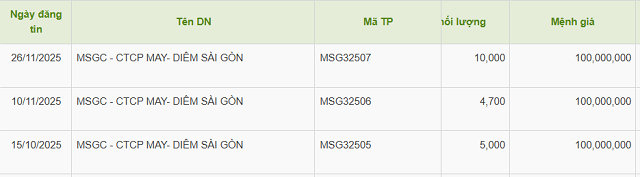

In November alone, the company headquartered at Ben Van Don Street (former District 4, Ho Chi Minh City) successfully issued two bond tranches, raising VND 1 trillion and VND 470 billion respectively. Including the VND 500 billion tranche issued in October, this marks three consecutive fundraising rounds in a short period.

All three tranches offer a fixed interest rate of 9% per annum, a 108-month term, and a single interest payment upon maturity. A common feature across all seven tranches is their “triple no” nature: non-convertible, without warrants, and unsecured.

May – Diêm Sài Gòn raises nearly VND 2 trillion from private bonds in a short time. Source: HNX

|

Established in 2004, the company is pursuing real estate development with a substantial land bank across multiple locations. However, many projects remain in the procedural or land clearance stages, resulting in suboptimal capital efficiency.

According to Saigon Ratings, May – Diêm Sài Gòn’s primary advantage stems from the backing of TNR Holdings Vietnam, a 44.97% shareholder currently overseeing urban real estate development for ROX Group (formerly TNG Holdings Vietnam).

Previously, other companies within the TNR Holdings Vietnam ecosystem have also accelerated bond issuance. For instance, Thanh Vinh Real Estate Investment and Development JSC, developer of the TNR Stars Thai Hoa project, raised over VND 2.6 trillion. These bonds carry a 6-8 year term and a fixed interest rate of 9.2%.

A similar case is Nam Quang Infrastructure Investment and Development JSC (TNI Nam Quang), developer of the Gia Loc Industrial Zone in Hai Phong. In November, the company raised an additional VND 1.5 trillion, bringing its total bond issuance within a month to VND 2.5 trillion. Interest rates remain at 9-9.1% per annum with maturities until 2033-2034. TNI Nam Quang is 54.2% owned by ROX iPark Vietnam, a member of the TNR Holdings Vietnam ecosystem.

The bond issuance trend within this ecosystem is likely to continue. Saigon Ratings recently completed a credit rating for Tam Trinh Investment and Construction Joint Venture Company, 94.8% owned by TNR Holdings Vietnam. This move is seen as preparation for an upcoming bond issuance.

Meanwhile, TNR Holdings Vietnam carries a significant debt burden from private bonds. According to its semi-annual financial report submitted to HNX, the company holds over VND 8.8 trillion in bonds, constituting approximately one-third of its total liabilities exceeding VND 24 trillion; while its equity stands at around VND 2.3 trillion.

TNR Holdings Vietnam’s first-half 2025 results were negative, reporting an after-tax loss of over VND 167 billion.

Gold View Tower at 346 Ben Van Don Street, Vinh Hoi Ward, Ho Chi Minh City, serves as the headquarters of May – Diêm Sài Gòn – Photo: TNL

|

Two TNR Holdings Vietnam-related companies raise additional VND 1.1 trillion from bonds

May – Diêm Sài Gòn raises nearly VND 2.5 trillion from “triple no” bonds in less than a month

– 15:53 27/11/2025

Vietjet Launches VND 1,000 Billion Bond Issuance

Vietjet has launched 10,000 corporate bonds under the code VJC12504, with a face value of 100 million VND per bond. This issuance totals a face value of 1,000 billion VND.

VPI No Longer the Parent Company of Van Phu – B&C

Following Văn Phú – B&C’s capital increase to 1.866 trillion VND, VPI’s ownership stake has been reduced to a mere 0.225%, effectively ending its status as the parent company.