According to global consulting firm McKinsey, up to five Chinese automakers, leveraging their technological and manufacturing advantages in electric vehicle production, are poised to enter the top 10 global auto manufacturers by 2030, disrupting the established hierarchy of the global automotive industry.

“The industry will undergo significant transformations by 2030,” stated Guan Mingyu, a senior partner at McKinsey, during a press conference on Thursday. “In fact, we’re already witnessing early signs of these monumental shifts.”

China’s electric vehicle (EV) leader, BYD, and Geely Holding Group, owner of Volvo Cars, ranked among the world’s top 10 automotive groups by sales volume last year.

Guan did not specify which Chinese automakers would secure the three new spots in the global top 10 ranking.

Emerging smart EV manufacturers, such as Xiaomi, Xpeng, and Leapmotor, reported surging sales over the past year, as their new models attracted thousands of mainland Chinese customers away from Tesla’s Shanghai-made Model 3 and Model Y. This highlights their strong potential to challenge traditional automakers in the world’s largest auto market, analysts noted.

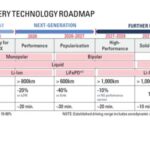

China currently dominates the global electric vehicle supply chain.

According to data and analytics firm GlobalData, BYD ranked fifth last year with 4.27 million vehicles delivered, while Geely placed tenth with 3.34 million units sold.

BYD anticipates that exports will account for approximately 20% of its total sales this year, up from around 10% last year.

The company forecasts delivering between 800,000 and 1 million vehicles overseas this year, out of an expected total of 4.6 million units, stated Li Yunfei, General Manager of Brand and Public Relations, in September.

Analysts attribute Chinese automakers’ leadership in EV technology and production, spearheaded by BYD, to government support and consumers’ openness to innovation.

China’s auto production accounts for over 30% of the global total, while mainland buyers purchased more than three out of every five EVs sold worldwide, according to data from the China Passenger Car Association.

Tesla’s Missed Opportunity: Chinese EV Sales Surge with 40% Lower Prices as US Giant Lags Behind Without Showroom Expansion

Unveiling a new haven for Chinese electric vehicles, this destination emerges as the ultimate solution amidst mounting barriers in the US and European markets.

Who’s Outselling Tesla as the World’s Top Electric Vehicle Seller?

In the first eight months of 2025, Chinese manufacturers delivered over 5.5 million electric vehicles, capturing nearly half of the global market share.