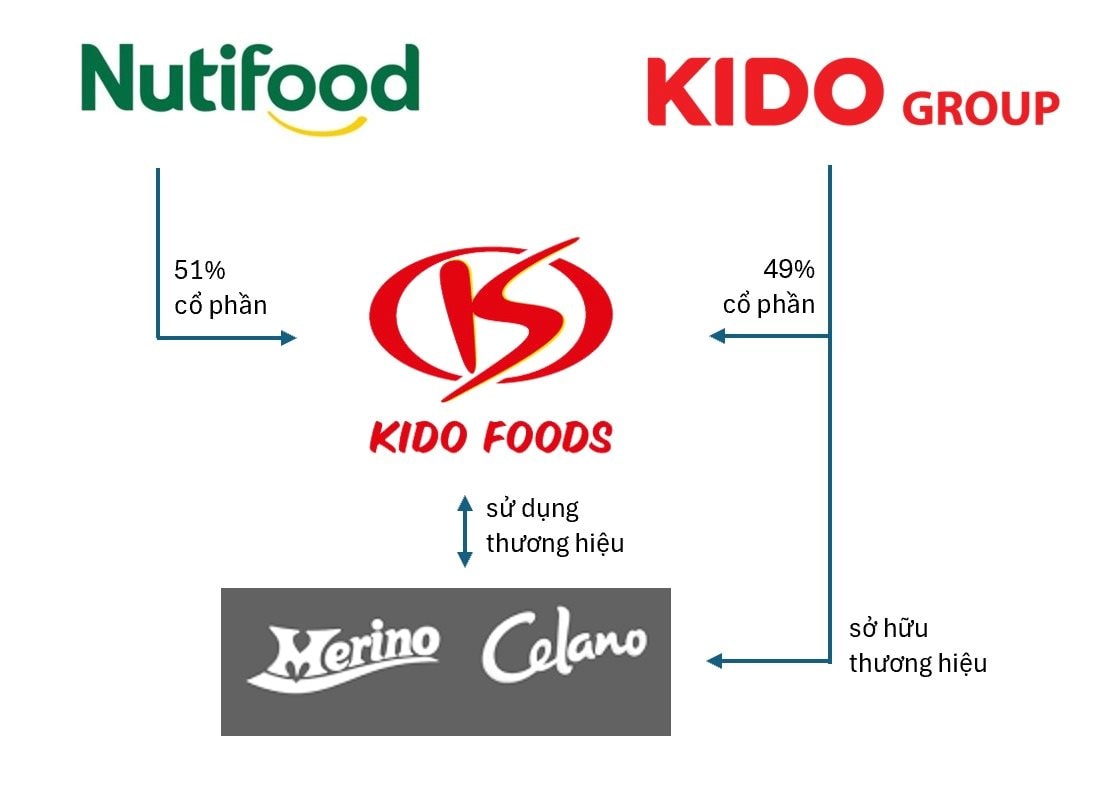

The most notable move in this consultation is KIDO’s plan to transfer its remaining 49% stake in Kido Frozen Food Joint Stock Company (KIDO Foods, KDF) to shareholders.

According to the proposal, KIDO intends to transfer over 36.3 million KDF shares to Nutifood Nutrition Food Joint Stock Company (Nutifood) or its designated partners. The expected transaction value is 2.5 trillion VND.

If completed, this deal will mark KIDO’s full exit from the ice cream and frozen food business, leaving the market to Nutifood.

Previously, KIDO planned to sell 24.03% of KDF to Nutifood. This transaction was executed in 2023 but was later rejected by KIDO’s Extraordinary General Meeting in 2024.

The sale of the remaining stake is seen as the final step to conclude the prolonged and complex M&A deal between these two food industry giants.

Resolving Intellectual Property Issues: Merino and Celano Brands

Legal hurdles have centered around intellectual property rights. KIDO proposes to cancel the brand transfer agreements signed in 2022.

Specifically, the Board of Directors seeks shareholder approval to cancel the transfer of 34 trademarks (including flagship brands like Merino, Celano, and Wel Yo) and 7 trademark applications from KDF to KIDO Group. KIDO will then reinstate these trademarks under KIDO Foods’ ownership.

This move is pivotal, as separating brand ownership from company ownership was a major obstacle in the deal. Returning the brands to KDF means Nutifood will fully control both the assets (factories, systems) and the soul (Vietnam’s leading ice cream brands) upon acquiring KDF.

Dividend Suspension and Business Expansion

Alongside the KDF deal, KIDO proposes suspending the 2024 cash dividend payment.

Management cites challenging economic conditions in 2025, with rising costs and intense competition, as reasons for prioritizing cash flow for operations in Q4/2025 and Q1/2026. Dividend payments are expected to resume in Q1/2026.

Additionally, KIDO seeks to expand its business scope to include real estate, restaurants, mobile food services, entertainment, and wholesale trade, aligning with its development strategy.

Shareholders must submit their opinions by 5 PM on December 11, 2025.

Vocarimex Delists and Exits Public Market After Nearly a Decade; KIDO Poised to Acquire Entire Stake

Vocarimex has presented and received shareholder approval for its voluntary delisting from public company status ahead of the January 1, 2026 deadline.