Furthermore, SHB is projected to be included in the FTSE Russell global equity index basket as Vietnam officially upgrades to an emerging market. These dual factors serve as a powerful catalyst for SHB’s exceptional growth potential in the coming period.

Attracting Foreign Investment: A Gateway to Professional and Long-Term Capital

With Vietnam’s stock market upgrading from “frontier” to “secondary emerging” status by FTSE Russell, experts and investors anticipate a surge in foreign capital inflows. As the market meets higher standards, major investment funds and institutions will turn their attention to Vietnam. This shift will bring Vietnamese stock valuations closer to the regional emerging market average.

Dragon Capital observes that many investors, particularly institutional funds new to Vietnam, are actively exploring and preparing to open accounts, paving the way for foreign capital to return in the next few quarters. This resurgence is underpinned by macroeconomic stability, high regional growth, political stability, market transparency, positive corporate earnings, robust liquidity, and diverse investment products.

Recently, FTSE released a report outlining its market classification plans and Vietnam’s weight in the indices post-upgrade (including 0.04% in the FTSE Global All Cap, 0.02% in the FTSE All-World, 0.34% in the FTSE Emerging All Cap, and 0.22% in the FTSE Emerging Index). Notably, FTSE identified SHB as a potential candidate for inclusion in the FTSE Global All Cap.

According to BSC Research, there is room for further weight adjustments for Vietnamese stocks. FTSE’s previous announcement, based on data as of October 31, 2025, did not account for potential market classification changes in countries like Greece, Egypt, and Oman, nor future shifts in market capitalization and investable weights. BSC suggests that Vietnam’s weight could continue to fluctuate, especially as Greece (currently 0.72% in the FTSE Emerging) is set to upgrade to “Developed” status, potentially freeing up weight for other emerging markets, including Vietnam, following the March 2026 interim review.

This presents an opportunity for stocks with available foreign ownership limits, like SHB, to attract international capital. Moreover, it opens doors to long-term, professional investors as the bank enhances its governance and transparency in line with international standards.

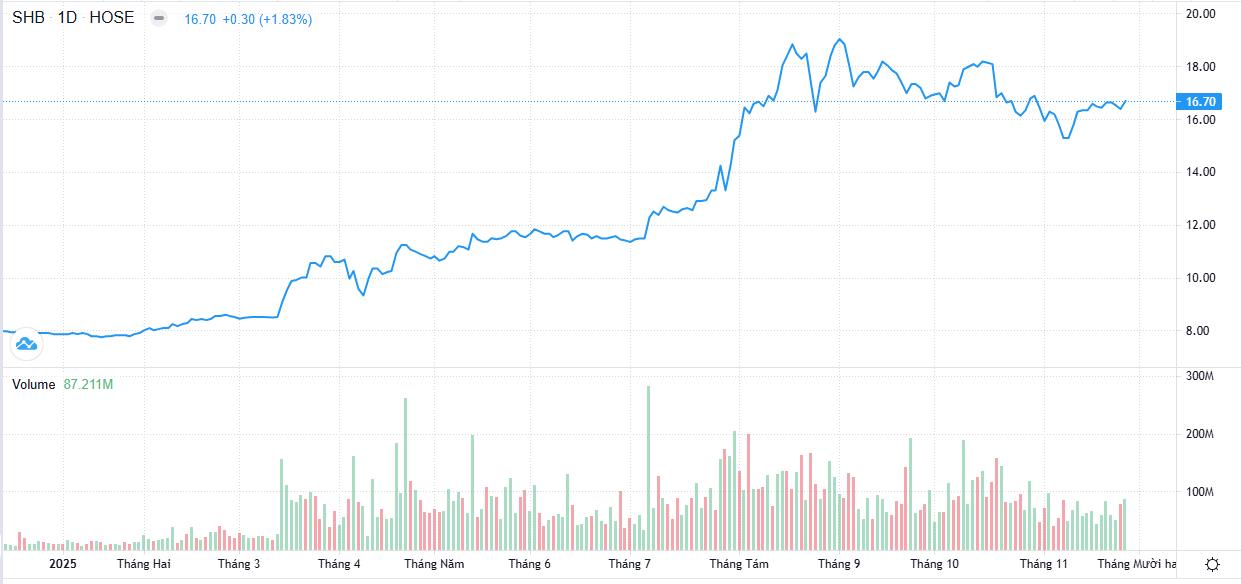

SHB Stock Performance Since Year-Start

Competitive Edge Through Robust Capital Base

BSC Securities estimates that by Q3 2025, Vietnam’s credit growth will reach approximately 13.4% year-to-date and 20% year-on-year, with total credit exceeding VND 17.7 trillion. Credit growth is projected at 18-20% by year-end 2025, sustained into 2026. BSC positions SHB among the key beneficiaries of the central bank’s accommodative monetary policy and the recovering real estate market. Consequently, SHB leads the industry in loan growth.

