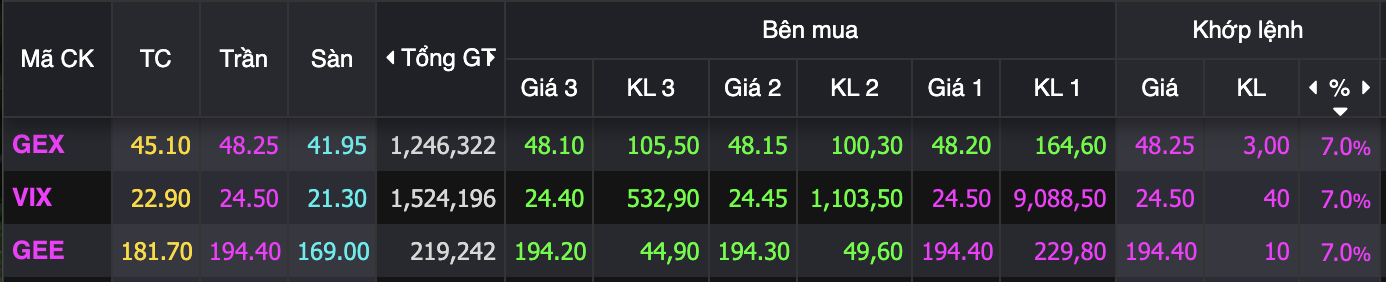

The trading session on November 26th witnessed a notable development on the HOSE exchange as stocks within the “Gelex ecosystem” collectively surged to their upper limits, becoming the focal point for market liquidity. Specifically, out of the 8 stocks that hit their ceiling on HOSE, three—GEX, GEE, and VIX—stood out as the top performers.

GEX climbed 7%, closing at 48,250 VND per share, with vibrant liquidity as over 26.2 million units were traded, totaling 1,246 billion VND.

VIX reached its maximum limit at 24,500 VND per share, with nearly 63 million shares changing hands, amounting to over 1,524 billion VND.

GEE also closed at its ceiling price of 194,400 VND per share, with a trading value exceeding 219 billion VND.

Combined, the trading value of these three stocks approached 3,000 billion VND.

The recovery of the Gelex group somewhat alleviated shareholder concerns after a steep decline from historical highs in mid-October 2025. Prior to this surge, GEX had lost 45%, while VIX had plummeted nearly 74% in just over a month.

However, compared to the beginning of 2025, GEX has surged by nearly 174%, VIX by 157%, and GEE by an impressive 641%.

The sudden rally in the Gelex group comes amid significant developments in their business operations.

Most recently, the State Securities Commission (SSC) granted the Certificate of Registration for the Initial Public Offering (IPO) to GELEX Infrastructure Joint Stock Company, a member of the GELEX ecosystem. According to the plan, the company will issue 100 million shares to the public and aims to list its shares on the Ho Chi Minh City Stock Exchange (HoSE).

If successful, GELEX Infrastructure is expected to raise 2,800 billion VND. The capital will be used to increase the charter capital of Titan Hai Phong Joint Stock Company to fund the “Investment Project for Construction and Business of Infrastructure in Tran Duong – Hoa Binh Industrial Zone (Zone A) – Phase 1” and for financial restructuring purposes.

GELEX Infrastructure will conduct its IPO through a public auction on HOSE.

In another development, VIX Securities is set to hold an Extraordinary General Meeting of Shareholders in 2025. The meeting is scheduled for November 28th in Hanoi, with the shareholder list finalized on October 9th.

The agenda will focus on two key items: adjusting the 2025 business plan and approving the issuance of shares to existing shareholders.

According to the proposal, VIX plans to issue over 919 million shares to existing shareholders at a price of 12,000 VND per share, with a ratio of 10:6 (for every 10 existing shares, shareholders can purchase 6 new shares). Post-issuance, VIX’s charter capital will increase from 15,314 billion VND to 24,502 billion VND, positioning the company among the largest securities firms in terms of capital.

