Following a brief correction, the global silver price has resumed its robust upward trajectory. Last night (Vietnam time), silver surged past $53 per ounce, nearing its historical peak from mid-October.

Silver prices are surging once again in recent days.

Since the beginning of 2025, silver has soared by 80%, making it one of the top-performing assets during this period.

According to the Vietnam Commodity Exchange (MXV), silver is breaking out and reaching its highest level in over a week, capturing significant investor attention.

MXV attributes the primary driver of this upward trend to expectations that the U.S. Federal Reserve (FED) will cut interest rates by the end of the year. Lower interest rates reduce the cost of holding non-yielding assets like silver, drawing capital back into the market.

Bank of America (BofA), one of the largest banks in the U.S. and globally, recently released an optimistic report on precious metals, forecasting silver to reach $65 per ounce by 2026. This projection is nearly 20% higher than silver’s historical peak.

Shocking Predictions for Silver’s Rally

Even more optimistically, Philippe Gijsels, Chief Strategist at BNP Paribas Fortis, who predicted silver would hit $50 per ounce over a year ago, believes it wouldn’t be surprising to see silver surpass $100 per ounce in the near future.

He suggests that we may still be in the early stages of the largest silver bull market in history. As silver approaches significant price levels, it often experiences accelerated buying momentum and peaks.

Meanwhile, Paul Williams, CEO of Solomon Global, a gold and silver supplier, predicts that the fundamental drivers of the silver market show no signs of slowing down. Despite reaching record levels, silver remains undervalued compared to gold. “In the current context, $100 per ounce silver by the end of 2026 is entirely feasible,” Williams forecasts.

According to MXV, silver is benefiting from two major trends. First, loose monetary policies in major economies are significantly reducing the opportunity cost of holding non-yielding assets. Second, strong industrial demand, particularly in solar energy, battery production, and electric vehicles, is solidifying a robust consumption base.

However, MXV cautions that the market must closely monitor employment trends, which could shift policy expectations. The latest weekly jobless claims dropped to 216,000, indicating that the labor market isn’t weak enough to force the FED into aggressive easing. Any signs of recovery could slow silver’s rally.

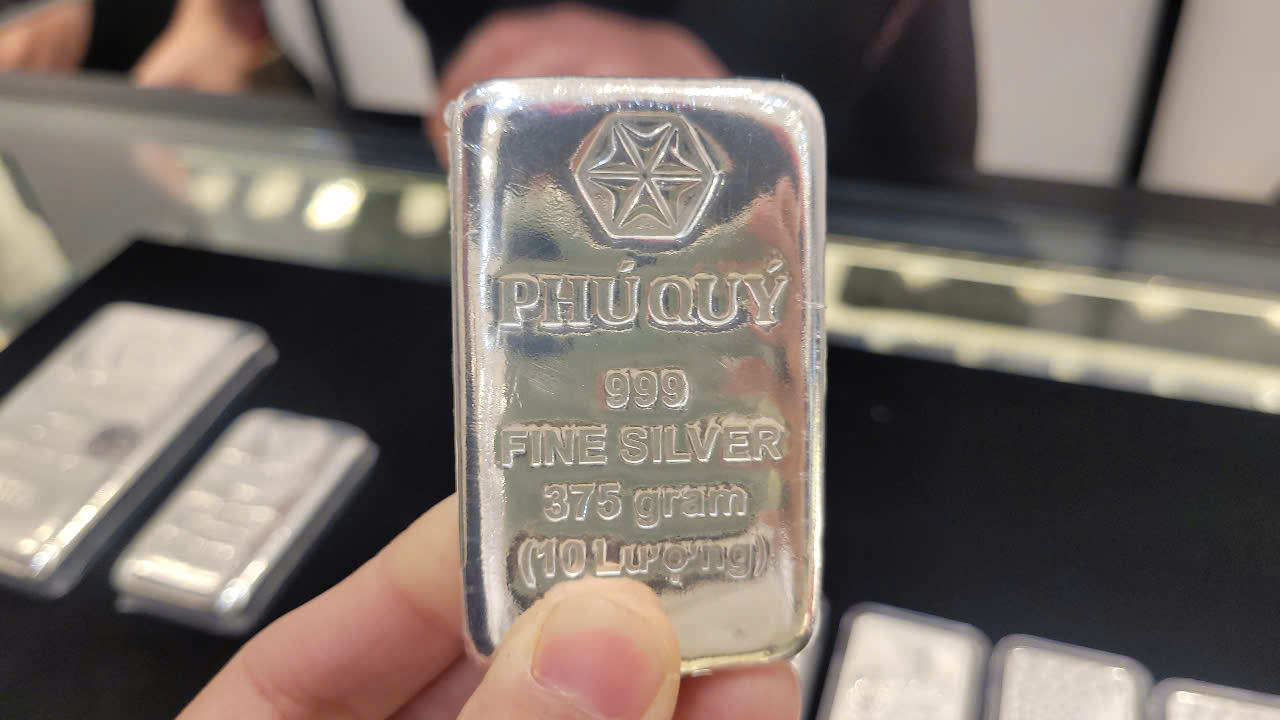

Domestically, during the afternoon trading session on November 27, Phú Quý silver bar prices rose 3.1% over the past week, trading at 54.15 million VND/kg (buy) – 55.83 million VND/kg (sell). By the end of the session, prices were adjusted further to 54.82 million VND (buy) – 56.53 million VND/kg (sell).

Silver Prices Rebound Today

Silver prices surged today, both domestically and internationally, marking a notable upward trend in the precious metals market.

Silver Price Holds Steady Above 52 Million VND per Kilogram

Silver prices today remain steady both domestically and globally as markets closely monitor U.S. policy developments.