In a recent letter to investors, Mr. Petri Deryng, the head of PYN Elite Fund, revealed that when allocating investments by country a decade ago, he set a long-term target for the VN-Index at 2,500 points.

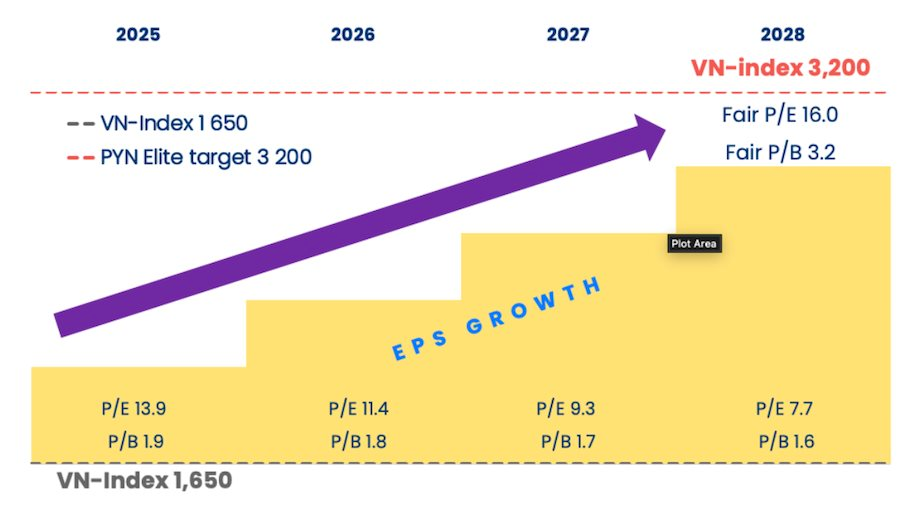

Today, PYN Elite Fund has decided to raise the VN-Index target to 3,200 points by 2028. Currently, the VN-Index is trading around 1,650 points.

The new target of 3,200 points is based on an assumed average profit growth rate of 18–20% in the coming years. For 2025 alone, the fund forecasts profit growth to exceed 20%.

Mr. Petri Deryng further explained that the Vietnamese government is aggressively steering the economy toward greater prosperity. Large-scale public investment projects are expected to usher in a new era of robust growth, simultaneously triggering a wave of private sector investment.

Simultaneously, the rapid modernization of the financial market and strong bank credit growth are providing additional support. In summary, according to PYN Elite, these policies are creating an even more favorable environment for Vietnam’s economic growth and the rising profits of listed companies.

Over the past 15 years, the VN-Index’s P/B ratio has surpassed 3 times on three occasions. In the long term, the average P/E ratio hovers around 16 times, and during three periods, it climbed above 20 times. According to PYN Elite, the 6-month and 12-month profit outlook remains highly positive. The market could resume its upward trend at any moment.

This is not the first time PYN Elite Fund has made optimistic forecasts far exceeding the market’s current value. The fund previously predicted the VN-Index would reach 2,500 points by the end of 2024, corresponding to a projected P/E ratio of approximately 16.5 times.

According to a newly released report, in October, the foreign fund PYN Elite recorded a negative investment performance of 4.85%, while the VN-Index declined by 1.3%. This marked the second consecutive month of negative performance for the fund, following four consecutive positive months. Year-to-date, the fund’s performance stands at 21%.

PYN Elite Fund is one of the largest foreign funds in the market, with a managed portfolio size of up to 940 million EUR (approximately 28,600 billion VND ~ 1.1 billion USD) as of the end of October.

The fund’s top 10 portfolio includes 4 banking stocks (STB, MBB, VIB, OCB), 1 securities company (VIX), 2 aviation companies (HVN, ACV), 1 retail company (MWG), 1 technology company (FPT), and 1 real estate company (HDG). Notably, FPT shares unexpectedly returned to the fund’s top 6 holdings with a 6% weighting, after being absent from the top 10 in the September report.

Market Pulse 28/11: Continued Divergence as Vingroup Stocks Bolster VN-Index by Over 14 Points

At the close of trading, the VN-Index climbed 6.67 points (+0.4%) to reach 1,690.99, while the HNX-Index dipped 1.52 points (-0.58%) to 259.91. Market breadth tilted toward the downside, with 417 decliners outpacing 289 advancers. The VN30 basket reflected this trend, as 17 constituents closed lower, 10 advanced, and 3 remained unchanged.

Technical Analysis Afternoon Session 27/11: MACD Crosses Above Zero Threshold

The VN-Index continues its upward trajectory, firmly positioned above the 50-day SMA, while the MACD has decisively crossed above the zero line. Meanwhile, the HNX-Index is experiencing a tug-of-war as it retests the Middle Band of the Bollinger Bands.

Vietstock Daily 28/11/2025: Is Market Polarization Returning?

The VN-Index trimmed its gains, forming a Long Upper Shadow candlestick pattern, signaling heightened profit-taking pressure as the index tests its September 2025 peak (around 1,695-1,711 points). Nevertheless, the short-term outlook remains positive, supported by the MACD indicator’s continued upward trajectory and its recent crossover above the zero line.

Vietnamese Billionaire Bags Billions Amid Fiery Stock Market Rally

Amidst a sea of red in the market and a VN-Index that plummeted by over 20 points, the fortunes of Vietnam’s top billionaires surged impressively. On November 25th, Phạm Nhật Vượng’s net worth soared by approximately $1.1 billion, while Nguyễn Phương Thảo’s wealth climbed by nearly half a billion dollars.