Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 632 million shares, equivalent to a value of more than 18.3 trillion VND; the HNX-Index reached over 61.7 million shares, equivalent to a value of more than 1.2 trillion VND.

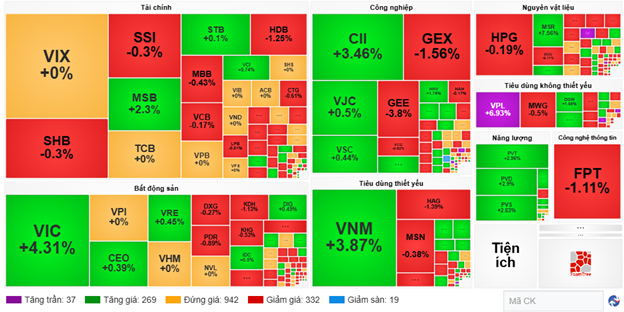

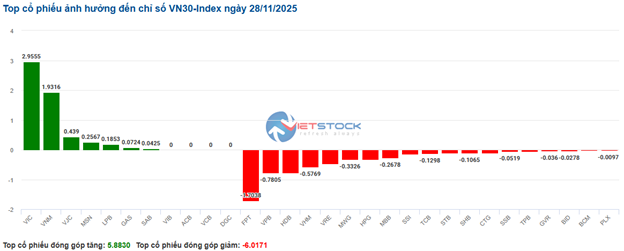

The VN-Index opened the afternoon session gradually narrowing its previous gains as selling pressure continued to rise, but a surprise occurred when buyers emerged, pulling the index above the reference level and closing in the green. In terms of impact, VIC, VPL, VNM, and VHM were the most positively influential stocks on the VN-Index, contributing nearly 15 points of growth. Conversely, VCB, FPT, GEE, and BID faced selling pressure, taking away more than 3.3 points from the index.

| Top 10 Stocks Impacting VN-Index on November 28, 2025 (in points) |

In contrast, the HNX-Index showed a rather pessimistic trend, negatively impacted by stocks such as KSV (-9.99%), KSF (-1.08%), HUT (-3.49%), and SHS (-1.87%).

| Top 10 Stocks Impacting HNX-Index on November 28, 2025 (in points) |

At the close, the market gained points, but there was a divergence across sectors. Specifically, the real estate sector led the market with a 2.41% increase, primarily driven by stocks such as VIC (+5%), VHM (+0.39%), VRE (+1.78%), NVL (+2.6%), and BCM (+0.3%). Following the recovery were the non-essential consumer goods and energy sectors, with gains of 1.99% and 0.34%, respectively. Conversely, the information technology sector saw the most significant decline, falling 2.21%, mainly due to FPT (-2.41%), CMG (-0.4%), and DLG (-0.37%).

In terms of foreign trading, foreign investors turned net buyers with over 310 billion VND on the HOSE, focusing on stocks like VNM (241.6 billion), VIC (130.79 billion), VIX (106.19 billion), and VPB (99.54 billion). On the HNX, foreign investors net bought over 13 billion VND, concentrating on PVS (26.25 billion), SHS (17.37 billion), VFS (4.68 billion), and IDC (4.29 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Pillars Hold Steady, Market Continues to Diverge

Major pillars provided good support, but the rally failed to spread amid lackluster liquidity. At the midday break, the VN-Index rose 9 points (+0.54%) to 1,693.37 points, while the HNX-Index dipped slightly by 0.16% to 261.02 points. Market breadth favored sellers, with 351 decliners and 306 advancers.

Market liquidity remained subdued. The HOSE traded just over 267 million units in the morning, equivalent to 8 trillion VND, down 19.26% from the previous session. The HNX recorded a volume of over 26 million units, worth more than 541 billion VND.

Source: VietstockFinance

|

In terms of impact, VIC was the most positively influential stock, contributing 9.67 points to the VN-Index. Additionally, VPL and VNM added a combined 3.82 points to the index. Conversely, GEE and FPT were the most negatively impactful stocks in the morning, taking away a total of 1 point from the index.

| Top 10 Stocks Impacting VN-Index in the Morning Session of November 28, 2025 (in points) |

Divergence continued to dominate sector performance. On the upside, non-essential consumer goods and real estate temporarily led the market with gains of 2.22% and 1.84%, respectively, driven by standout performers such as VPL (up to the ceiling), FRT (+0.96%), DGW (+1.47%), VCG (+0.9%); VIC (+4.31%), VRE (+0.45%), DIG (+0.49%), and TAL (+2.46%). However, several stocks saw notable declines, including PNJ (-0.78%), HUT (-1.74%), TNG (-1.03%), SVC (-1.08%); KSF (-1.08%), KDH (-1.13%), KBC (-0.84%), PDR (-0.89%), and TCH (-1.23%).