As of September 30, 2025, SHB’s credit balance grew 15% to nearly VND 616.6 trillion, driven by strategic partnerships with major state and private conglomerates, ecosystem development, and a robust supply chain network. SHB is also pivoting towards retail and digital banking, optimizing operational costs (CIR at 18.9%, among the industry’s lowest) and profitability (ROE at 19.2%). In the first nine months of 2025, pre-tax profit surged 36% year-on-year to VND 12,235 billion (85% of the annual target).

BSC emphasizes that in a credit-expansion cycle, the Capital Adequacy Ratio (CAR) is critical. Compared to ASEAN peers under Basel III, Vietnamese banks have significantly lower capital buffers (12% vs. 19% regional average). Thus, capital raising will dominate the banking sector’s agenda in the coming years. In this race, banks with substantial capital bases, like SHB, are best positioned to maintain their competitive edge.

SHB’s recent AGM approved a VND 7.5 trillion capital increase for 2025. The plan includes issuing 459 million shares to existing shareholders, 200 million private placement shares to professional investors, and 90 million ESOP shares. Post-issuance, SHB’s charter capital will reach VND 53.4 trillion, ranking it among the top four private banks.

The additional capital will fund lending expansion, infrastructure investment, strategic projects, IT modernization, and digital banking initiatives, positioning SHB for leadership through comprehensive transformation. This will enhance financial capacity, competitiveness, and compliance with international banking safety standards.

SHB maintains a CAR of 12%, rising to 12.5% as of June 30, 2025 (well above the 8% minimum). Its risk management system adheres to international three-line defense standards, with advanced measurement, control, and warning mechanisms.

Agriseco Securities highlights that as of November 19, 2025, the banking sector’s average P/B ratio stands at 1.6x, below the five-year average of 1.8x after a 20-30% correction from the August 2025 peak. Given positive growth prospects, Agriseco finds bank stocks attractively priced for accumulation. Capital raise plans for late 2025 and early 2026 further support bank stock valuations.

Year-to-date, SHB shares have surged 110% to VND 16,700, with average daily volume of 70-80 million shares, often exceeding 100 million. SHB’s P/B of 1.16x is compelling relative to the sector average. Combining capital expansion, strengthened industry positioning, and market upgrade potential, SHB presents a highly promising investment opportunity.

South Korea Invests Over $15.7 Billion in Hanoi’s Neighboring Province, with One Company Accounting for 70% of Total Capital, Expanding Production Further

As businesses forge ahead with their expansion strategies in Vietnam, the focus on scaling production capabilities has become paramount. This pivotal move not only underscores a commitment to growth but also positions companies to capitalize on the burgeoning opportunities within the Vietnamese market. By strategically enhancing production, enterprises aim to meet the escalating demand, optimize operational efficiency, and solidify their competitive edge in this dynamic economic landscape.

ESG and Technology: Dual Forces Shaping the Future of Capital Markets

According to Richard McGillivray, Senior Director for Asia Pacific at CFA Institute, ESG (Environmental, Social, and Governance) and technology are the twin forces shaping the future of capital markets.

Unveiling the Allure of the ‘AI in Action’ TV Competition: Decoding Its Irresistible Appeal

The inaugural episode of “A.I Thực chiến” will premiere on November 26, 2025, at 8 PM on VTV2, with a rebroadcast on November 28 at 9 AM on VTV3. As Vietnam’s first-ever AI-focused competition and a flagship national TV program on artificial intelligence, it offers a 1 billion VND cash prize, a 1 million USD scholarship, and the chance to become a “USD Millionaire Under 30” sponsored by Techcombank, Masterise Group, and One Mount Group.