Vu Dang Linh, CEO of Mobile World Investment Corporation (MWG), revealed that Bach Hoa Xanh (BHX)’s revenue has fallen short of expectations. Vietnam’s consumer goods market has stagnated, with minimal growth. External factors such as heavy rains, storms, and flooding have also impacted performance.

“MWG is proactively enhancing efficiency. We’ve identified challenges and are focusing on optimizing existing stores, which is yielding positive results. We anticipate improved revenue from these stores in the coming months. Performance is already showing signs of recovery in the final quarter,” stated the CEO of MWG.

Despite revenue setbacks, profitability remains robust, with BHX reporting a Q3 profit of approximately VND 200 billion. Mr. Linh confirmed that BHX’s annual profit is projected to exceed VND 600 billion. The 2026 plan is still under development.

Addressing investor concerns about BHX’s ability to clear accumulated losses for a 2028 IPO, Mr. Linh affirmed that IPO remains a goal, but the timing will be carefully assessed. He emphasized that eliminating accumulated losses is a prerequisite for listing, acknowledging the challenge but expressing confidence in its feasibility.

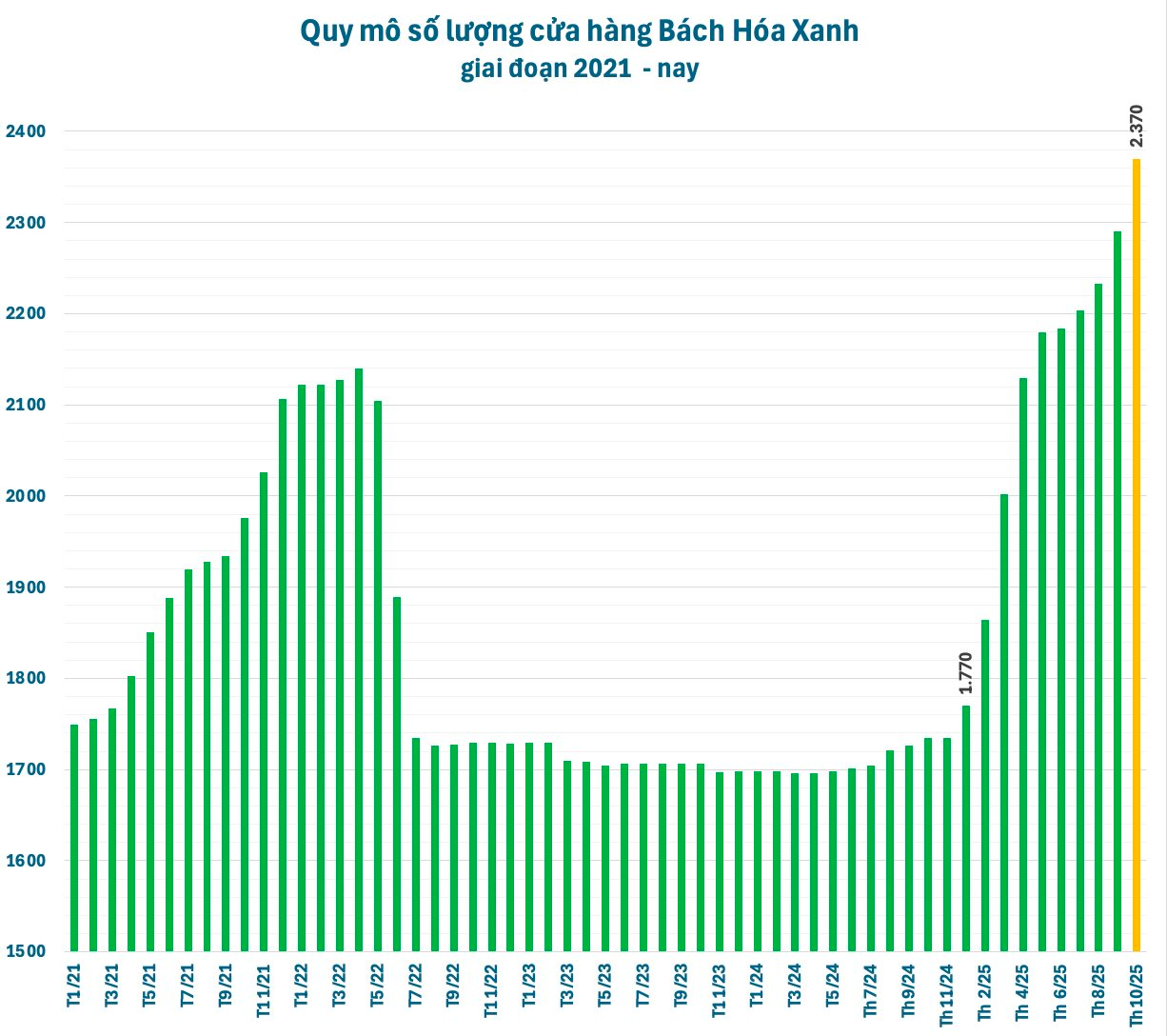

BHX is central to MWG’s expansion strategy, with 80 new stores opened in October and a total of 600 new locations year-to-date, surpassing the initial 400-store target. To scale revenue significantly, MWG will develop and implement tailored business models for different regions.

Modern retail channels account for less than 25% of Vietnam’s market share, with a growing shift from traditional to modern formats. The CEO views this as an opportunity for BHX to expand and capture greater market share. “While 2026 plans are not yet finalized, new store openings will continue at a pace no lower than 2025,” Mr. Linh noted, adding that 1,000 stores next year is achievable but subject to further review.

BHX will use Ninh Binh as a strategic hub for northern expansion. As the northern market is new, MWG will proceed cautiously, assessing feasibility before scaling operations. Ninh Binh was chosen for its proximity to Thanh Hoa, facilitating distribution synergies.

Mr. Linh acknowledged the complexity of logistics in central Vietnam due to its elongated geography but expressed confidence in managing northern logistics effectively, leveraging MWG’s established nationwide supply chain.

Seizing Opportunities Amid Regulatory Scrutiny: MWG CEO on Tax, Counterfeit, and Substandard Goods Crackdown

The MWG Group’s mini-supermarket chain is set to launch its first store in Ninh Binh this November. According to MWG’s CEO, Mr. Vu Dang Linh, this food retail system has the potential to open over 1,000 stores annually in the upcoming period.

MWG Officially Registers to Purchase 10 Million Treasury Shares

MWG is set to execute a treasury stock purchase via order matching, scheduled to take place from November 19, 2025, through December 18, 2025.