Additionally, the oil and gas sector traded actively, with buying pressure concentrated in stocks such as PVT (+2.96%), PVD (+2.9%), PVS (+2.83%), BSR (+0.97%), PVC (+1.87%), and PVP (+1.05%).

Conversely, the information technology sector recorded the most significant decline in the morning, primarily due to the leading stock FPT, which fell by 1.11%.

Source: VietstockFinance

|

Foreign investors continued to be net sellers, with a value of over 201.5 billion VND across all three exchanges. Selling pressure was concentrated in VCB, with a value of 61.4 billion VND. Following were VJC and FPT, with values of around 37-40 billion VND. Meanwhile, VNM led the net buying list with a value of 131.93 billion VND, far ahead of other stocks.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of November 28, 2025 |

10:30 AM: VN-Index Hovers Near Reference Level, Selling Pressure Dominates Finance and Real Estate Sectors

Investors remained hesitant, leading to no improvement in trading volume. As a result, the main indices gradually narrowed their early gains and fluctuated around the reference level. By 10:30 AM, the VN-Index rose 0.5 points, trading around 1,684 points, while the HNX-Index fell 0.3 points, trading around 261 points.

Stocks in the VN30 basket saw mixed performance, but selling pressure was more dominant. Specifically, FPT, VPB, HDB, and VHM took away 1.7 points, 0.78 points, 0.77 points, and 0.57 points from the index, respectively. Conversely, VIC, VHM, VJC, and MSN were among the few stocks maintaining gains, contributing over 5.5 points to the VN30-Index.

Source: VietstockFinance

|

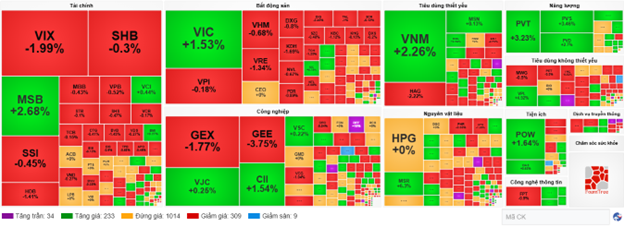

The financial sector continued to show divergence, with red increasing compared to the start of the session. Notable decliners included VIX (-1.99%), SSI (-0.45%), SHB (-0.3%), and MBB (-0.64%). In contrast, only a few stocks like MSB, VCI, OCB, and NAB managed to stay in the green.

Similarly, the real estate sector saw widespread declines. Notable losers included VHM (-0.68%), VRE (-1.19%), DXG (-0.27%), and KDH (-1.69%).

Compared to the start of the session, sellers gained a significant advantage. The number of decliners reached 309, while advancers totaled 233.

Source: VietstockFinance

|

Opening: VIC Surges, Pulling VN-Index Higher at the Start

At the start of the November 28 session, by 9:30 AM, the VN-Index rose over 1 point to 1,694 points. The HNX-Index also increased slightly above the reference level, reaching 261 points.

Green dominated the early session, with several raw material stocks rising positively from the start, including MSR (+6.3%), HPG (+0.19%), DCM (+0.15%), and POM (+13.79%).

The financial sector remained highly divergent in the early session. On the buying side, notable performers included MSB (+4.98%), LPB (+0.61%), and VCI (+1.03%). Conversely, on the selling side, VIX, SHB, MBB, CTG, and VPB saw declines, though not significantly.

Leading stocks such as VIC, MSB, LPB, and VNM drove the index higher, contributing over 5.7 points of growth. Conversely, VJC, GEE, and FPT weighed on the market, pulling it down by over 1.3 points.

– 15:40 28/11/2025

Market Pulse 27/11: Efforts to Gain Momentum Face Ongoing Challenges

Despite early attempts to rally in the afternoon session, the VN-Index faced continued resistance around the 1,690-point mark, leading to a swift correction. By the close, Vietnam’s benchmark stock index managed a gain of just under 4 points, a far cry from the session’s peak of nearly 15 points.

Vietstock Daily 28/11/2025: Is Market Polarization Returning?

The VN-Index trimmed its gains, forming a Long Upper Shadow candlestick pattern, signaling heightened profit-taking pressure as the index tests its September 2025 peak (around 1,695-1,711 points). Nevertheless, the short-term outlook remains positive, supported by the MACD indicator’s continued upward trajectory and its recent crossover above the zero line.

Vietnamese Billionaire Bags Billions Amid Fiery Stock Market Rally

Amidst a sea of red in the market and a VN-Index that plummeted by over 20 points, the fortunes of Vietnam’s top billionaires surged impressively. On November 25th, Phạm Nhật Vượng’s net worth soared by approximately $1.1 billion, while Nguyễn Phương Thảo’s wealth climbed by nearly half a billion dollars.

Vietnamese Billionaire Pham Nhat Vuong Sets Unprecedented Record on Historic “Red Day”

Billionaire Pham Nhat Vuong has become the first Vietnamese individual to achieve this remarkable milestone.