During the regular investor meeting on the afternoon of November 27th, the CEO of Mobile World Investment Corporation (HOSE: MWG), Mr. Vũ Đăng Linh, announced that the group has restructured its subsidiary companies. This move aims to separate operations among units in preparation for the IPO of Dien May Xanh JSC, which manages both The Gioi Di Dong and Dien May Xanh chains.

Currently, Dien May Xanh JSC—99.95% owned by MWG—has completed its name change and recently acquired the repair and warranty division, Tho Dien May Xanh, from its parent company.

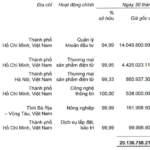

MWG to Execute Two Subsidiary Transfers Valued at Over 2.1 Trillion VND

CEO of MWG – Mr. Vũ Đăng Linh

|

At the Wednesday meeting, revenue for Dien May Xanh and The Gioi Di Dong in November was slightly lower than the peak iPhone sales in October. However, Q4 revenue is projected to surpass Q3. The MWG CEO noted strong growth in the ICT sector, driven by high-value AI-integrated products. “This trend will continue as AI remains a hot technology,” he stated.

For Apple products, MWG holds a 50% market share in Vietnam, with cumulative revenue of 500 million USD over nine months. Mr. Linh confirmed the retailer will further expand this product line. While increased Apple product contributions may lower overall gross margins, he emphasized that MWG prioritizes absolute profit over maintaining margin rates.

Mr. Linh declined to share 2026 plans, as MWG’s leadership is still in discussions. However, given the positive performance of mobile and electronics segments, he hinted at potentially higher cash dividends in the future.

Despite IPO plans and growth ambitions, the MWG CEO stated that the number of mobile and electronics stores will remain stable in the coming years. New store openings will primarily replace older ones to enhance operational efficiency. ICT growth will focus on quality over physical store quantity.

Additionally, MWG is partnering with V-Green to expand electric vehicle charging infrastructure across its stores.

In Indonesia, MWG’s EraBlue chain now operates 164 stores, with plans to reach 180 by year-end 2025 and open at least 150 new stores in 2026.

According to the MWG CEO, EraBlue’s revenue grew by 70% this year, despite a downturn in Indonesia’s consumer electronics market. “This is a significant opportunity. Consumers choose EraBlue for its superior service compared to competitors. Our local market-savvy partners have been instrumental in our success… Achieving 500 stores within two years is entirely feasible,” he shared.

Regarding e-commerce, MWG’s representative mentioned that the MWG Shop platform is still under website development. “We aim to open the platform to external sellers by 2026.”

– 14:24 27/11/2025

Unlocking Daily Earnings of Nearly $20 Million: Insights from Nguyen Duc Tai

Vietnam’s largest retail system, owned by Mr. Nguyen Duc Tai, generated nearly VND 14.7 trillion in revenue during October, averaging approximately VND 474 billion per day.

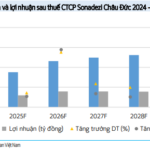

Should You Invest in SZC, BSR, and MWG?

Securities firms are recommending the purchase of SZC, citing expectations of improving business conditions following Vietnam’s new agreement framework with the U.S. They also advise increasing exposure to BSR, driven by the anticipated surge in petrochemical product demand during the latter part of the year. Additionally, MWG is favored due to the promising recovery of its ICT segment and the profit-taking phase of the Bach Hoa Xanh retail chain.