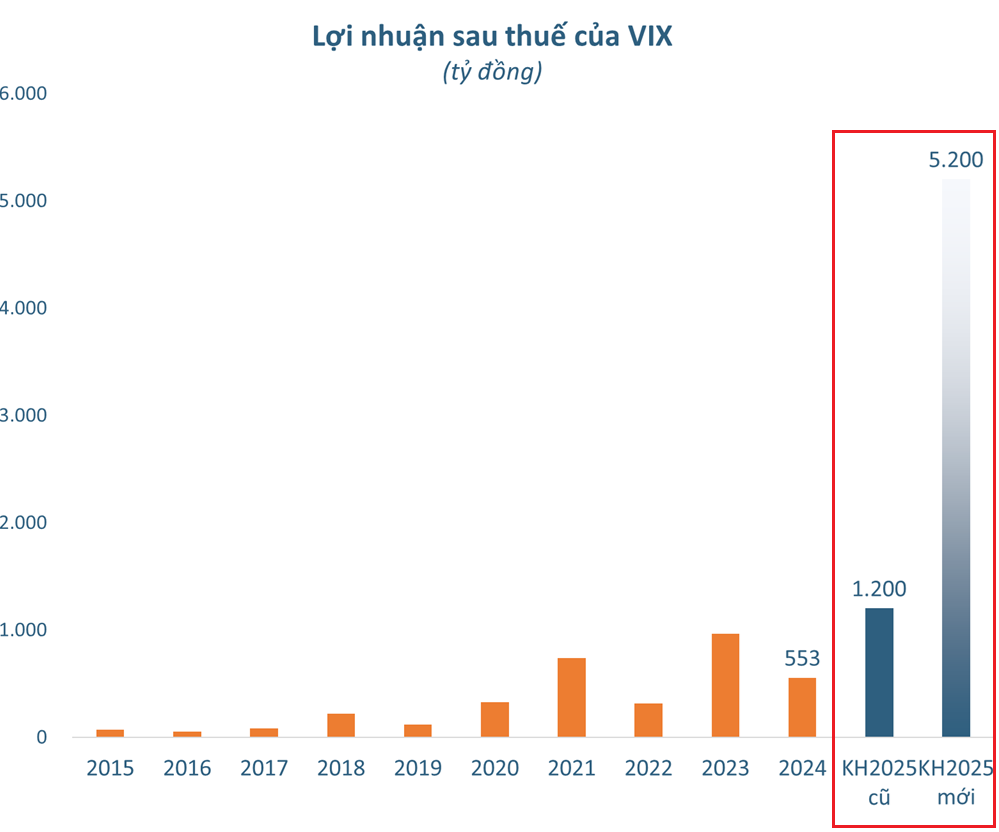

Alongside the capital increase, VIX has significantly adjusted its 2025 business targets. Pre-tax profit is now aimed at 6,500 billion VND, 1,500 billion VND higher than the September plan and a 433% increase from the beginning of the year. Correspondingly, after-tax profit is set to rise to 5,200 billion VND.

In the first nine months, VIX leads the securities industry in profits, with pre-tax and after-tax profits of 5,116 billion VND and 4,123 billion VND, respectively, more than seven times higher than the same period last year.

SSI to Offer Over 415 Million Shares at Half the Market Price

SSI is set to offer 415.18 million shares to its shareholders at a price of 15,000 VND per share, representing a 50% discount compared to the current market price.

Packaging Supplier to Unilever, Pepsico Plans to Delist, Ending 13-Year Tenure on HoSE

Sovi is set to conclude its 13-year journey on the HoSE as its ownership structure becomes overwhelmingly concentrated under SCG (Thailand), rendering the company no longer compliant with public company criteria.

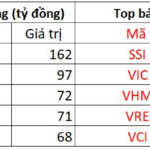

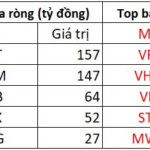

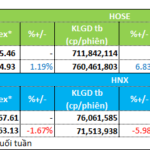

Seafood & Food Stocks Lead the Week in Attracting Investment

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.