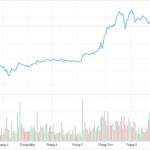

Gold prices in Vietnam as of November 27, 2025.

During today’s afternoon trading session, the buying price of gold rings at Bao Tin Manh Hai decreased by VND 500,000 compared to this morning, reaching VND 149.5 million per tael. The selling price remained unchanged at VND 152.2 million per tael.

Gold prices listed at Bao Tin Manh Hai this afternoon. (Source: Bao Tin Manh Hai)

Other gold retailers have not adjusted their prices since this morning.

—

At the opening of today’s morning session, Bao Tin Manh Hai listed gold rings at VND 150 – 152.2 million per tael, a decrease of VND 400,000 per tael for buying and VND 1.2 million per tael for selling compared to yesterday’s close.

Meanwhile, other major gold brands have not reported new adjustments. Specifically, Bao Tin Minh Chau listed gold rings at VND 149.9 – 152.9 million per tael; SJC traded around VND 148.5 – 151 million per tael; DOJI and PNJ maintained gold rings at VND 149.4 – 152.4 million per tael.

Gold bar prices at major enterprises are fluctuating between VND 151.4 – 153.4 million per tael.

In the global market, spot gold is currently at USD 4,161 per ounce, slightly down from yesterday.

In a recent forecast, Goldman Sachs maintains an optimistic outlook on gold. According to Daan Struyven, Head of Oil Research at the bank, gold could reach USD 4,900 per ounce next year, driven by sustained demand from central banks and inflows into gold ETFs. Notably, even a small shift in individual investors’ portfolio diversification strategies could significantly boost the precious metal’s price.

Struyven stated that Goldman Sachs remains highly positive on gold. “We forecast a nearly 20% upside for gold by the end of 2026, targeting USD 4,900 per ounce. While the increase may not be as rapid as this year’s nearly 60% rise, we believe the two key drivers of the 2025 rally will persist into 2026.”

The first driver is the consistent buying from central banks. “After Russia’s foreign reserves were frozen in 2022, reserve managers in many emerging economies realized the need to diversify into gold—a truly safe asset when held in national reserves,” he explained.

The second driver is the U.S. Federal Reserve’s rate-cutting cycle. “When the Fed cuts rates, gold, being a non-yielding asset, typically attracts inflows into gold ETFs. Our economists predict the Fed will cut rates by an additional 75 basis points,” he added. “Gold is currently supported by both central bank purchases and private investor demand.”

When asked about the impact of the U.S. dollar’s recent strength, Struyven emphasized that the more critical factor is the potential expansion of diversification trends.

“Currently, this trend is primarily among central banks. However, if it extends to private investors, gold’s price outlook could be even more favorable than our current forecast.”

He also noted that the relatively small size of the gold market means even modest capital shifts can cause significant price movements.

“Global gold ETFs are roughly 70 times smaller than the U.S. Treasury bond market. Thus, even a small portion of capital exiting global bond markets could drive gold prices higher.”

According to Struyven, this is why gold is currently Goldman Sachs’ top long recommendation in commodities.

“Even in the base case, gold has substantial upside potential. In less favorable market scenarios, such as fiscal concerns or Fed independence issues, gold could perform even better.”

Previously, on October 6, Goldman Sachs raised its 2026 gold price forecast from USD 4,300 to USD 4,900 per ounce, citing strong ETF inflows in the West and sustained central bank purchases as key drivers.

The bank also predicts central banks will purchase an average of 80 tons of gold in 2025 and 70 tons in 2026, as emerging economies continue to reduce their USD holdings in favor of gold reserves.

Since the beginning of the year, spot gold prices have risen nearly 60%, driven by strong central bank buying, increased ETF demand, a weaker U.S. dollar, and growing interest from individual investors seeking protection against trade and geopolitical uncertainties.

Goldman also noted that speculative short positions in the gold market remain relatively stable. “After September’s sharp rise, gold holdings in Western ETFs have aligned with our interest rate-based forecast, indicating the recent rally is not overextended,” the analysts concluded.

South Korea Invests Over $15.7 Billion in Hanoi’s Neighboring Province, with One Company Accounting for 70% of Total Capital, Expanding Production Further

As businesses forge ahead with their expansion strategies in Vietnam, the focus on scaling production capabilities has become paramount. This pivotal move not only underscores a commitment to growth but also positions companies to capitalize on the burgeoning opportunities within the Vietnamese market. By strategically enhancing production, enterprises aim to meet the escalating demand, optimize operational efficiency, and solidify their competitive edge in this dynamic economic landscape.

Unveiling the Allure of the ‘AI in Action’ TV Competition: Decoding Its Irresistible Appeal

The inaugural episode of “A.I Thực chiến” will premiere on November 26, 2025, at 8 PM on VTV2, with a rebroadcast on November 28 at 9 AM on VTV3. As Vietnam’s first-ever AI-focused competition and a flagship national TV program on artificial intelligence, it offers a 1 billion VND cash prize, a 1 million USD scholarship, and the chance to become a “USD Millionaire Under 30” sponsored by Techcombank, Masterise Group, and One Mount Group.

Gold Ring Prices Drop at Close on November 26th

A leading gold retailer has slashed the price of gold rings by VND 400,000 per tael compared to this morning’s trading session.