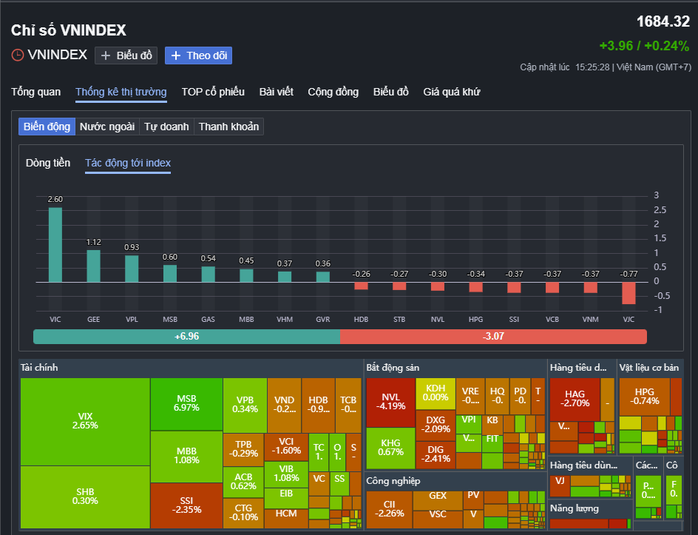

The VN-Index closed the trading day at 1,684.32 points, up 3.96 points or 0.24%, primarily driven by large-cap stocks. However, the index’s green surface doesn’t accurately reflect market health, as the breadth favored decliners significantly.

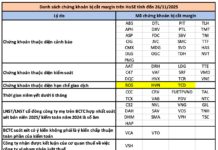

Data from HoSE revealed 171 declining stocks, compared to only 137 gainers and 58 unchanged stocks, painting a clear picture of a “green exterior, red interior” market. Red dominated most sectors, notably real estate, securities, basic materials, and retail.

Meanwhile, a few pillars like MSN, VIC, VPB, and select energy stocks saw mild rebounds, just enough to keep the VN-Index above the reference mark.

The primary cause was heightened profit-taking pressure as the VN-Index approached the critical 1,700 resistance level. This zone often triggers volatility, as many investors remain in the red from late October’s accumulation phase. Consequently, capital flows turned cautious, favoring risk-off selling over new positions.

Foreign investors also turned net sellers, offloading over 10.9 billion VND after a streak of net buying. On the sell side, VCB, VIC, ACB, and TCB faced the heaviest pressure, while POW, TCX, MBB, and VIX were rare bright spots, attracting foreign inflows.

On the market heatmap, red dominated real estate, with NVL, DIG, DXG, and KDH plunging. Securities firms, typically market leaders in bullish phases, retreated as SSI, VCI, HCM, and SHS all lost ground.

Even steel and basic materials, expected to benefit from public investment, weakened, as seen in HPG, NKG, and HSG’s slight declines.

The financial-banking sector showed sharp divergence: while VIB, MBB, and VPB stayed green, pillars like VCB, TCB, and CTG corrected, limiting overall market support. Notably, MSB surged to its ceiling price following VNPT’s divestment announcement.

According to the Hanoi Stock Exchange (HNX), Vietnam Posts and Telecommunications Group (VNPT) registered to auction over 188.7 million shares in Maritime Bank (MSB).

The starting price is set at 18,239 VND per share, nearly 1.5 times MSB’s current market price of 13,000 VND per share.

The auction is scheduled for the morning of December 26, 2025, at HNX, open to domestic and foreign institutional and individual investors.

Analysts note that the November 27 session reflects a “gaining but weak” market—a typical sign of approaching strong resistance. Without improved capital flows, the VN-Index may continue to oscillate in upcoming sessions, needing more accumulation time before sustainably surpassing 1,700 points.

Bank Stock Surges as Brokerage Firms Unexpectedly Sweep Up Shares on November 26th

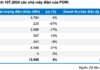

Proprietary trading desks at Vietnamese securities companies collectively net-purchased VND 322 billion worth of equities on the Ho Chi Minh Stock Exchange (HOSE) during the referenced period.

Market Pulse 28/11: Continued Divergence as Vingroup Stocks Bolster VN-Index by Over 14 Points

At the close of trading, the VN-Index climbed 6.67 points (+0.4%) to reach 1,690.99, while the HNX-Index dipped 1.52 points (-0.58%) to 259.91. Market breadth tilted toward the downside, with 417 decliners outpacing 289 advancers. The VN30 basket reflected this trend, as 17 constituents closed lower, 10 advanced, and 3 remained unchanged.

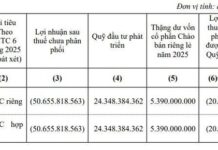

Enterprise Reports 15x Profit Surge Year-Over-Year, Stock Hits 9 Consecutive Circuit Breakers, Soaring 150% in Just 2 Months

Amidst the VN-Index’s struggle to find equilibrium, marked by low liquidity and pronounced anchoring effects, Halcom Vietnam JSC’s stock (HID) has emerged as a rare standout. Defying the prevailing cautious sentiment, HID has consistently surged to its maximum daily limit, showcasing remarkable resilience and investor confidence.