I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF NOVEMBER 24-28, 2025

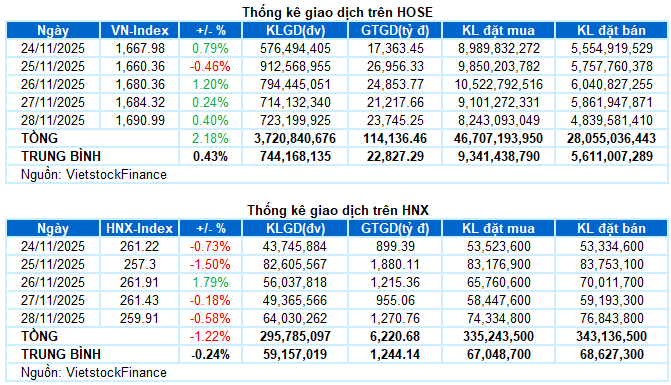

Trading Activity: Major indices moved in opposite directions during the November 28th session. The VN-Index rose by 0.4%, closing at 1,690.99 points. Conversely, the HNX-Index declined by 0.58%, ending at 259.91 points. For the week, the VN-Index gained a total of 36.06 points (+2.18%), while the HNX-Index lost 3.22 points (-1.22%).

The VN-Index concluded the final trading week of November on a positive note, with 4 out of 5 sessions closing higher, marking its third consecutive week of recovery. However, this achievement was largely driven by a few key stocks, while the broader market remained highly fragmented. Many sectors saw little benefit from the overall rebound. Liquidity remained a concern, showing no significant improvement, reflecting cautious investor sentiment and a focus on leading stocks rather than widespread participation. By week’s end, the VN-Index closed at 1,690.99 points, up 2.18% from the previous week.

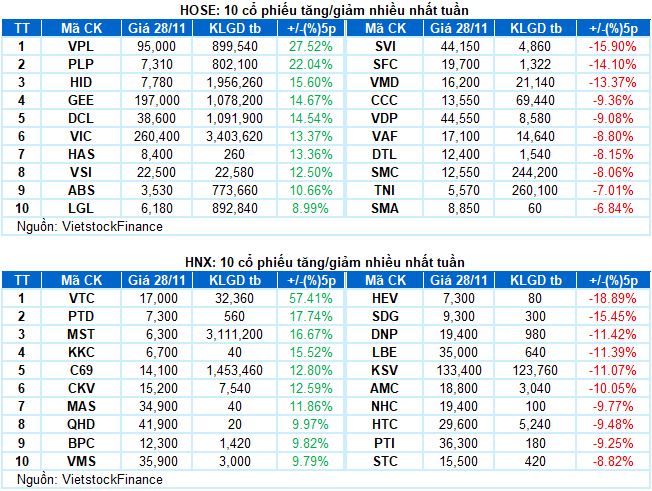

In terms of impact, the top 10 stocks contributed a combined 16.27 points to the VN-Index in the final session, with VIC alone adding over 11 points. Conversely, VCB, FPT, and GEE were the biggest drags, subtracting a total of 2.66 points from the index.

Despite the benchmark index’s gains, most sectors ended in the red. The information technology and telecommunications sector underperformed, led by declines in key stocks such as FPT (-2.41%), VGI (-1.36%), CTR (-1.59%), and VNZ (-1.69%).

Two major sectors, finance and industrials, weighed heavily on investor sentiment, with numerous stocks falling over 1%, including BID, LPB, MBB, STB, SSI, EIB, VIX, VND, BVH, SHS, MBS; HVN, GEE, GEX, VGC, VCG, CTD, VSC, PC1, and PAC.

In contrast, the real estate sector stood out with a notable 2.41% gain, driven by strong performers such as VIC (+5%), VRE (+1.78%), IDC (+1.26%), and DIG (+1.98%). However, several stocks within the sector also saw significant declines, including KSF (-1.08%), KDH (-1.13%), KBC (-1.12%), VPI (-1.76%), and SZC (-1.44%).

Similarly, the consumer discretionary sector maintained its positive momentum, thanks to gains in VPL (+6.15%), PNJ (+0.89%), VGT (+1.6%), and MSH (+1.13%). Meanwhile, stocks like HUT (-3.49%), DGW (-1.02%), DRC (-1.29%), CSM (-1.49%), HHS (-0.7%), and PET (-1.98%) remained in negative territory.

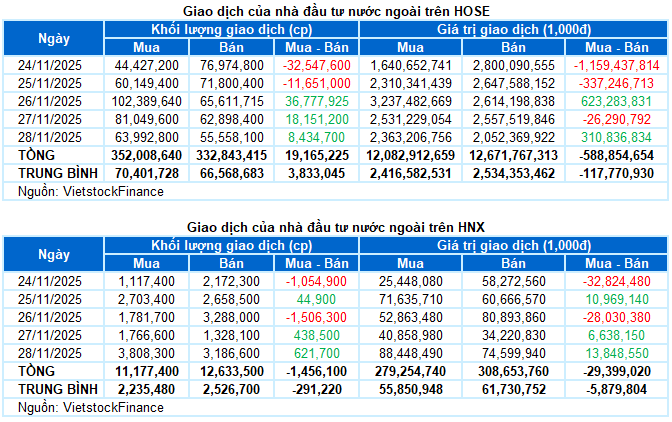

Foreign investors continued their net selling streak, with outflows exceeding 618 billion VND across both exchanges last week. Specifically, they net sold nearly 589 billion VND on the HOSE and over 29 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock. Unit: Billion VND

Top Performing Stock of the Week: VPL

VPL Surged 27.52%: VPL had a stellar week, with all 5 sessions closing higher. The stock price broke above the 50-day and 100-day SMA and closely followed the Upper Band of the Bollinger Bands.

Additionally, the Stochastic Oscillator and MACD indicators continued their upward trajectory, further reinforcing the positive short-term outlook.

Worst Performing Stock of the Week: SMC

SMC Fell 8.06%: SMC retraced after a 4-week winning streak. The stock price dropped below the Middle Band of the Bollinger Bands, accompanied by above-average trading volume in the final session, indicating increasing selling pressure.

Currently, the MACD has crossed below the Signal line, signaling a sell. If conditions do not improve, SMC is likely to retest its August 2025 lows (around 11,650-12,300) in upcoming sessions.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:23 28/11/2025

Tracking the Shark Money Flow on November 28: Proprietary Traders and Foreign Investors Diverge, VNM Grabs Attention

In the final trading session of November, foreign investors demonstrated a strong appetite for Vietnamese equities, recording a net purchase of nearly VND 320 billion. Conversely, securities firms’ proprietary trading desks took a contrasting approach, offloading a net VND 360 billion worth of stocks. Notably, VNM shares captured significant attention, featuring prominently in both foreign investors’ top net buys and proprietary trading desks’ top net sells.

Stock Market Update November 27: Widespread Stock Declines, One Bank Stock Surges to a Striking Purple

The stock market session on November 27th closed in the green, yet underlying dynamics painted a less optimistic picture.