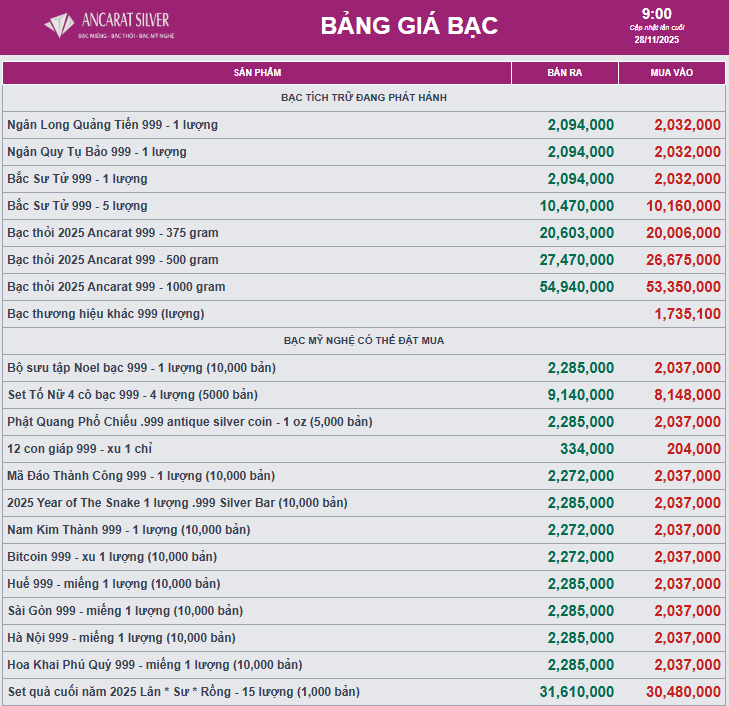

At Ancarat Vietnam Joint Stock Company, silver prices surged today, listed at VND 2,032,000 per tael (buy) and VND 2,094,000 per tael (sell) in Hanoi, marking an increase of VND 37,000 per tael for buying and VND 57,000 per tael for selling.

Meanwhile, the 1kg 999 silver bar is priced at VND 53,350,000 per bar (buy) and VND 54,940,000 per bar (sell), updated at 9:00 AM on November 28th.

Globally, silver prices rose to $53.8 per ounce.

Silver traded above $53 per ounce as markets anticipate U.S. monetary policy shifts. FX Empire analyst Arslan Ali noted that gold prices—and consequently silver—have climbed to a two-week high, as markets price in an 84% chance of a Federal Reserve rate cut in December.

He highlighted that the CME FedWatch tool shows the probability of a Fed rate cut has soared from 50% to 84% in a short period, reflecting a significant shift in investor expectations.

Additionally, recent U.S. economic data has fueled the rally in precious metals. Lower-than-expected retail sales and a steady Producer Price Index (PPI) at 2.7% have raised concerns that current monetary policy may be tighter than necessary. Arslan Ali believes this strengthens the case for imminent Fed action.

A weaker U.S. dollar and Treasury yields dropping to one-month lows further support the upward trend in gold and silver, as the opportunity cost of holding non-yielding assets diminishes significantly.

Silver Prices Rebound Today

Silver prices surged today, both domestically and internationally, marking a notable upward trend in the precious metals market.

Silver Price Holds Steady Above 52 Million VND per Kilogram

Silver prices today remain steady both domestically and globally as markets closely monitor U.S. policy developments.